US Stimulus & Vaccine Delays – Is it too late?

News

|

Posted 13/11/2020

|

9951

Wall St took a dive last night whilst gold firmed as the market digested the new reality that there will be no fiscal stimulus before January whilst the 2nd COVID wave sweeps the nation and the Pfizer vaccine, if passing all tests, will be unavailable much longer than the euphoria earlier in the week was pricing in. Our AUD dropped which turbo charged gold and silver gains locally.

Trump has lost interest in a stimulus package so the White House is out of the talks leaving it all to Senate leader McConnell to negotiate with Democrats Pelosi. The Democrats want $2.2t and McConnell no more than $0.5t. Fed Chair Powell speaking at the ECB again implored the need for fiscal stimulus stating there will be no full recovery without the confidence that such spending would bring.

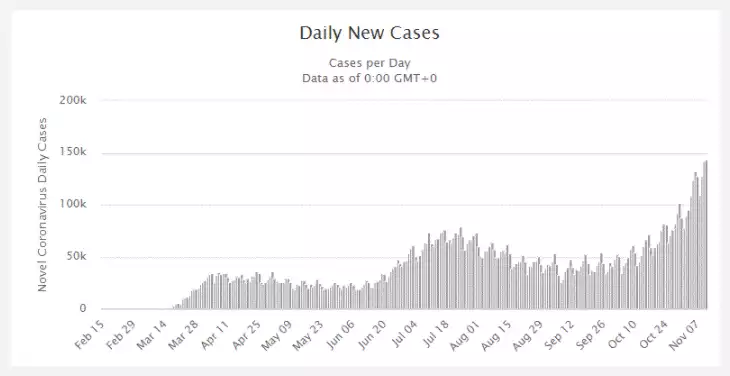

To put the second wave into perspective there are now more daily new cases than at any time since the pandemic began:

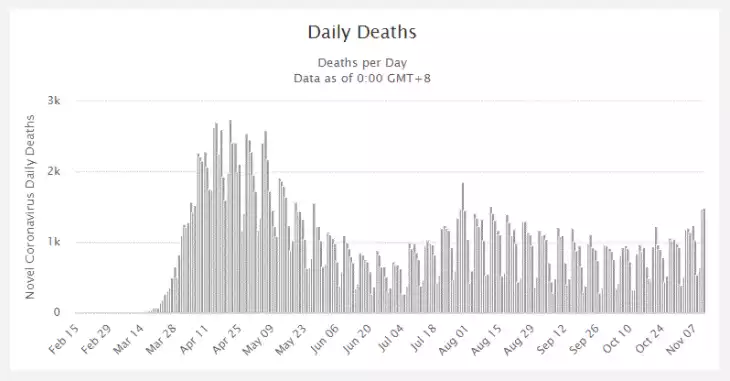

And the narrative that there are less deaths is starting to unwind with deaths on the rise again:

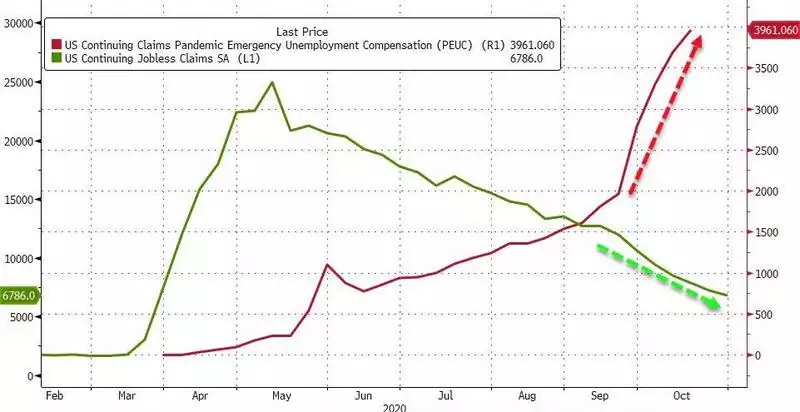

Likewise the market has been taking comfort in improving employment figures but where the rubber hits the road in unemployment benefits we have seen simply a rotation from normal unemployment benefits to pandemic emergency unemployment compensation:

