U.S. Home Prices Poised for a Surge as Mortgage Refinancing Skyrockets

News

|

Posted 26/09/2024

|

1343

While there are many positives to the Fed's recent move to cut rates, the nature of its delayed timing means we are likely to see significant housing and rental inflation that will only worsen the current cost of living crisis.

From a housing perspective, the Federal Reserve couldn't have chosen a worse time to start easing monetary policy, though with an election just over a month away, it didn't have much of a choice.

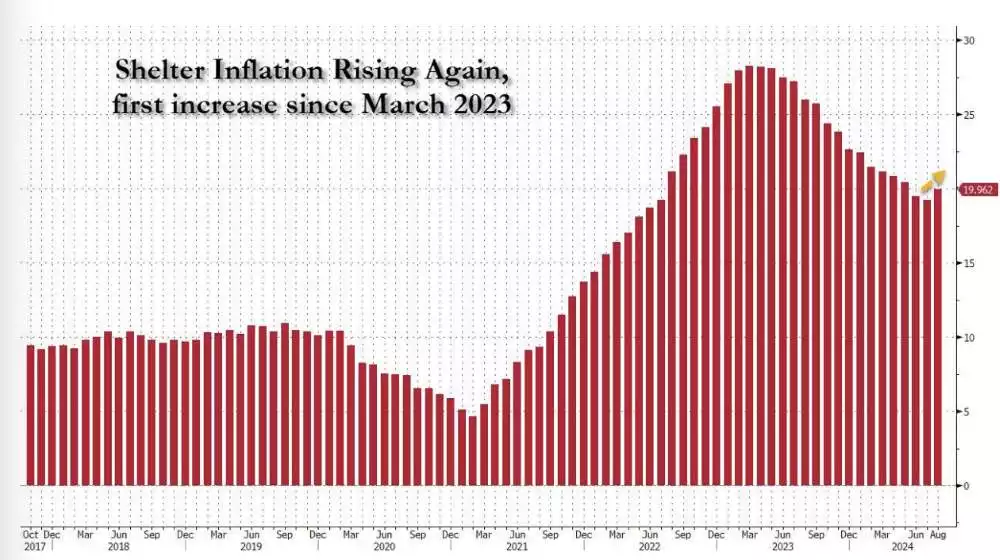

As we have discussed previously, there is often a significant lag present in the economic data that central banks/governments use for decision-making. Just before the Fed's recent 50-basis-point rate hike, the Bureau of Labor Statistics (BLS) reported the first annual increase in shelter costs since March 2023.

This is just the warm-up. Get ready for the next wave of surpassing price levels thanks to the Fed's 50 bps rate cut which has already translated into the cheapest mortgage borrowing costs in two years, applications to refinance mortgages surged for a second week in a row.

According to the Mortgage Bankers Association, its refinance index for roughly 75% of its U.S. residential mortgage applications rose by more than 20% for the week ending September 20, the highest since April 2022. It achieved this after a 24.2% increase the previous week, as the thirty-year fixed home loan rate fell by a rate of 6.13% for the eighth week consecutively.

The Mortgage Bankers Association (MBA) home purchase application index also rose by 1.4% which was the highest since February, reflecting strong increasing activity in the housing market despite it still recovering.

Normally when the Federal Reserve starts cutting rates, we don't see a big rush of refinancing applications right away—people usually hold off, hoping for even lower rates. But this time, things are playing out differently. Last week, the yield on the 10-year Treasury note ticked up as traders began speculating about how much the Fed will cut rates in November and what the overall reduction plan will look like. They're also starting to factor in the next wave of inflation, which is likely to be driven in part by a surge in home prices. This shift is pushing borrowers to act sooner rather than later, anticipating further rate cuts to come.In essence, homeowners are front-running the Fed.

Why do lower refinancing rates lead to higher home prices? It's simple: lower rates improve affordability. As mortgage rates drop, homeowners can save thousands of dollars in annual payments, freeing up cash for home improvements, debt repayment, or consumer spending. Most of this extra cash will likely go towards purchasing homes, pushing prices even higher in a market already suffering from low supply.

"While the level of refinance activity is still modest compared to prior refi waves, they now account for the majority of applications," said Joel Kan, MBA's vice president and deputy chief economist.

Over the next few months, pay attention to the Owner-Equivalent Rent (OER) component of the Consumer Price Index (CPI), the largest sector or segment of the index. It is poised to go through the roof as mortgage refinancing booms.

Ultimately, while we hope lower rates will provide temporary relief for homeowners, they are also likely to fuel rising home prices and rents given the unique timing of the rate cuts and the current economic situation globally, adding more pressure to an already constrained housing market.