U.S. Shares Break – US Gov Debt Rockets – What next?

News

|

Posted 05/10/2023

|

2957

U.S. Stocks Just Broke

After one year of continuously bouncing upward on a trend line, the S&P 500 has just suffered a decisive break underneath it in the last day.

Although this signal is not a guarantee that the index will fall, or fall immediately, this is a textbook example of a trend reversal.

This morning we see U.S. news outlets touting a relief rally, strength, recovery, and a race upward, yet the S&P has not even risen past yesterday's drop. Not one of these articles notes the fall through a year-long trend line.

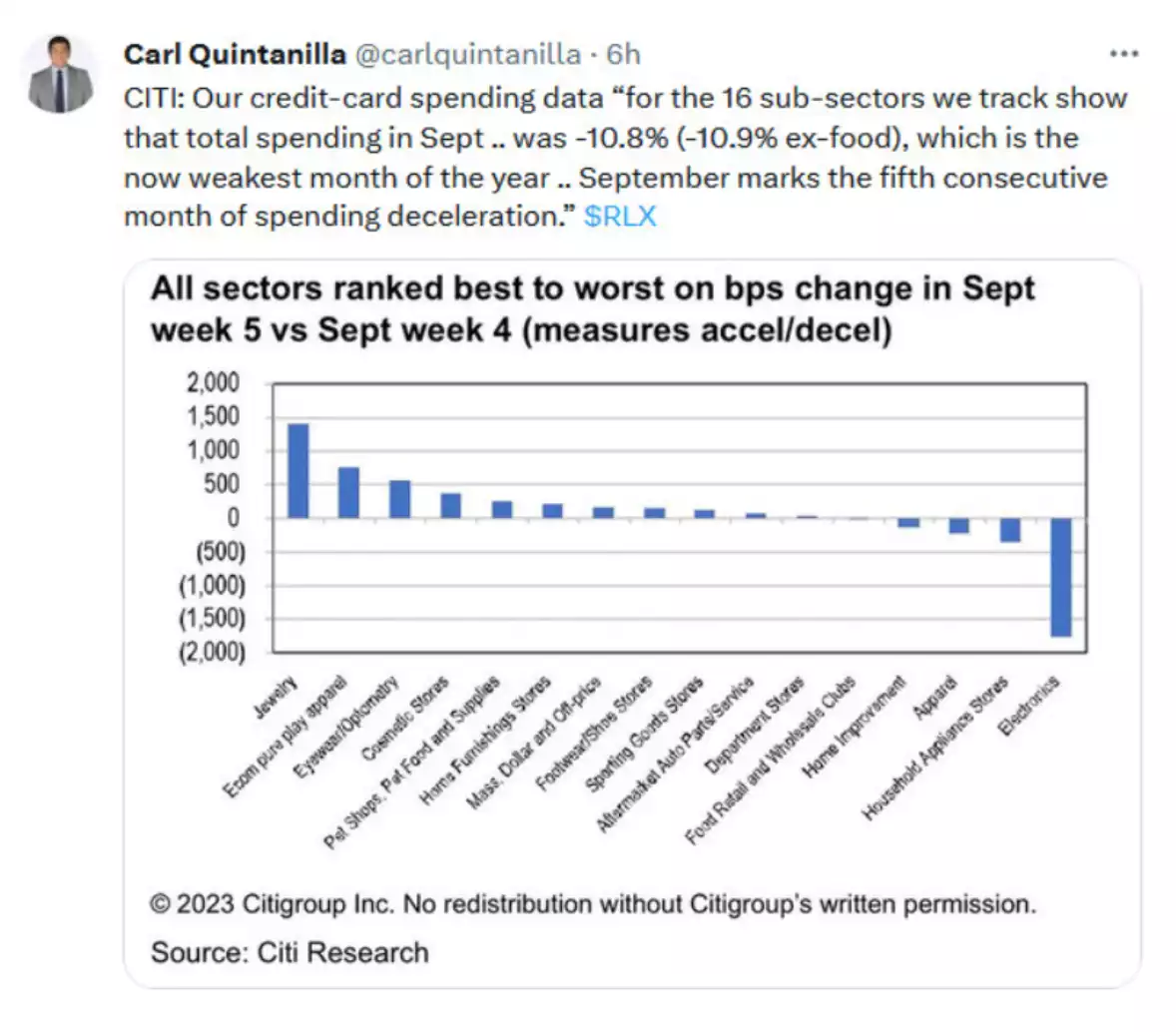

More Bad Credit Data

According to a post by Carl Quintanilla, data from Citi shows that for 16 economic sub-sectors tracked:

