Unemployment, Participation, and The Will to Work Among Men

News

|

Posted 13/05/2025

|

1327

Last Wednesday night, the US Federal Reserve maintained its benchmark interest rate at 4.25%–4.50%, resisting pressure from President Trump for a rate cut. This decision followed a volatile period in the gold market, where prices surged to a record high of US$3,500 per ounce on April 22 amid speculation of a significant rate reduction, only to retreat by US$60 as the rumours were dispelled.

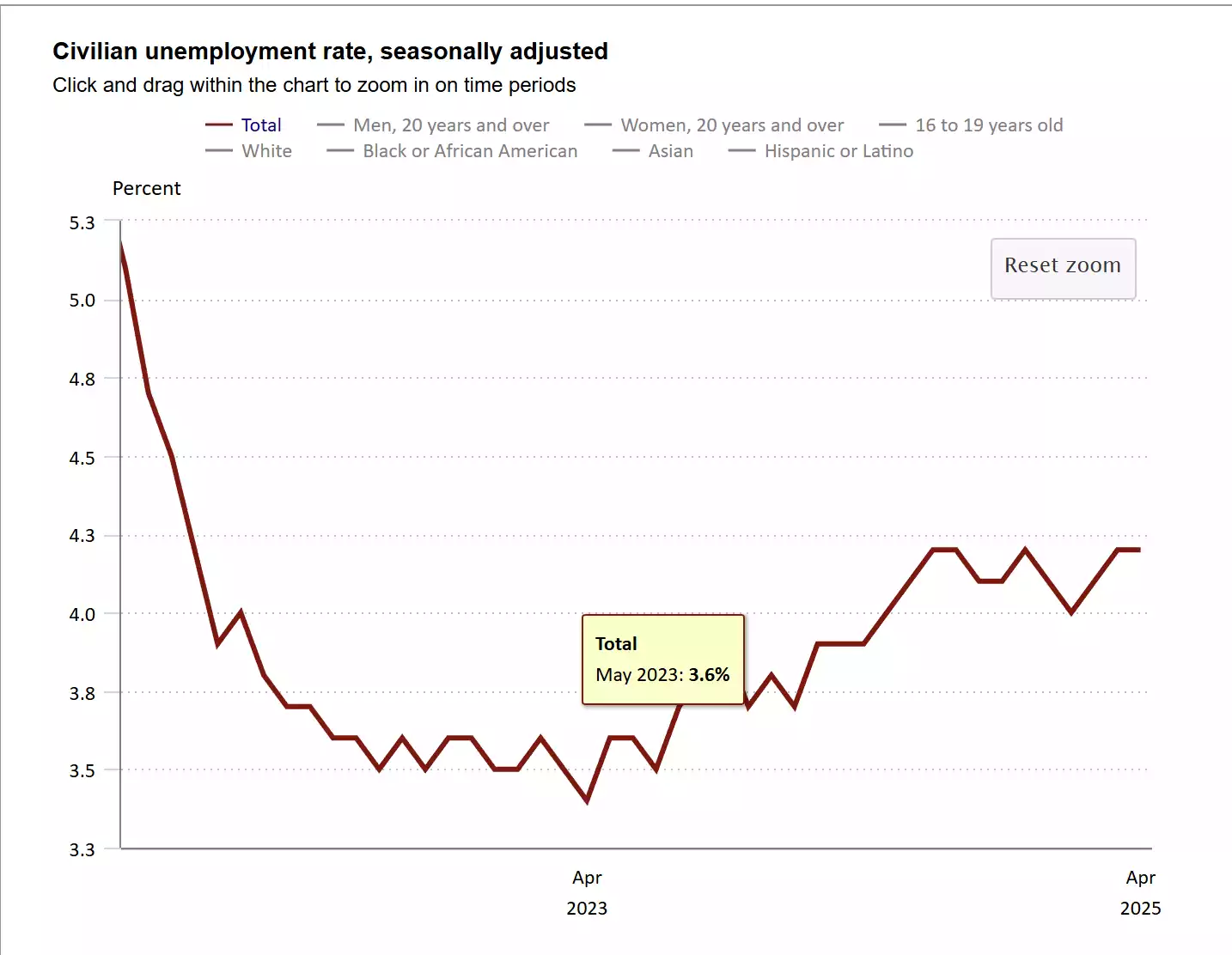

The gravity-defying unemployment rate was cited as the main reason for the Fed holding at its current level. When factoring in the participation rate, true unemployment is significantly higher than official figures suggest. As highlighted in the article on Australia’s “real unemployment rate,” the numbers are misleading when part-time workers and those willing but unable to find work are included. This means the burden of taxation is increasingly falling on a smaller and smaller group within society. Notably, the biggest decline in participation is among men aged 15-54, while women’s participation has been rising steadily over the past 80 years and has rebounded since COVID. At the same time, programs like the NDIS are growing at two to three times the rate of inflation (CPI), and unless a solution is found to the declining participation rate and the underreporting of unemployment, central banks like the Federal Reserve and the RBA risk keeping interest rates too high for too long. This puts additional stress on working families and drives falling birth rates.

