US Housing Market Shows Growing Structural Imbalance

News

|

Posted 27/01/2026

|

1418

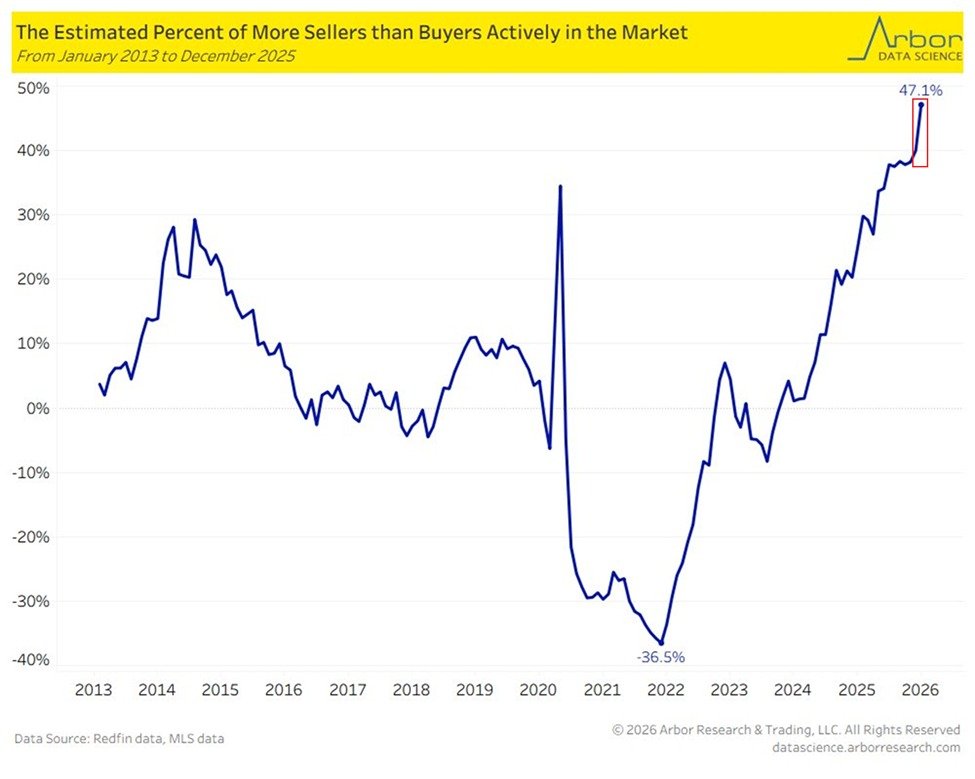

Recent data from Arbor Research highlights a significant shift underway in the US housing market. The chart shows there are now around 47% more sellers than buyers actively participating, the largest imbalance recorded since at least 2013.

While periods of imbalance are not unusual, the scale and persistence of the current divergence warrant closer attention. Buyer demand has weakened materially, yet prices have been slow to respond. This suggests the market is not undergoing a typical rebalancing, but rather experiencing a pause driven by affordability constraints and behavioural factors.

On the demand side, higher mortgage rates and tighter credit conditions have significantly reduced purchasing power. Affordability remains near historic lows, keeping many prospective buyers sidelined. On the supply side, sellers continue to list properties, but pricing expectations remain anchored to conditions that prevailed during the low-rate environment of recent years.

The outcome is a market with rising listings but falling turnover. Transactions are slowing, not because supply is scarce, but because clearing prices have not adjusted sufficiently to meet current demand. In this environment, liquidity becomes the primary adjustment mechanism rather than price.

Housing’s role as a cornerstone asset for household balance sheets makes this dynamic particularly important. Prolonged periods of weak turnover can increase vulnerability, especially if broader economic conditions deteriorate or if financial stress becomes more concentrated among sellers.

Historically, sustained imbalances of this nature tend to resolve in one of two ways. Either demand returns through easier financial conditions, or prices gradually adjust lower to restore activity. At present, neither outcome is clearly underway, leaving the market in a state of extended stasis.

The absence of significant price movement should not be mistaken for stability. Low transaction volumes often mask underlying pressure, with adjustments occurring later and more unevenly once conditions change. This is particularly relevant in regions that saw the strongest gains during the previous cycle.

Overall, the data suggests the US housing market has entered a more fragile phase, one characterised by reduced liquidity and heightened sensitivity to changes in interest rates, employment, and credit availability. For investors, it serves as a reminder that asset prices can remain static even as underlying market dynamics continue to shift.