US Dollar at a Junction – Fed Cut Expected

News

|

Posted 10/12/2025

|

1301

The US Dollar Index (DXY) has just formed a failed, left-translated daily cycle—signalling technical weakness with a clear break in structure.

Meanwhile, US 10-year bond yields have broken below their trendline and, so far, have failed to reclaim prior support. This shift adds to the growing case for a rate cut by the Federal Reserve.

While the breakdown in bond yields has not yet confirmed a broader downtrend, should it do so, it would likely support global liquidity in the near term. Rising bond collateral values enable a greater volume of debt issuance globally, as US Treasuries serve as premium-grade collateral for major institutions and central banks.

Adding to this picture, the MOVE Index—tracking bond market volatility—remains in a downtrend. Lower volatility in bond markets further supports liquidity conditions: the more stable the collateral, the lower the risk premium, and the more leverage it can support.

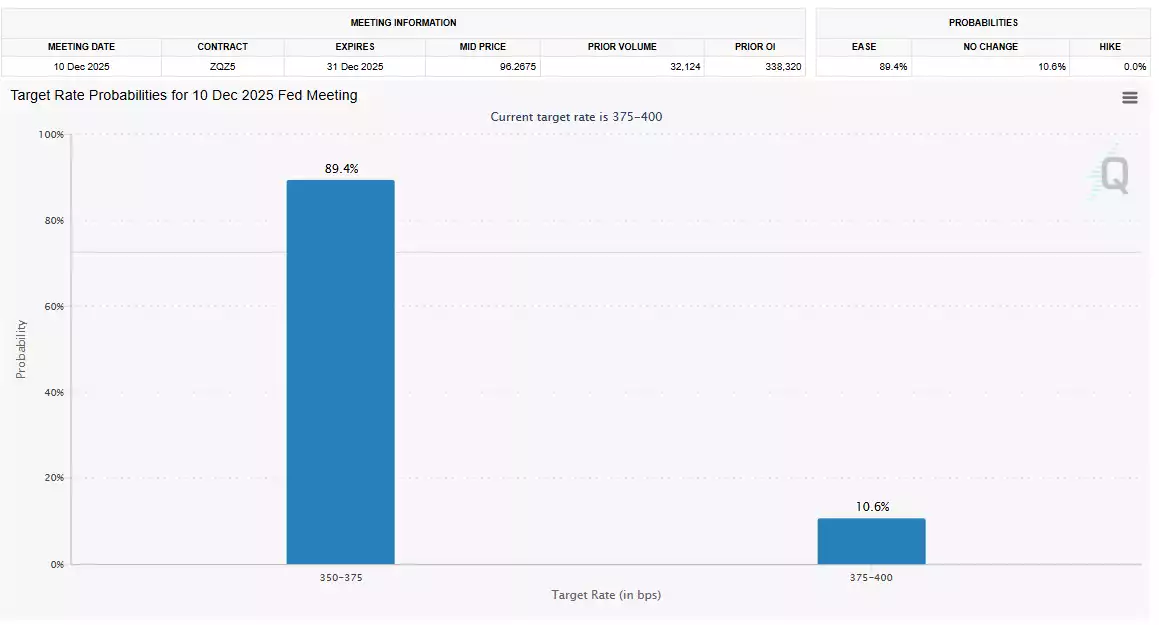

Markets have largely priced in a 25 basis point cut from the Fed tonight, based on current conditions.

If the Fed surprises with a 50 bps cut, it would likely trigger a strong bullish response across most markets, with the DXY rolling over further. Conversely, no cut—although unlikely—could result in a short-term liquidity shock.

While near-term conditions appear supportive for both hard and risk assets, it's important to note that global liquidity seems to have entered a consolidation phase. This suggests a more cautious approach may be prudent in the medium term.

Longer-term, gold and silver continue to demonstrate strong performance potential. By contrast, major equity markets appear fragile as we approach the convergence of two significant macroeconomic cycles: the end of the 18.6-year land cycle and an 80-year socioeconomic cycle.

Historically, such transitions favour precious metals over equities, as capital flows from human-made financial structures toward tangible, enduring stores of value.