US -4.8% GDP Just the Beginning

News

|

Posted 30/04/2020

|

20079

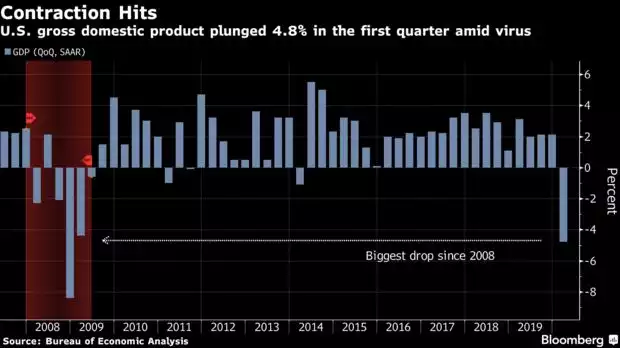

Last night’s headline -4.8% GDP print, whilst worse than expected, is far from telling the real story of the US economy, itself a proxy for the rest of the world. Whilst a recession is technically 2 consecutive negative GDP prints, no one is saying this is not now officially a recession and an end to the US’s longest ever economic expansion. Whilst yes -4.8% is the worst print since 2008, it tells only a fraction of the story, about 20% of the story to be exact. From Bloomberg:

“It’s kind of incredible when you think about the fact that the economy was running pretty much on a normal footing for over 80% of the first quarter,”

When that is extrapolated and knowing what we know now already for Q2, the forecasts for this next quarter make that -4.8% look small. In reference to the chart below we will clearly need a much bigger chart…. From Bloomberg:

“The current quarter is likely to be far worse, with analysts expecting the economy to tumble by a record amount in data going back to the 1940s. Bloomberg Economics has projected a 37% annualized contraction, but UniCredit is the most bearish with a 65% estimate.”

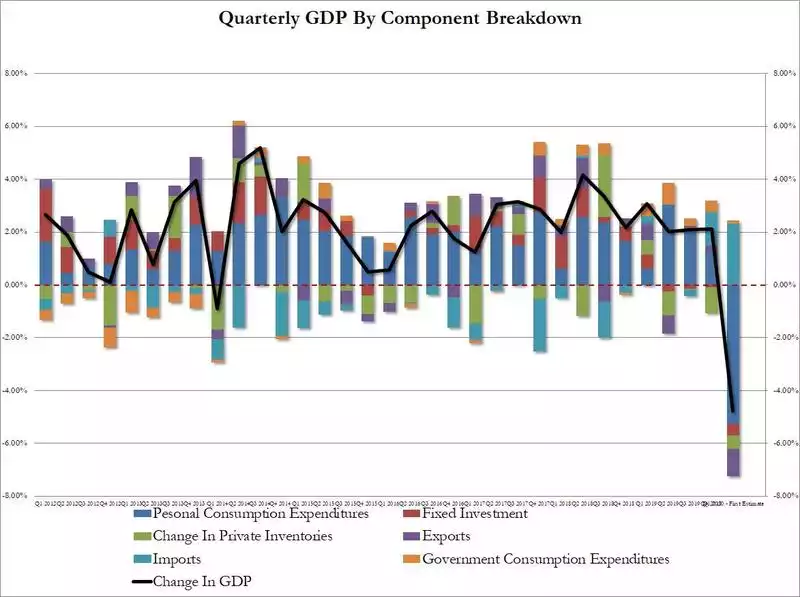

The makeup of the plunge was hugely impacted by PCE (Personal Consumption Expenditure – the worst since 1980) and then across the board with only an uptick in imports and (surprise surprise) government spending the only positives:

The markets’ reaction? Meh…

‘Coincidentally’ the release of a positive report showing Gilead’s Remdesivir virus cure progress came just seconds before the GDP print. Whilst showing only a marginal improvement in projected mortality rates, not a cure nor a vaccine, the market decided to focus on that rather than that pesky GDP print and rallied strongly. Yep, the biggest quarterly drop in GDP since the GFC, worse than expected and on just 20% of the quarter in lockdown saw sharemarkets rally. If you needed any further proof of a bull trap rally (read here if you missed our explanation) you’ve been drinking too much Dettol. This chart speaks volumes…

But clearly not everyone is drinking from the Isocol fountain. Precious metals and crypto rallied on the news.

The Fed then came out and reinforced they will do whatever it takes:

Cause:

"The ongoing public health crisis will weigh heavily on economic activity, employment and inflation in the near term, and poses considerable risks to the economic outlook over the medium term,"

Response:

“To support the flow of credit to households and businesses, the Federal Reserve will continue to purchase Treasury securities and agency residential and commercial mortgage-backed securities in the amounts needed to support smooth market functioning, thereby fostering effective transmission of monetary policy to broader financial conditions”

Effect:

“The Federal Reserve is redefining central banking. By lending widely to businesses, states and cities in its effort to insulate the U.S. economy from the coronavirus pandemic, it is breaking century-old taboos about who gets money from the central bank in a crisis, on what terms, and what risks it will take about getting that money back.”

(courtesy of Wall Street Journal’s Fed watchers Jon Hilsenrath and Nick Timiraos)

Denial:

"The debt is growing faster than the economy. This is not the time to act upon those concerns"

Literally from the mouth of Jerome Powell, Chair of the Federal Reserve, in his press conference last night.

The problem is, neither the Fed, the US Government nor nearly any other central bank or government in the world today seems to think this rampant accumulation of debt and debasement of money is a concern.

People are buying up gold, silver, bitcoin, Ethereum etc etc for that very reason. Debt always eventually matters as does economic reality for shares.