US stalls and passes QE baton

News

|

Posted 18/09/2014

|

4572

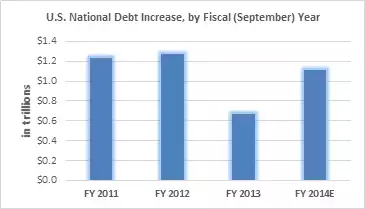

Gold declined again last night as the US Fed gave a little more indication of raising rates next year. That said Chair Yellen went to lengths to continue the “considerable time” weasel words as their growth remains only “moderate” and inflation remains low, and pointed out time wasn’t “calendar” time rather is “highly conditional” on the economy recovering to the extent it needs to before they will consider raising rates. Still, many heard what they wanted to hear and the USD rallied, along with bond yields and down came the gold price. Many remain sceptical about their ability to raise rates without re-crashing the economy and the realism of paying more interest on the US’s $17.7t of debt. On this, the graph below shows fiscal 2014 (of which they are nearly finished) will see more than $1t added to that debt. They also announced a reduction of QE by another $10b/month and remain on target to end it next month. But whilst the US finishes its (official) money printing program Europe is likely to announce the details of its program commencing tomorrow, China yesterday announced it was injecting another Y500b ($81b) now, and Japan and the UK continue unabated. So the easy ‘money’ party continues, and so does the debt accumulation.