US Sharemarket “Extreme” Warning

News

|

Posted 26/10/2016

|

6347

US shares retreated last night and the USD rose to an 8 month high as the odds for a December rate hike increased to 70% (as a side note gold continued to hold strong, indeed it rose, in the face of the rise of the USD. We think this is an important indicator of gold price bullishness). Regular readers will know the usual good news is bad news trend here. Rates are due to go up because ‘everything is awesome’ but shares come off as they are supported not by ‘awesome’ fundamentals but largely by the cheap money game such tightening signals coming to an end. There is also the well founded fear that even that 0.25% rate rise could trigger the crash, so they are getting out of Dodge now.

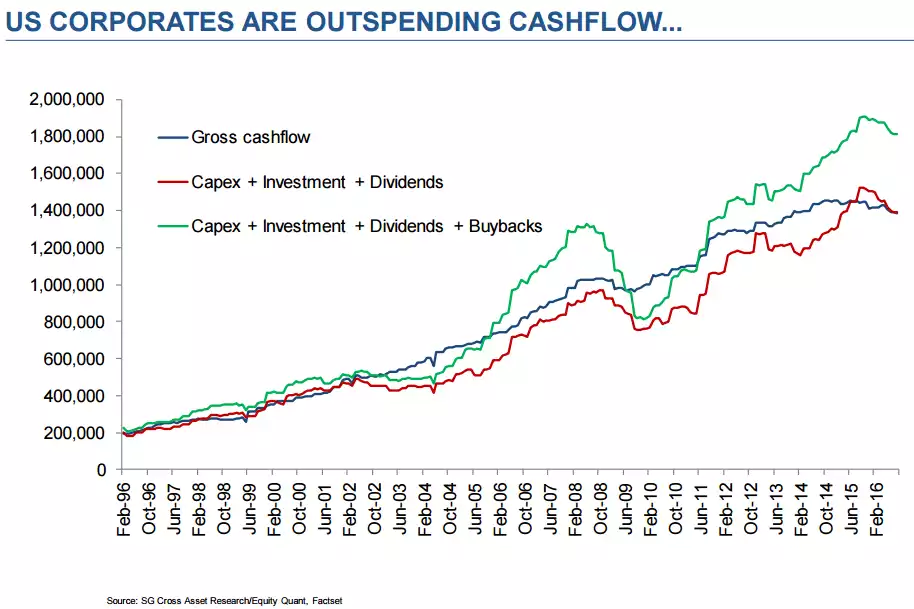

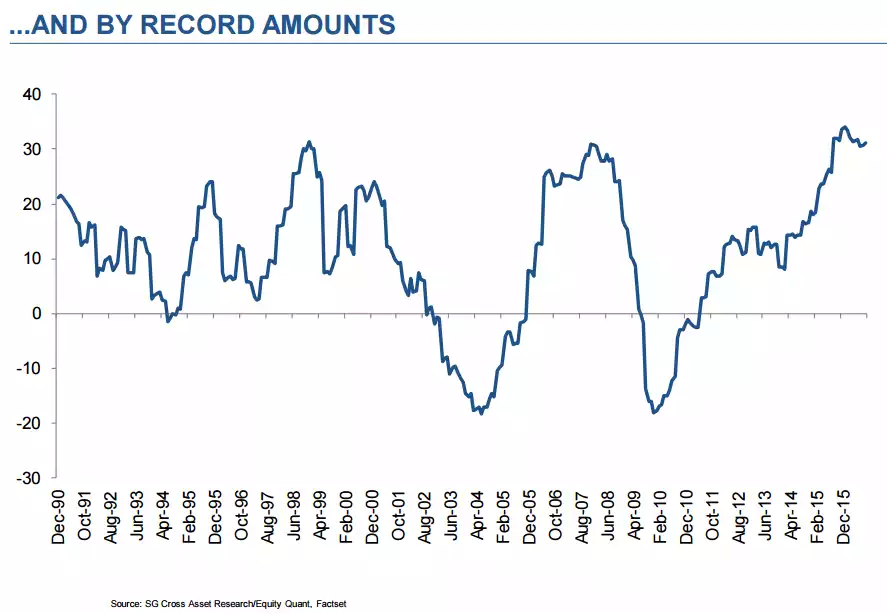

Banking giant Société Générale’s global head of quantitative strategy, Andrew Lapthorne, is warning of this set up. We’ve written extensively on the fact that US corporates are buying back their own shares, often using debt financing, at a record rate for the pure aim of improving their share price. Lapthorne confirms this, showing that US corporates are spending more than their cashflow (ala debt) at an unprecedented rate. When you look at the chart below you can see when this last neared such lunacy…. Just prior to the GFC…