US Rate Cuts Expected by September

News

|

Posted 30/07/2025

|

1311

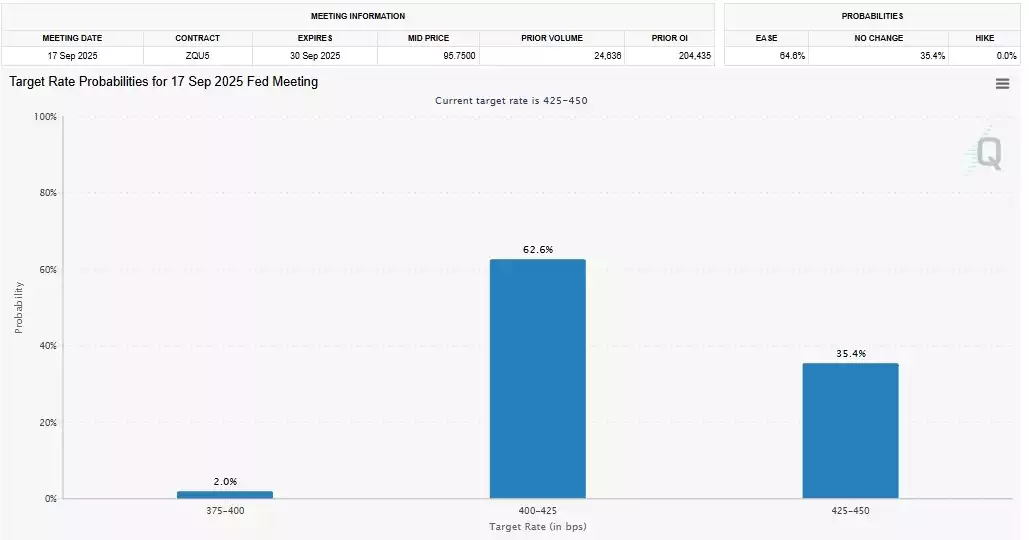

With the US Fed meeting this week, consensus among market participants is that rates will remain on hold. With no meeting scheduled in August, markets are now pricing in the first-rate cuts by September.

Many believe the Fed has kept rates elevated for too long—former President Trump among them—but the bond market appears aligned with the Fed’s cautious approach. Bond yields remain steady, and volatility in the bond market continues to decline. When the Fed cut rates last August in the lead-up to the US election, bond yields rose in response—likely pricing in a renewed risk of inflation. That reaction highlighted the market’s view at the time: rates needed to stay higher for longer.

With the MOVE Index (which tracks bond market volatility) continuing to trend down, global liquidity has been trending up. Low bond market volatility reduces the risk premiums on bonds, improving their collateral value and increasing the amount of debt able to be issued into the global financial system. In short, calmer bond markets are good for global liquidity and risk assets.

Cutting rates prematurely could destabilise the bond markets, affecting the yield curve, bond market volatility and bond yields, effectively having a net negative effect on global liquidity and financial markets if timed incorrectly.

While some may argue that last year’s rate cuts were politically motivated, the Fed’s actions since then have proven supportive for markets. Inflation is now lower, equities are near all-time highs, yet the Fed chair continues to face criticism for being “too restrictive.”