Federal Reserve Decision

The Federal Reserve has kept interest rates steady, citing

‘The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. Inflation remains somewhat elevated.’

With unemployment rising only slightly to 4.2%, the Federal Reserve has opted to hold interest rates steady while the Trump Tariff's impact on inflation and unemployment is still working its way through the economy.

But once again, the question must be asked: What is the real unemployment number? Have changes to how unemployment is measured, which all the central monetary functions of economies rely on, been fiddled with too much for political gain? If so, could this be part of a growing imbalance where the societal taxation burden is falling on fewer and fewer working individuals? And could this be an underlying cause of the declining birth rates?

Participation Rate and Will to Work

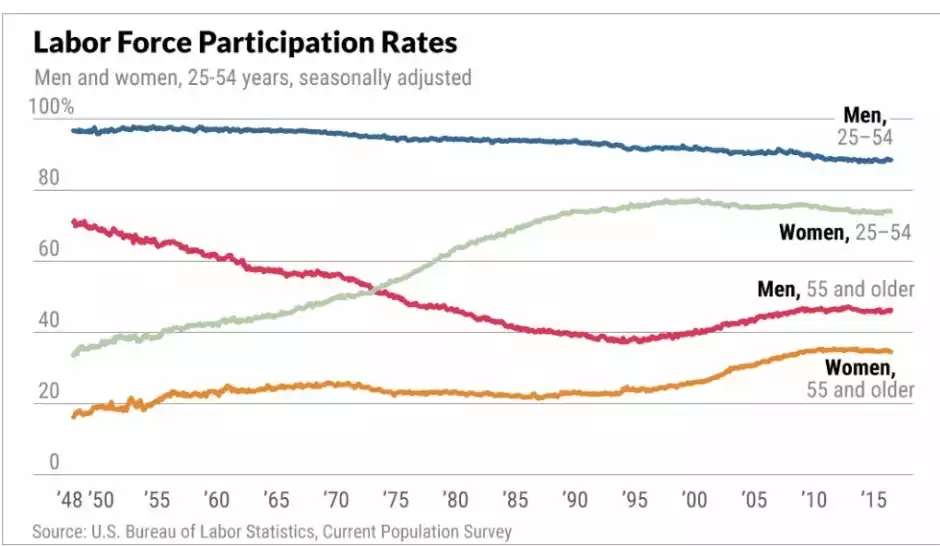

The participation rate in both the US and Australia continues to drop – interestingly, when dissecting this number, the main culprit is able-bodied men aged 15-54. In fact, women ages 25-54 have been rising in participation rate since the 1950s, offsetting the losses in the male participation rate.

