US Tech Stocks PLUNGE upon Q3 Earnings Release

News

|

Posted 27/10/2022

|

11421

It looks like macroeconomic concerns have finally caught up to American technology stocks this week, as the release of earnings reports for Facebook, Google and Microsoft all resulted in their stock prices subsequently crashing.

Yesterday, we discussed if our government really wanted to reduce inflation, and today we will be observing the impacts these macroeconomic factors such as inflation have had on some of the largest multinational companies.

Facebook’s Q3 earnings released this morning resulted in a 16% drop in its stock price, with its earnings per share having cratered by 49% compared to a year ago. The $1.64 EPS that was reported wildly underdelivered relative to the 1.89 EPS projection the market had priced in.

CEO Mark Zuckerberg went on to admit that “We face near term challenges in revenue.”

Meta (Facebook) also said that Foreign Exchange rates played a massive role in the lower earnings growth. More specifically, if foreign exchanges rates remained constant with the third quarter of 2021, revenue would have been $1.79 billion higher.

Put simply, the strengthening US dollar has not necessarily been good for big business.

On Monday, Brad Gerstner, the chief executive of Hedge Fund Altimeter Capital, published a letter to Mark Zuckerberg that urged him to reduce staff by 20% and cut spending by $5 billion a year.

Turns out his concerns were more than warranted.

Microsoft, which dropped 6% yesterday, saw its slowest revenue growth in five years.

They too, wildly underperformed the market projections, most notably total sales, which is estimated to be between $14.5-$15 billion range, well below the anticipated $16.9 billion outlook.

Additionally, Microsoft has also been struck by economic factors outside off their control, this time inflation precipitated by the European energy crisis, which cost them an extra $800 million in energy costs this fiscal year.

Alphabet, Google’s parent company, had its Q3 earnings report released yesterday, which saw their profit drop by 27% compared to last year. Unsurprisingly, their stock tanked by 7%.

One common theme that we are seeing here that all these stocks have been consistently underperforming their market projections for the previous quarter, which appears to be a microcosm of a much broader issue of analysts attempting to distance themselves from the reality of the current economic climate.

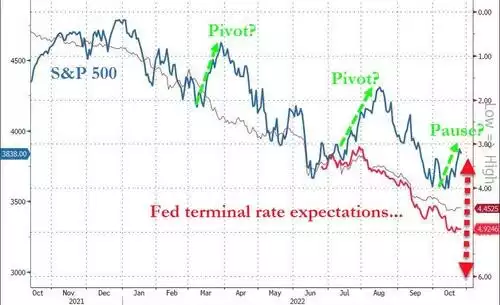

For example, over the past year the market has constantly tried to decouple itself from the FED’s rate expectations, sadly to no avail.

“Don’t fight the Fed” – borne of the impacts of them ADDING liquidity was the hero trade since the GFC. “Don’t fight the Fed” in this new era of then REMOVING liquidity cannot be ignored.

With Apple and Amazon’s earnings reports to also come out tonight, it will be very interesting to see if the market has already priced in the likely impending bad news, or if there is more market pain to come if we continue to grossly underperform the optimistic earnings projections.

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************