US Credit Rating Downgraded - The End Of An Era

News

|

Posted 21/05/2025

|

1508

On the 16th of May, Moody's downgraded the United States' credit rating from AAA to AA1 due to concerns around rising government debt and massive fiscal deficits. This was the last AAA rating held by the US out of the three major credit rating agencies (Fitch downgraded in 2023, and Standard & Poor's downgraded in 2011).

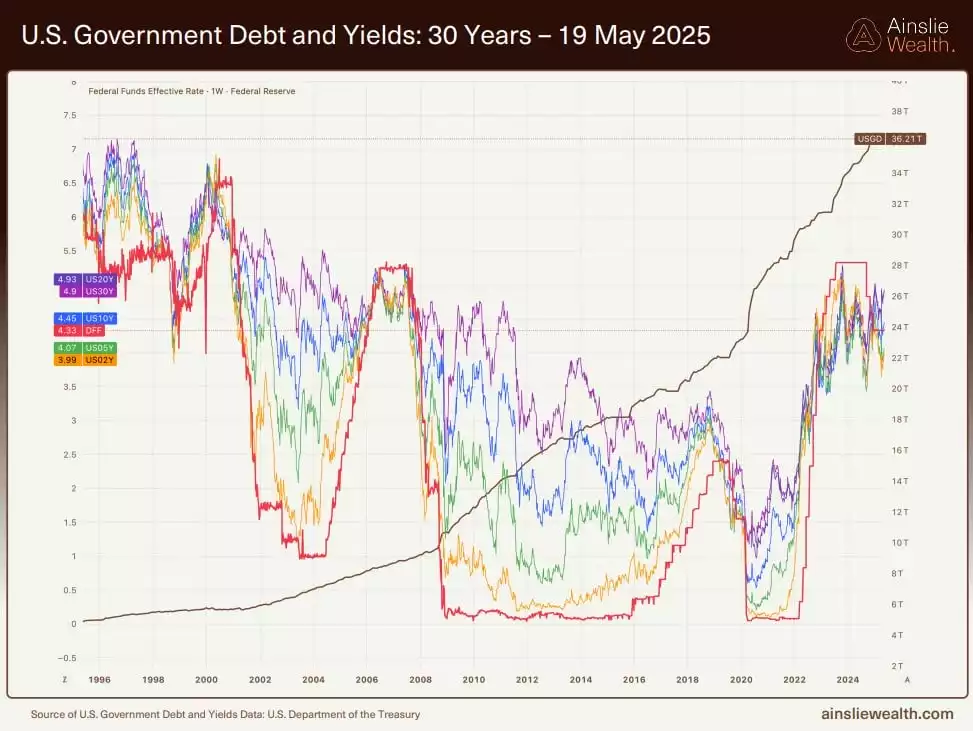

With a federal debt of US$36.2 trillion (124% of GDP), interest payments on this debt around US$1 trillion annually (higher than the entire defence budget), and US$9 trillion of that debt due for refinancing in 2025 (at a higher interest rate than the original issuance in 2020), the US debt situation is spiralling.

