US Retail Sales Numbers Skyrocket, Further Empowering FED Hawkishness

News

|

Posted 16/02/2023

|

9932

Following the release of the higher-than-expected January CPI numbers earlier in the week (6.4% vs 6.2% market consensus), US retail sales too blasted through expectations, increasing by the most in over 2 years.

US retail sales (seasonally adjusted) rose by 3% compared to December levels, beating the market’s expectations of only 1.8% for one of the largest monthly increases in over 2 decades.

The industries that saw a particularly strong increase were furniture (4.4%), electronics (3.5%) and the food and beverage industry (7.2%).

Economists remain baffled as to why the figures were so high compared to this time last year, though one potential unsubstantiated theory is that shoppers front loaded their holiday shopping which meant the December base figure was lower than usual.

One thing that is very clear however, at least according to economic analyst at decision intelligence company Morning Consult’s Kayla Bruun, is that these figures will only strengthen the Feds hawkishness in the short to medium term.

“Although resilient consumer spending is a positive sign for the health of the economy, renewed demand for supply constrained categories could add to inflation pressures, potentially eliciting more aggressive action from the Fed.”

Interestingly, only last week did Bank of America Institute report on a surge in spending based on an analysis of Bank America credit and debit card data. The report suggested that “while lower income consumers are pressured, they still have solid cash buffers and borrowing capacity.”

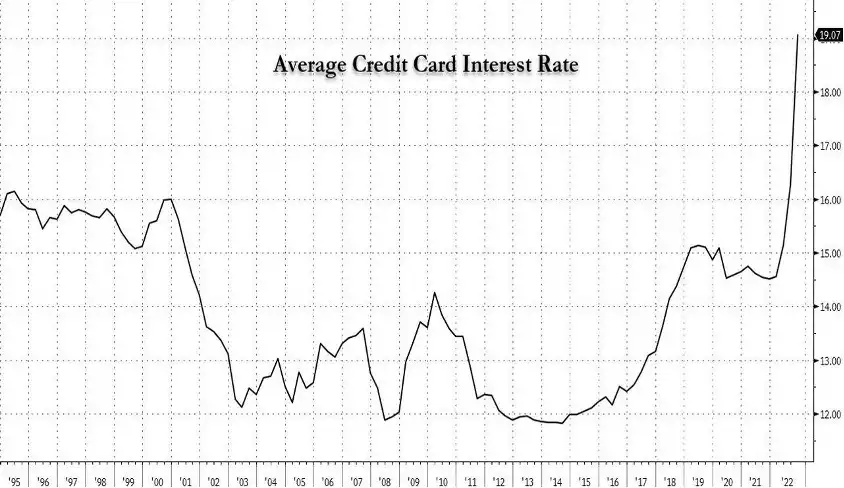

While the term “solid borrowing capacity” does not exactly provide a complete picture, it is evident that consumers are borrowing now more than ever, and the interest rates being offered reflect not only the modern high interest rate environment of today, but also the risk profile of the borrower. US credit card debt soared by 18.5% to hit a record high of $930.6 billion according to the latest credit report by TransUnion.

This aligns with data coming out of Australia as well, as Commonwealth Bank recently announced a record high half year cash profit of $5.15 billion, up an annual 9%. Evidently, Banks love the current high interest rate environment, as can easily pass on their increased borrowing costs (and much more) to their customers.

With borrowing, retail spending, and credit card interest rates all effectively at all-time highs, safe to say the economy to some extent is relatively unstable (even ignoring Russia-US geopolitical tensions).

With the FED now being empowered to further continue the rate hikes, the current economic state of the average person is only likely to worsen as those rate hikes get passed on to you from your local bank.

Our own central bank, the RBA, saw its chief before the Senate Estimates committee yesterday with big questions about how his 9 consecutive interest rate rises is hurting ordinary Australians, particularly off his assertion in 2022 that we wouldn’t see rises before 2024. Lowe was calm and forthright and stated categorically:

"We want to get inflation down because it's dangerous….It's corrosive. It hurts people. It damages income inequality and if it stays high it leads to higher interest rates and more unemployment."

This current spending credit fueled spending spree pays no heed to the dangers ahead, particularly when many on fixed interest rates have yet to feel the heat. AMP chief economist Shane Oliver yesterday warned of this hitting a wall this year (ex ABC News):

“Dr Oliver, the chief economist at AMP, estimates about 1 million households, or roughly a third of the 3.3 million with a mortgage, will need to make significant spending cuts to keep up with minimum repayments.

"That's a high number — that's 10 per cent of Australian households that are actually quite vulnerable," Dr Oliver said.

He sees it as a "significant risk" to the broader economy if those households cut their spending substantially.

"That impacts everything, whether it's retailers, service providers, tourist operators, and so on, will see less demand over the course of the next 12 months."”

Hence, in times like this, with the world as unbalanced as ever, it is always important to remember to balance and protect your wealth any way you can.

On a lighter note, if you haven’t been watching Tough Talk (brought to you by Ainslie) they had a cracker on Phillip Lowe here. You can watch these weekly by subscribing to our emails.

https://www.youtube.com/watch?v=Ehs7lbOeG5Y

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************