U.S. Stock Market could be in Bubble Territory already

News

|

Posted 06/03/2024

|

1668

As gold and bitcoin continue to soar to new and previously unseen heights, concerning signs are starting to present themselves in U.S. equities.

The current state of the U.S. equity market seems to be reminiscent of the "number go up" mentality, where stocks keep rising without a significant downturn. Despite the ongoing rally, equity investors shouldn't become complacent. Significant parallels are starting to emerge between the current market and the dot-com bubble of the early 2000s, suggesting caution is warranted.

Stock market dynamics often involve a fierce battle between bulls and bears, and bull markets tend to persist longer than expected. However, even the most optimistic investors should be mindful of potential risks and warning signs.

Several concerning indicators have started to emerge:

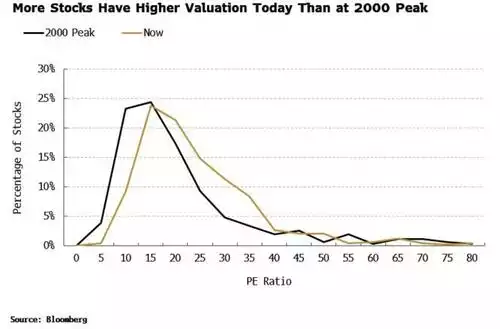

Valuations: While the overall price-to-earnings (P/E) ratio of the S&P 500 is lower than during the 2000 peak, there's a notable increase in the number of stocks with higher P/E ratios than the average (the right tail on the graph below), resembling the dot-com era.

Obviously a high stock valuation on its own is by no means a definite sell signal, but as these overvaluations become more widespread within the market, it makes it more likely than when these equities do to start to sell off the impact will be more pronounced.

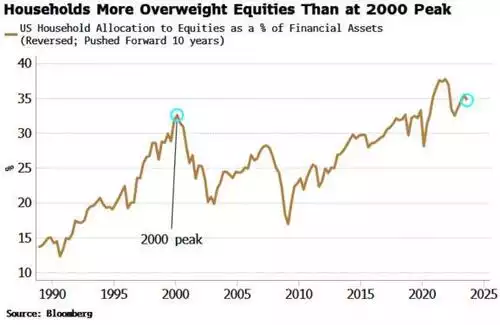

Household Sector Allocation: The household sector in the U.S. is heavily invested in equities compared to 2000, suggesting a potential downside for long-term returns, as generally households are those who are latest to the party. The old adage of ‘sell your holdings when a taxi driver starts giving you stock tips’ is an old adage for a reason. It is often correct.

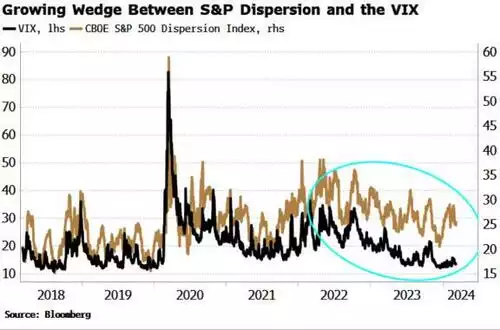

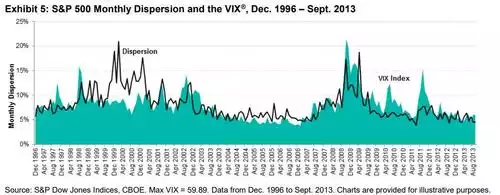

Dispersion and Implied Volatility: There's a growing gap between dispersion (individual stocks' variance compared to the index) and implied volatility, particularly in the tech sector. This disparity indicates a potential bubble in the tech sector, reminiscent of the late 1990s.

Despite these warning signs, there are still positive factors supporting the market, such as excess liquidity and the solid fundamentals of major companies. Unlike the dot-com era, today's leading companies have established track records and viable businesses.

It is definitely possible that the excess liquidity can continue to support U.S. equities, however we are starting to see a possible global re-allocation of assets, with Gold (as we discussed yesterday here) and Bitcoin as at all time highs.

Investors should in no way dismiss the risks associated with the current bull market. It's essential for investors to exercise caution and avoid complacency. The concept of hedging equity returns through Gold or Bitcoin appears to be more popular and easier than ever, particularly with the recent BTC ETF approval.

Fearlessness in this market could lead to carelessness, and it's crucial for bulls to tread carefully.