US Dollar Continues Weakening Despite Trump Tariffs

News

|

Posted 20/03/2025

|

1784

While many insisted that Trump’s desire for a weaker US dollar would remain unfulfilled due to his tariff policies – those paying attention to cycles knew that he would have his cake and eat it too.

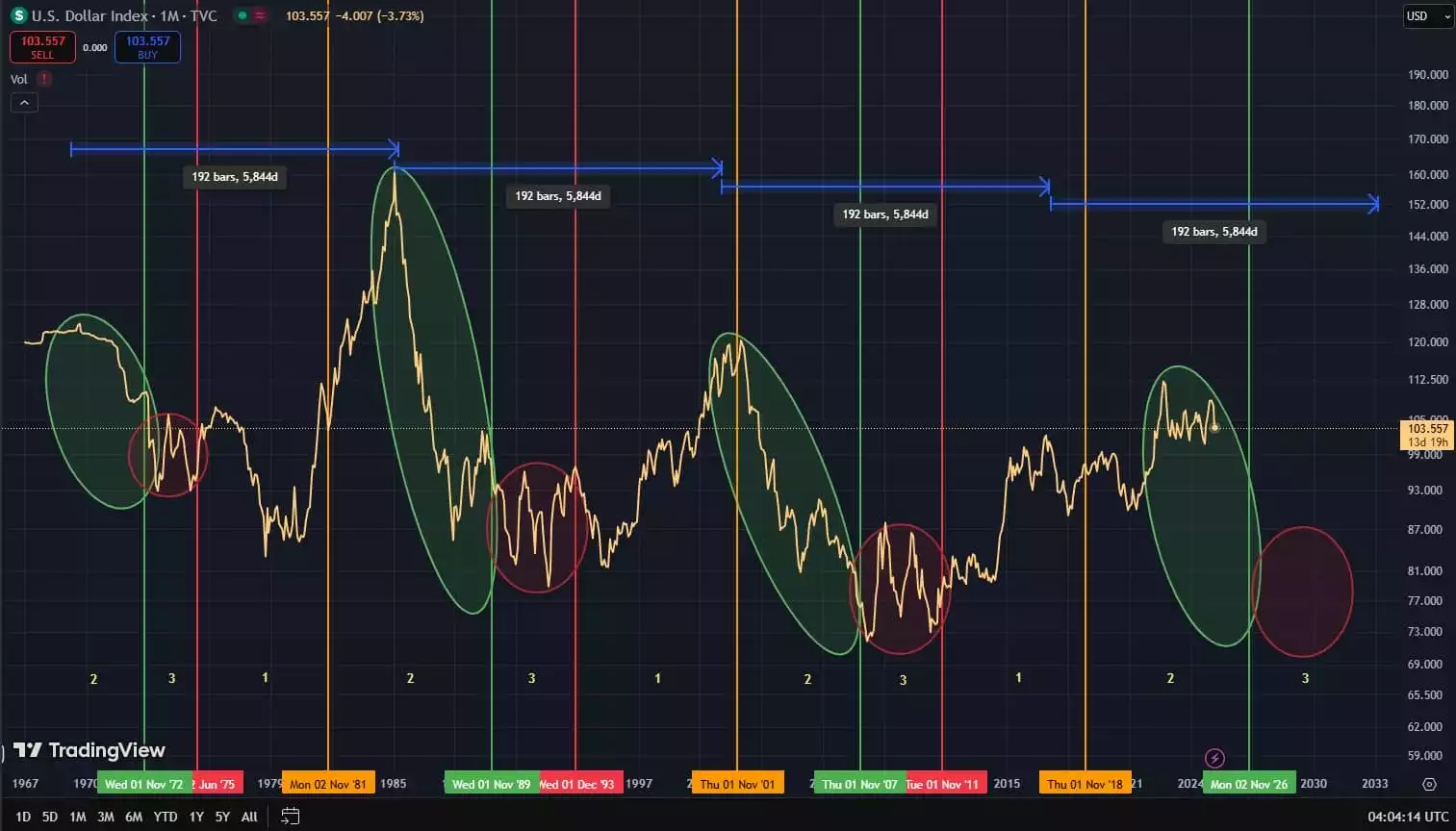

With the mainstream media insisting Trump’s Tariffs would result in a wrecking ball of dollar strength – both the 8-year DXY - and 18.6-year land cycles - were congruent in pointing towards the DXY falling, regardless of any US driven trade war.

