US Fed Hikes Higher than pre GFC – “Data Dependent”

News

|

Posted 27/07/2023

|

1908

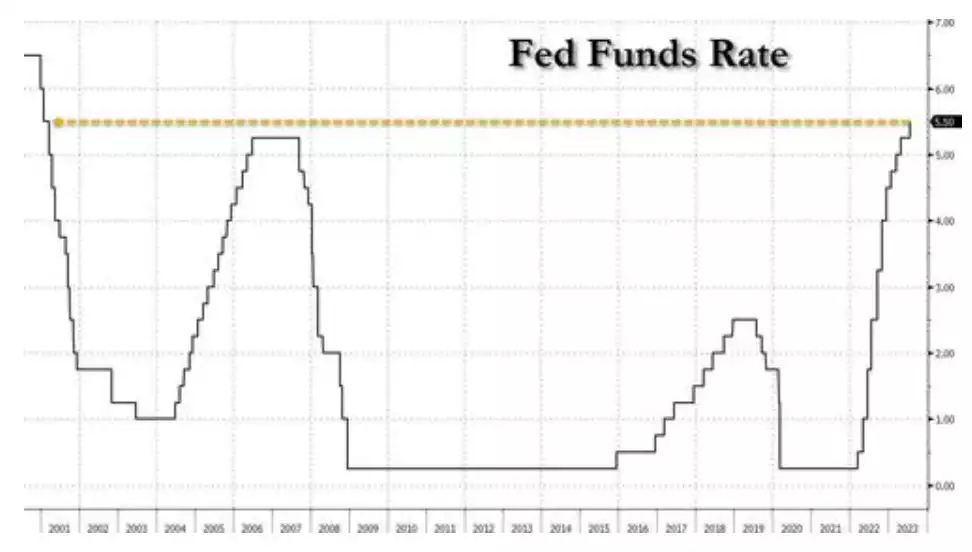

The much anticipated July US Fed meeting was last night and as generally expected they hiked rates yet again, 25bps taking rates to 5.50%. That is the 11th consecutive hike and sees the Fed Funds rate now higher (and much faster) than the peak of the 2006-2008 cycle which peaked at 5.25% and we all know how that ended…

The Fed's Press Conference just finished this morning. Let's disassemble some jargon and see what they may be trying to achieve.

Whilst the minutes maintained their anchor of "The Committee remains highly attentive to inflation risks.", the big conclusion of the Fed Press Conference this morning was that they need to make data-driven decisions on a meeting-by-meeting basis. A more correct, technical way of wording this would be to at least say they are being "information" dependent. We are not looking at raw stats of various prices and seeing if inflation is serious. What's happening is carefully selected data is being even further cherry-picked and displayed in a weighted result. Once "data" is put "in formation", it becomes information, and this information is meant to have a certain effect.

The main information the Fed uses to support its rationale is CPI - Consumer Price Index. In other words, the cost of a basket of goods. If your job was to go to your local supermarket and fill the shopping basket to make inflation look bad, could you do it? Which items have increased in price the most? Now let's say you are asked to fill the basket in a way that makes inflation look low. Would this be easy to do in a supermarket today? One easy trick would be to leave the supermarket completely and find something else for your basket.

One of the most recent inventions is "Core CPI". The Core CPI "data" is meant to inform viewers of the real extent of inflation, minus any irrelevant noise. It deems food and energy prices as part of this irrelevant noise because they are "too volatile". In terms of markets, volatile means something moving up, down, or both, across a period of time. The costs of food and energy have been volatile by going up. Some might say "rising" would be a better word than volatile in this situation. The incredible irony here is that CPI is meant to measure how fast items are going up, but if an item goes up, it's disqualified. Not to mention the two items being disqualified are food and energy (who do you know that eats food and uses electricity?).

The CPI information being created and then analysed seems to indicate that they want people to perceive inflation as reasonably low and manageable. If central banks like the Fed made inflation look aggressive and out of control, yes, people may happily agree to more hikes, but people would also flee fiat currencies for safe havens such as gold and silver. If they made inflation look non-existent, it would be too easy to call the bluff and they would also not get the rate hikes that could end up consolidating the capital in the economy. It seems the sweet spot is that inflation is just bad enough to justify keeping rates higher, but to not lose confidence in the banking structure. This seems like a potential repeat of the actions done in the late 70s and early 80s, which led to a double-dip recession.

We will discuss this article today in more depth on Gold & Silver Standard Insights. Submit any questions you may have for the discussion to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.