- Total spending in September was down -10.8%

- It was the fifth month in-a-row spending dropped

- This made September the weakest month of the year

U.S. consumers may have taken the heaviest hit yet in the last month, but the government has been doing quite the opposite…

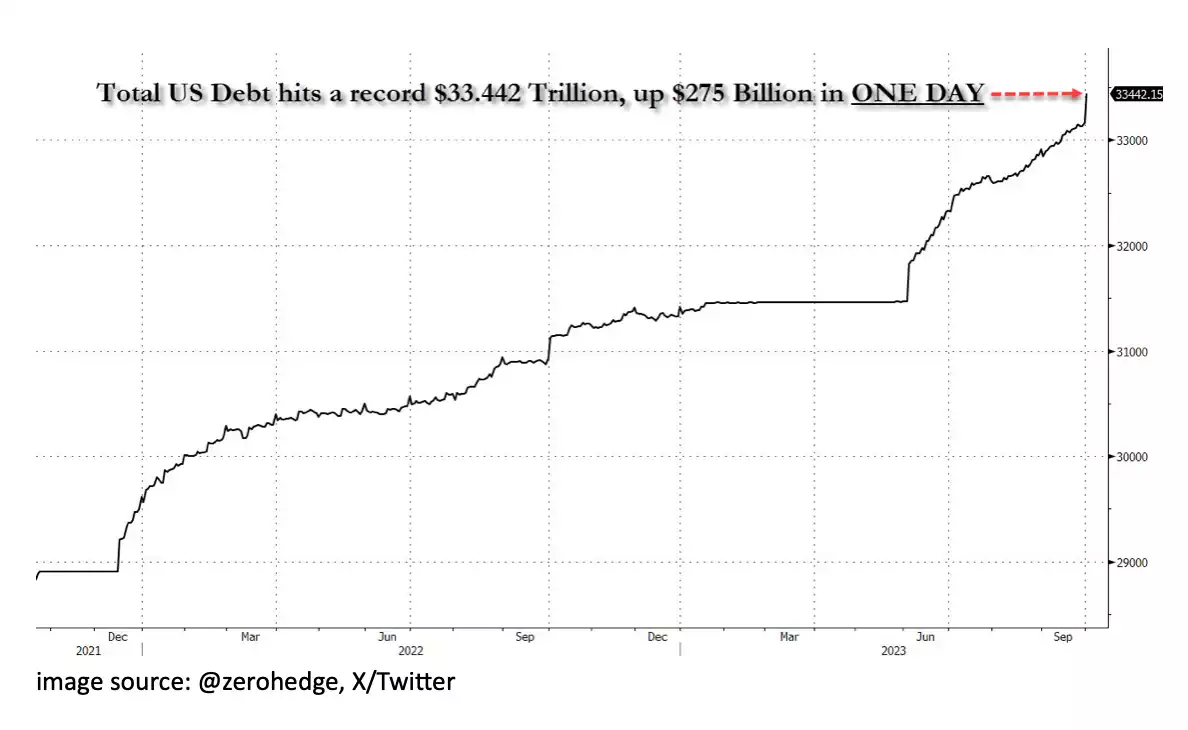

Total U.S. Debt Skyrockets

The U.S. government has just accumulated $275 billion in debt in a single day. The last two weeks show a total rise in debt of almost half a trillion dollars. Let’s put that into perspective: US debt could be rising by one trillion dollars every month. Historically, it has risen more aggressively with time.

image source: @zerohedge, X/Twitter

What is the easiest way out of this mess? It's to cut interest rates again and create more money. But, with the size of the last round of stimulus and the current egregious amount of debt, the problem of diminishing returns could be the biggest issue. As the liquidity pool grows ever-larger, the amount of money that needs to be added to create a visible difference eventually becomes virtually impossible to manage. One of the ways to attempt to assist the process of managing such large amounts of money is to digitise everything and eliminate cash. This would keep money from exiting the system and allow for even more large-scale stimulus.

What’s Hedging?

Despite skyrocketing debt and the prospect of inevitable interest rate cuts, gold is currently trading at a heavy discount. Will the stock market be okay and continue its “relief rally” or is something brewing underneath the surface? Perhaps the Non-farm Payrolls for September (being released this Friday night) will rattle the cage. The short-term may be unknown, but the longer-term solution to unsustainable debt-based currency always seems to be a continuous inflation, and thus devaluing, of the currency.

That inevitably is very bullish for gold unless this time is different to the 5000 years before it…