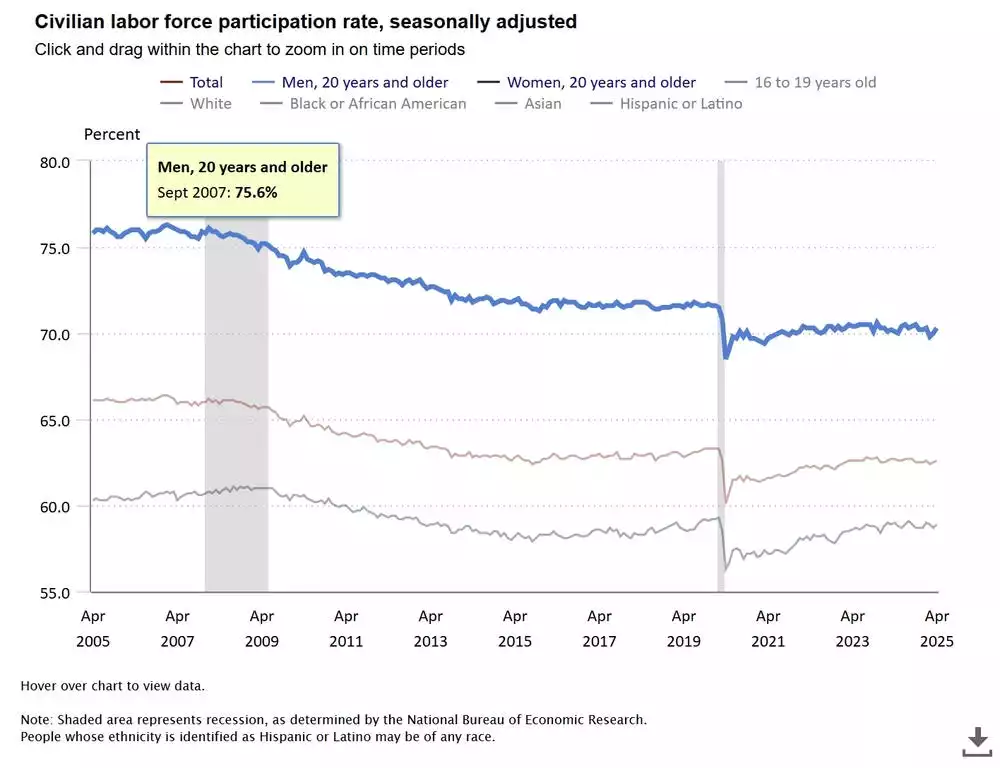

Women’s participation rate has remained stable since the early 1990s, with men’s declining from 86.6% in 1948 to 68% in 2024. When looking at a recent study from the Bipartisan Policy Center (BPC), this decline is even more dramatic among men aged 15-54, falling from 98% in September 1954 to 89% in January 2024.

Looking at civilian labour force participation rates during the COVID recovery, women’s participation (grey line) has nearly returned to pre-COVID levels of 59.2% before the pandemic, compared to 58.9% currently for women over 20. In contrast, men over 20 (blue line) have experienced a weaker recovery, with participation dropping from 71.7% pre-COVID to 70.3% now.

Mike Rowe, CEO of the mikeroweWORKS Foundation, has recently coined the term, defining this as “The will to work”, and says that there is a worrying trend among able-bodied men who aren’t even looking for jobs – around 6.8 million Americans. He goes on to say

“The skills gap is real, but the will gap is also real”.

According to the BPC survey, 28% of men who are no longer looking for work say that they are doing so by choice, ‘will to work’ therefore accounts for an increase in unemployment of around 3% that the working population is taxed to pay for their benefits.