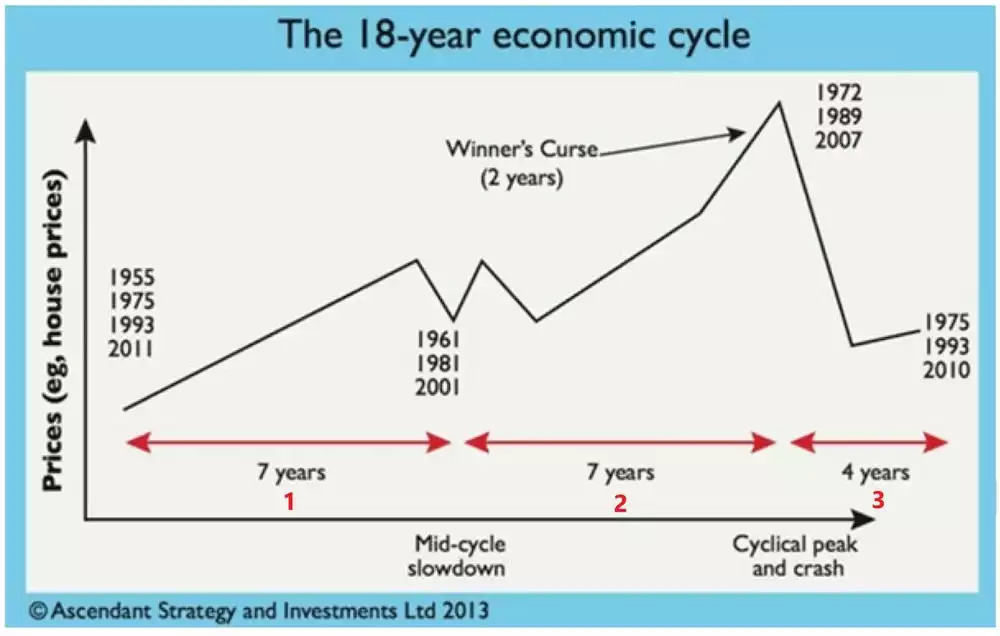

This type of investor complacency and greed often marks the final phase of the 18.6-year land cycle. As liquidity and leverage build, so too does the illusion of invincibility. Market gains persist—until risk management is abandoned altogether. This final surge, known as the “winner’s curse,” typically ends with a sharp, broad-based financial crash. The last such episode was the 2008 GFC. Based on historical timing, the peak of the current cycle would be expected between 2024 and 2028, with early 2026 as the average target.

While gold and silver rise with most markets during the winner’s curse phase, they continue rising significantly in the recovery phase, which follows the crash, while most markets struggle. Precious metals investors who take a disciplined, long-term view often come through this turbulent period in a stronger position—while many others are caught offside.

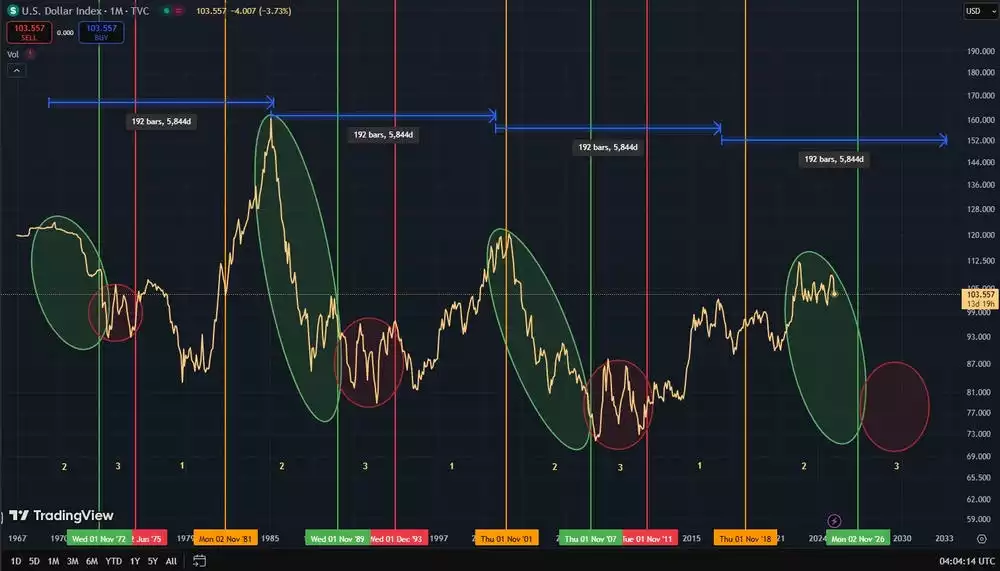

If rate cuts arrive in September against a backdrop of low inflation, we can expect global liquidity to rise sharply and the US dollar (DXY) to continue its structural downtrend. This would be consistent with the final stage of the 18.6-year cycle, where inflation re-emerges as the cycle nears its peak.

A weakening dollar amid low interest rates typically supports risk assets. As shown below, the DXY tends to fall sharply during Phase 2 of the land cycle—the final stage of the uptrend—before rebounding during the post-crash recovery in Phase 3.

With the current cycle progressing as expected, a further decline in the dollar, rising liquidity, and surging markets—fuelled by complacency—could be the precursors to a once-in-a-generation financial crash.

While both gold and silver historically perform well during this late-cycle blow-off, crash, and recovery phase, silver has often outpaced gold during the recovery. After the 2008 crisis, the gold-to-silver ratio dropped from the 70s to around 35 as silver rallied sharply.

It’s also worth noting that four land cycles make up an 80-year socio-economic cycle. We are now in the fourth and final land cycle of that broader cycle. The last 80-year cycle culminated in the Great Depression. In the decades that followed (1950–1980), the gold-to-silver ratio spent much of its time between 20 and 40.

If the next crash echoes the scale of the Great Depression, we may again see the gold-to-silver ratio settle into a range few investors alive today have witnessed.

Watch the Insights Video inspired by this article here: https://www.youtube.com/watch?v=7gm4v2JN3JY