Both the 8-year DXY cycle and the 18.6-year land cycle suggest that the DXY was due to have peaked earlier this year – and with the frenzied mainstream media covering a tariff driven dollar rally (an excellent counter indicator, as always) – this view was further strengthened.

While this idea might have seemed less apparent 8 weeks ago – checking back in on it today - with the DXY having fallen off a cliff - and gold having shot up in value – we find it reinforced by price action. However, zooming out - we can see that we are still early - in this breakdown of US Dollar strength.

8-year DXY cycle

With the DXY sitting around 107 in Feb and many on the lookout for a rally amid tariffs – it was prudent to note that we were sitting exactly 8 years from the previous cycle peak of 2017.

This set up implied a cyclical drop off in the DXY – which would have a significant impact on global liquidity - and as a result - the price appreciation of precious metals.

7 weeks later, we can see the DXY sitting at 103 today – and overlaying today’s DXY chart on the 18.6-year cycle – we can see this drop off phase - has only just begun.

18.6-year cycle

The 18.6-year land cycle has 3 phases. The chart below overlays the DXY over each phase.

Phase 1 and 2 involve asset price appreciation and phase 3 involves asset price depreciation (usually amid a broad based financial crash).

Phase 1 (roughly 7 years) is driven by economic expansion - usually lead by the US – here we see the DXY rise, along with most asset prices.

Phase 2 (roughly 7 years) involves an increase in liquidity and leverage – significantly benefiting hard assets like gold and silver – with most assets increasing in value together. The final stage of phase 2 involves blow off tops in asset valuations - as complacency proliferates market sentiment – in this final stage we see the DXY fall off a cliff, acting as a tailwind to this environment – and a precursor to the next phase.

Phase 3 (roughly 4 years) - the crash and recovery. Here we see land prices fall, along with many assets crashing suddenly – as participants swing from complacency, towards a flight to safety. In this phase - gold and silver outperform significantly – recording continued capital gains while most other assets struggle to recover. We can also note in the recovery phase that the Gold to Silver Ratio falls off a cliff - with silver usually outperforming gold during this time. The DXY moves sideways in a range for these 4 years, as economies move into recovery mode.

From a timing perspective we are currently on the lookout for this final stage of phase 2 (likely that it has already begun) – which is due to peak anytime between 2025 and 2028.

With this in mind, and a macro lower high potentially in place for the DXY – we can see the DXY downtrend has just begun.

DXY Technical Analysis

With a break below the 50% of the range formed from the liquidity cycle low of 2022 to today – we now have a serious candidate for a macro lower high in place.

Zooming out, we can see the next downside target for the DXY is 101.

This level - is not only the major lows of the current range - but also the 50% of the larger move from late 2021 (the liquidity cycle peak) to today.

If 101 is broken, we will see the perfect environment for a blow off rally in most assets - in line with the 18.6-year cycle expectations discussed earlier.

While nothing goes up or down in a straight line – and counter trend rallies are to be expected along the way (we might not be far from one now, in fact) – we have a strong downtrend forming on the DXY. This DXY trend is important to keep an eye on, as a macro indicator for hard assets like gold and silver – a falling DXY is very bullish for precious metals.

While most assets enjoy tailwinds amid a falling DXY, during this final phase of the 18.6-year cycle – gold and silver continue rising, as we pass through the collapse - and recovery phases (during which most other assets struggle). This empowers precious metals investors to navigate these phases with ease – achieving both security and capital growth - during a complicated macro transition - that often churns up even the most seasoned investors.

Watch the Ainslie Insights video discussion of this article here: https://www.youtube.com/watch?v=A7vKnpaXhXw