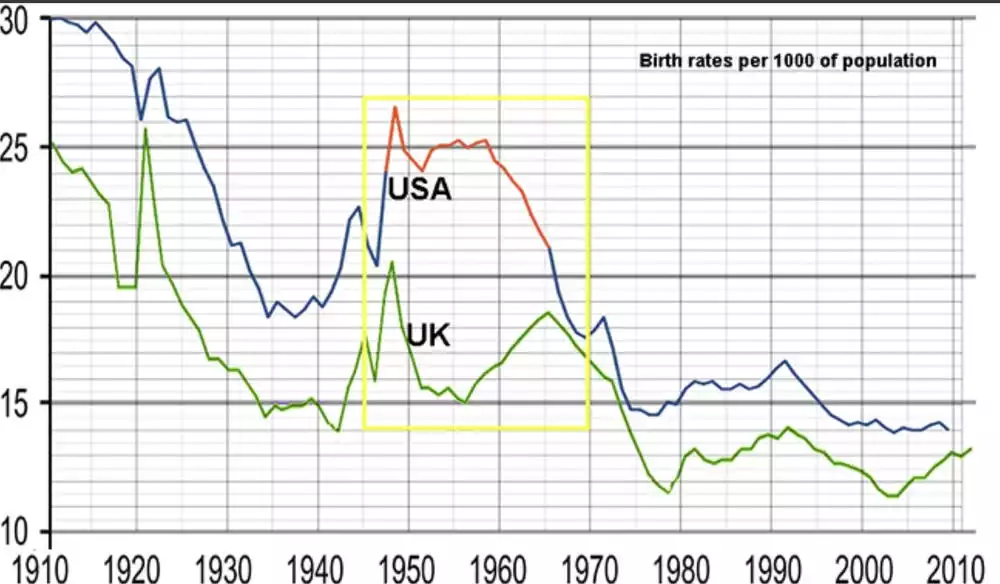

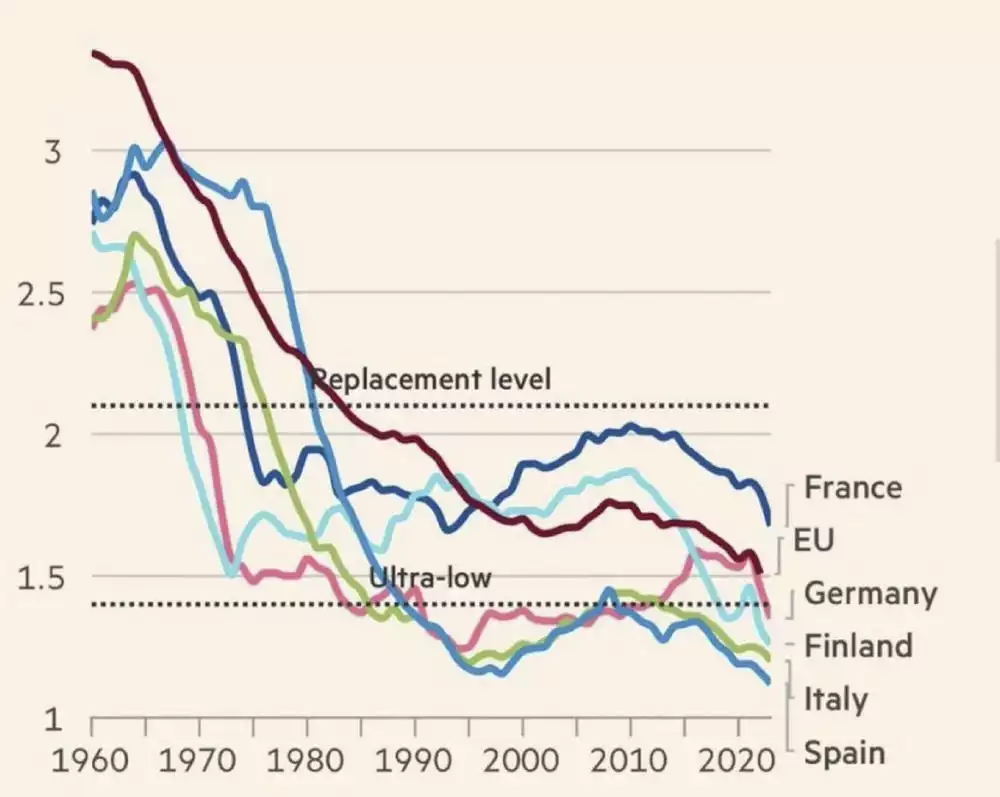

Declining Western World Birth Rates

While some of this may be explained by the male becoming the ‘stay at home’ component of the family unit, the drop in Western world birth rates shows that families have not adjusted to the participation rate drop of men and more and more women working with fewer and fewer births. In fact, when the birthrate began dropping in the Western world, it lines up with when the male participation rate also began dropping and the female rate began rising in the 1950s/1960s.

As more people choose smaller families or opt out of the workforce, and governments struggle to adapt, the economic pressures are likely to intensify. Central Banks will continue to use the wrong data when setting interest rates, and governments will be forced to continue increasing taxes, loading the burden more and more on individuals in their prime, ‘child-bearing years’.

As birth rates fall and more people drop out of the workforce, governments face the challenge of supporting more people with fewer taxpayers. This can lead to higher debt, more money printing, and increased financial strain on working families. In these situations, precious metals become important as a safe haven, helping people protect their wealth when trust in government finances and economic stability is under pressure.