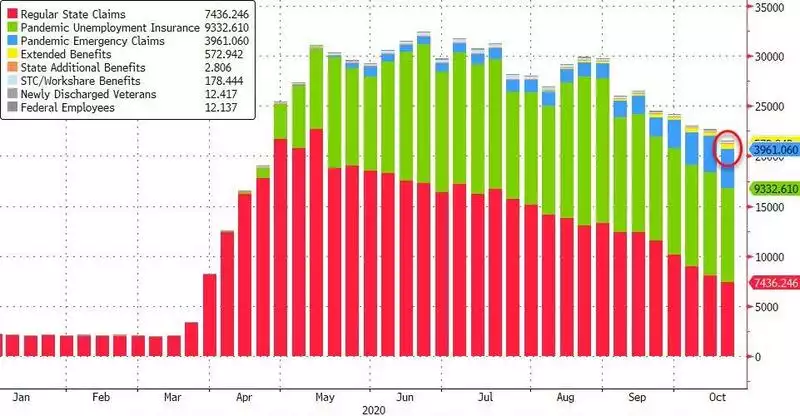

To quantify that, of the 350m Americans, 20 million are claiming unemployment benefits:

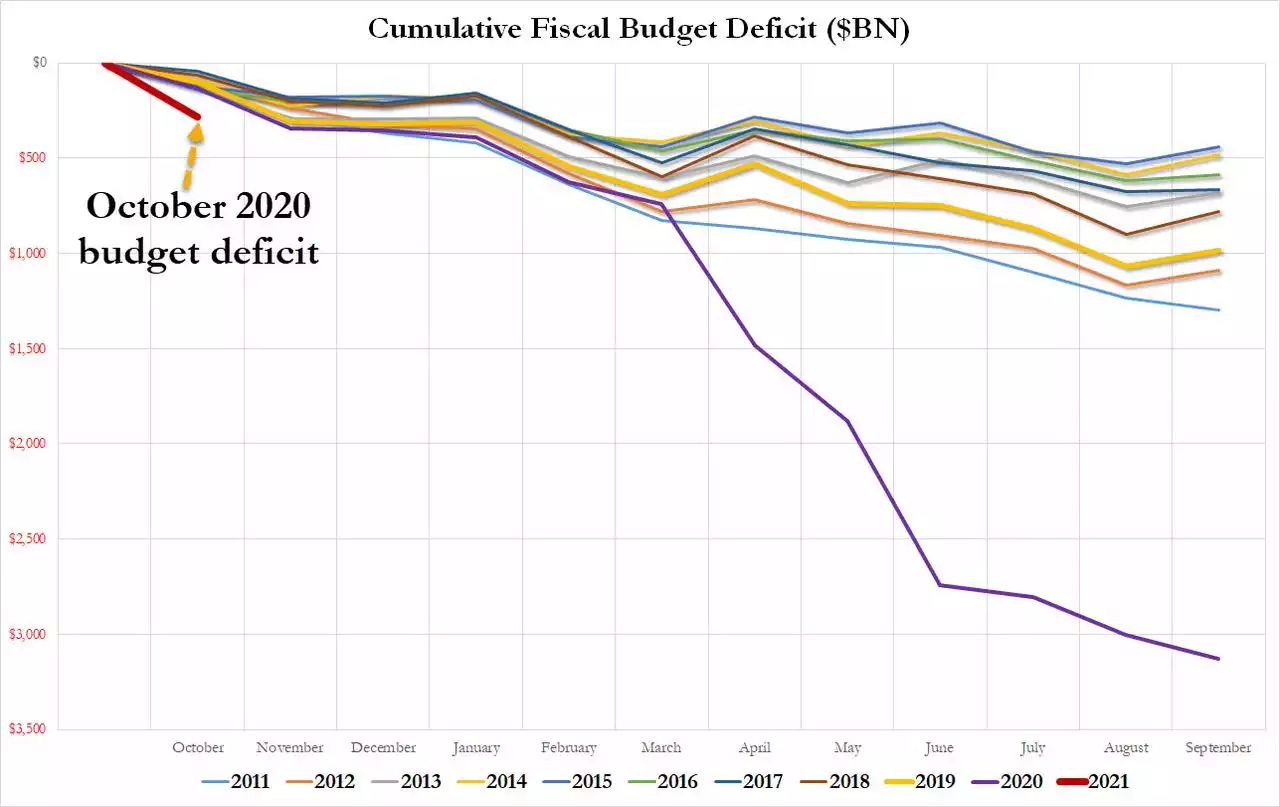

And so, as we start the US fiscal year last month, they are already looking at the largest October deficit on record and well on track to exceed the record setting 2020 fiscal year of $3.1 trillion…

This is all under Republican rule and the expectation of greater spending under the Democrats makes one wonder what 2021 will bring. Just remember every deficit dollar spent is a new one created, debasing the so called world reserve currency.

Whilst a vaccine will help we must remember it is still some time off and this snowball is growing by the day. The CEO of Pfizer sold 62% of his shares at the peak this week. What does that tell you….