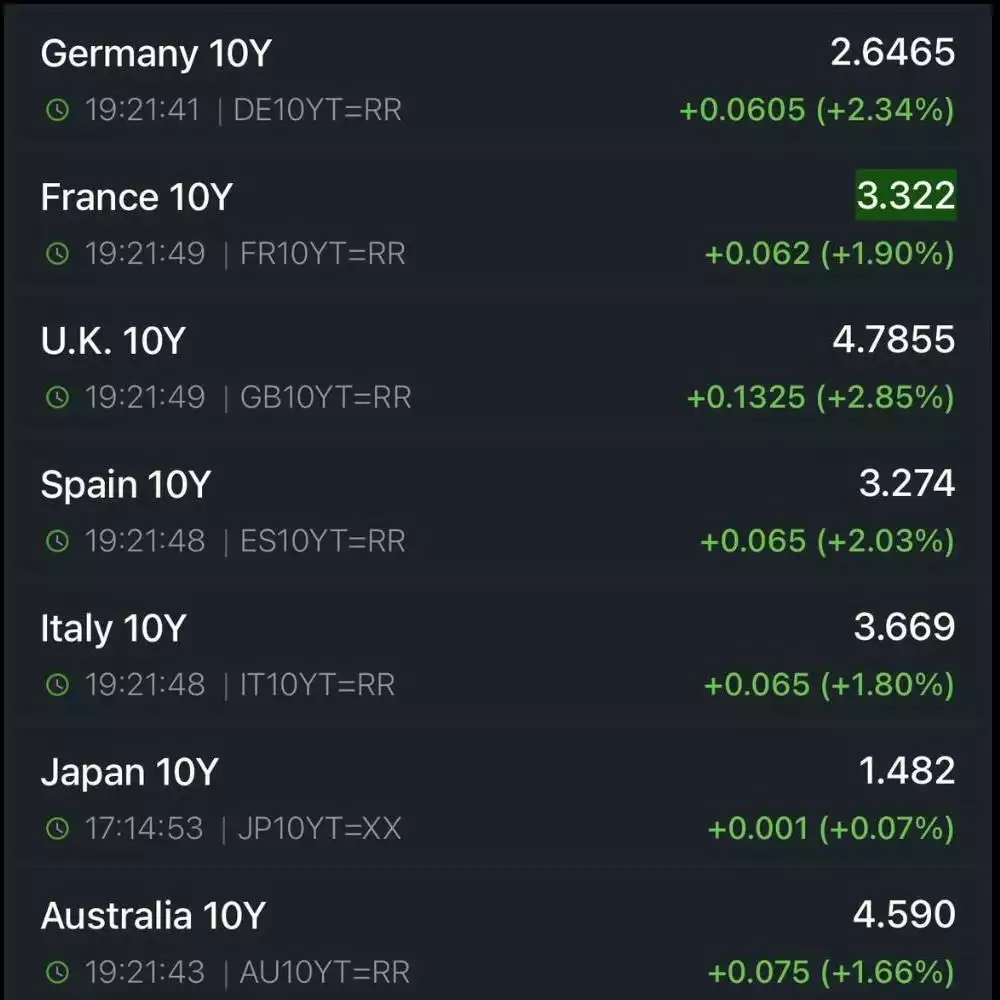

The US 10-year yield rose to 4.5% in response to the downgrade, and interestingly, government bond yields rose in most major nations simultaneously, putting downward pressure on global liquidity and bond collaterals.

While stock markets seem to be resilient to the news, this downgrade of the US marks the end of an era for the US bond market.

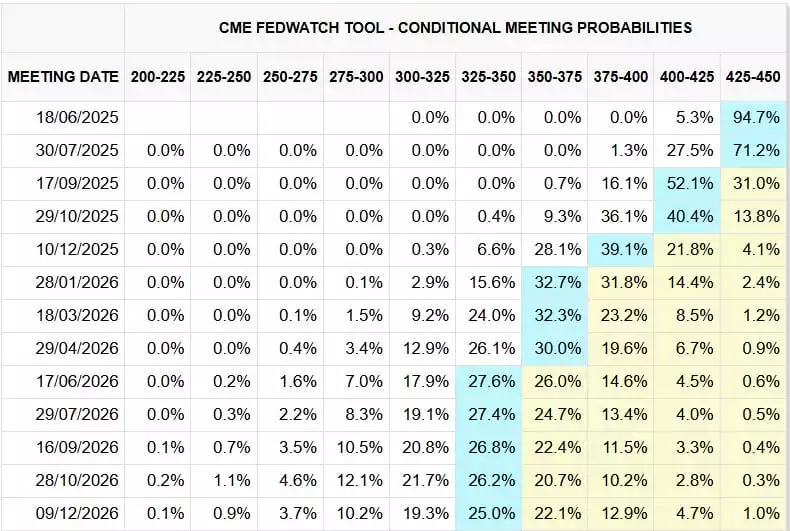

The upward pressure on long-dated bond yields (and resultant downward pressure on long-dated bond collaterals) reduces the chances of US interest rate cuts in the near term. Rate cuts in this environment would likely lead to the yields rising further to price in growth and inflation, resulting in a further drop in collateral values.

This precarious situation for the US Fed could force their hand into conducting yield curve control via open market operations to bring down the US bond yields, keeping in mind that refinancing US$9 trillion of government debt at higher interest rates would result in an additional US$100-200 billion in annual interest payments.

The US 10Y is currently at an inflection point – sustained closes above 4.5% would signal further upside for long dated bond yields and downside for collateral – resulting in significant pressure on global liquidity, cost of borrowing and the global financial system as a whole - which is underpinned by debt, built on bond collateral.

For the US government, the 9T of refinancing in 2025 is a serious problem at these higher bond yield rates.

While yield curve control might help this refinancing and even allow for rate cuts, unfortunately, the influx of global liquidity that would result from it would almost certainly lead to further significant asset and consumer inflation.

It would appear the walls are closing in for the central bank and its bag of tricks. Their decisions in the upcoming months will help reveal their main priorities. With an official mandate of balancing inflation and unemployment, their actions might prioritise helping the servicing of government debt.

While a painful consequence for citizens, inflation is beneficial to a government drowning in debt, helping to reduce the real value of this currency-denominated debt.

While individuals might be unable to overhaul the entire debt-based financial system, holding hard assets (rather than a constantly debased local currency) helps one benefit from this debt-based, inflation-dependent system, rather than be a victim of it. Gold and silver have served the purpose of storing value for thousands of years - and will continue to do so, while currencies and entire empires come and go.