U.S. Cuts Interest Rates By 0.25% - While Tempering Expectations For 2025

News

|

Posted 19/12/2024

|

1809

Balancing inflation with liquidity - but for how long?

With the U.S. Federal Reserve currently caught between a rock and a hard place of managing inflation while holding up the debt-based house of cards, that is our global financial system, this morning’s Fed meeting was an exhibition of skill at doing just that.

With U.S. bond yields rising as a reaction to the 0.25% rate cut (cutting rates into a strong economy and low unemployment, increases inflation expectations) their rise was tempered by the much-needed hawkish rhetoric of the Fed chair - expressing limited rate cuts in 2025.

Too sharp a rise of U.S. bond yields from this point could be catastrophic to the U.S. banking system, currently in a precarious position, as the U.S. Fed balances inflation expectations, with liquidity requirements.

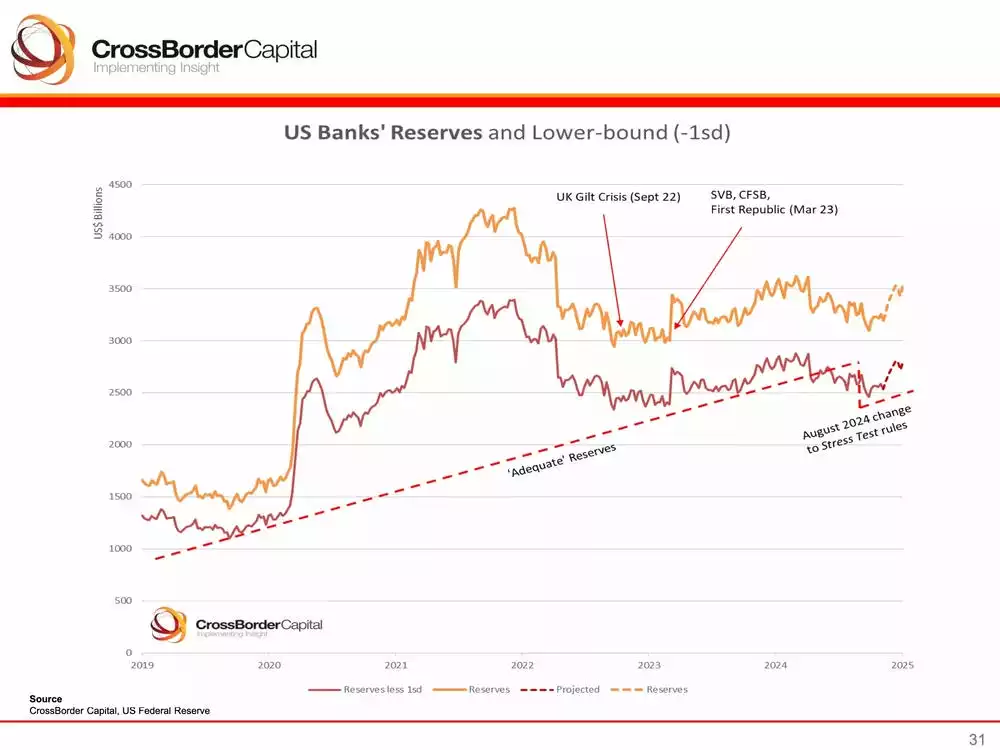

With U.S. bond yields rising since the rate cutting cycle started in September - bond collateral values have been dropping. This has been putting pressure on the capital reserves of U.S. banks - which, by law, primarily hold U.S. government bonds as collateral.

Quietly, and in anticipation of this, the adequate reserve requirements for U.S. banks were reduced in August, ahead of the rate cutting cycle commencing - fundamentally weakening the foundation of the U.S. banking system.

With the U.S. Fed signalling a pause in rate cuts, the CME FedWatch Tool shows a 90% expectation of no rate cuts for the Fed’s January meeting. Therefore, it appears the U.S. bond yields might have peaked for now, giving the U.S. banking system some much-needed reprieve.

With the current target rate being between 4.25% and 4.5% and the current US10Y bond yield at 4.52% we also see a return to normality in the bond market, as bond yields are back above the cash rate, after being consistently lower since October 2022. Having bond yields below the cash rate signals an unwell bond market, as investors take on duration risk, for no additional reward.

While markets temporarily react negatively to the idea of limited rate cuts in 2025, a closer examination reveals the necessity for the U.S. Fed’s aggressive monetary policy today - to maintain stability in the banking system. The question remains, how much longer can this delicate balancing act be sustained?

The fragility of the current financial system is becoming increasingly apparent to everyone paying attention. While a broad-based systemic collapse seems inevitable, the longer the can is kicked down the road, the greater its eventual ramifications.

As we simultaneously move from one 18.6-year land cycle to the next (last one was the 2008 GFC) and one 80-year socioeconomic cycle to the next (last one was the Great Depression) - the expectation of a broad-based systemic collapse is reasonable - and with the current data on hand, it seems all but unavoidable.

While gold and silver are benefiting from the increased liquidity created, as the can is being kicked down the road, they are also reliable vehicles to gain shelter from the storm, while simultaneously acquiring significant capital growth during the inevitable systemic collapse phase which follows - as the central banks’ balancing act is tipped over by the laws of nature.

During such times, investors seek assets which are not connected to any particular government, hedge fund or banking institution. As the human created systems collapse and reset, we return to gold and silver, which have been eternal, reliable, and consistent, while entire civilisations have come and gone.