US “growth engine” v reality

News

|

Posted 10/02/2015

|

4963

The US economic recovery is saving the world. That is what the main stream press is touting. US Treasury Secretary Jack Lew yesterday warned the US could not be “the sole engine of growth” as a follow up meeting from the G20 see’s countries around the world looking to spur on growth in a moribund global economy. So let’s look a little closer at this growth “engine”, the US…

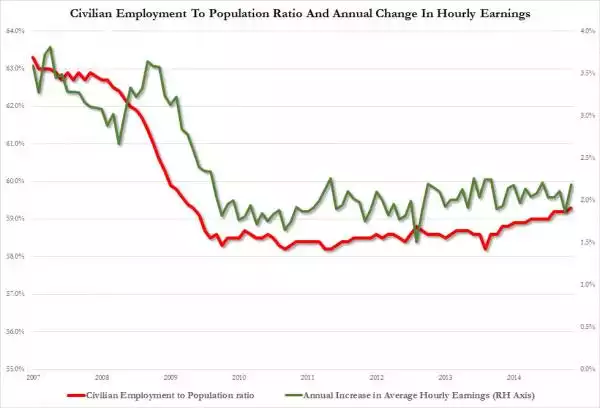

Markets rejoiced and gold got smashed Friday night because of the higher than expected jobs number at 257,000 for January. But the graph below strips this back to a percentage against civilian population and real earnings too. Reason for celebration?

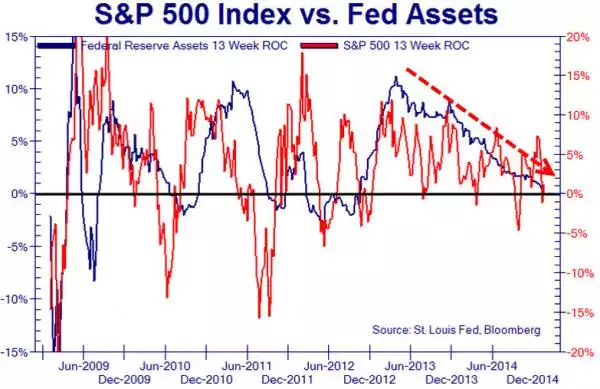

Since the US Fed started tapering artificially fuelling this engine with QE3 (printed money) how’s she been running?

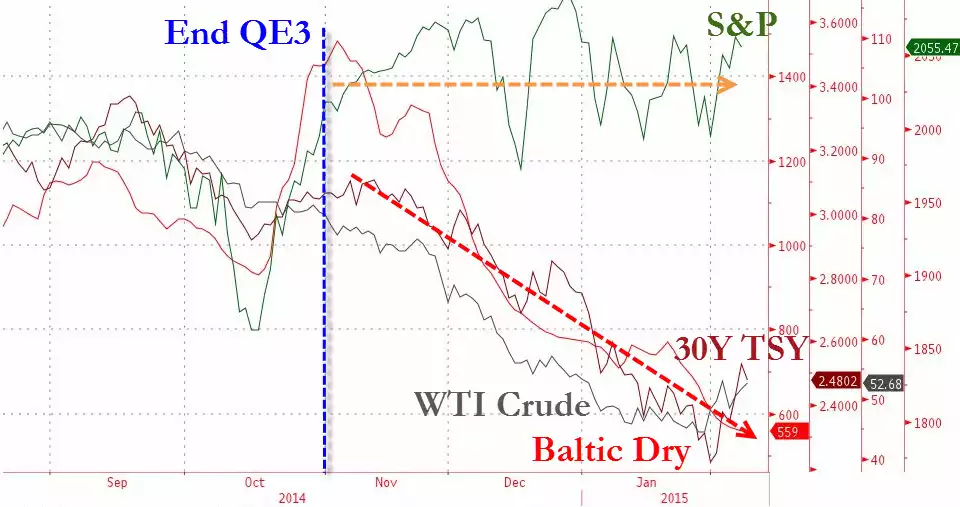

And since they stopped QE3 altogether what has happened with the economy?

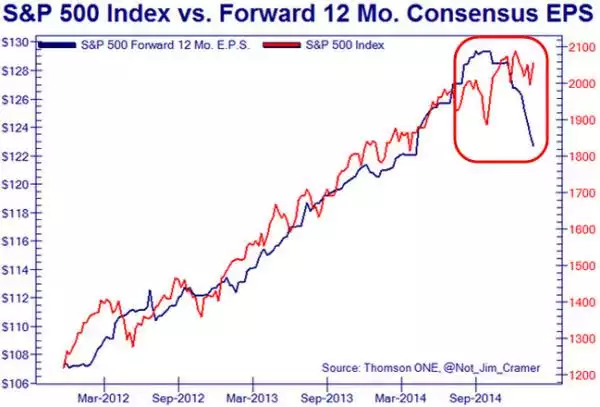

As we reported on Friday in the Weekly Wrap radio, 87% of US companies have revised down earnings for 2015 and if you remove Apple’s earnings the remainder achieved a net ZERO for the last quarter. How does this look against price on the S&P500?

So clearly the growth engine is just awesome, there’s nothing to worry about, and ultra low bond yields and gold and silver rising is coincidental.