U.S. Banking Sector Structurally Weakened - Prior to Interest Rate Cuts

News

|

Posted 17/01/2025

|

1208

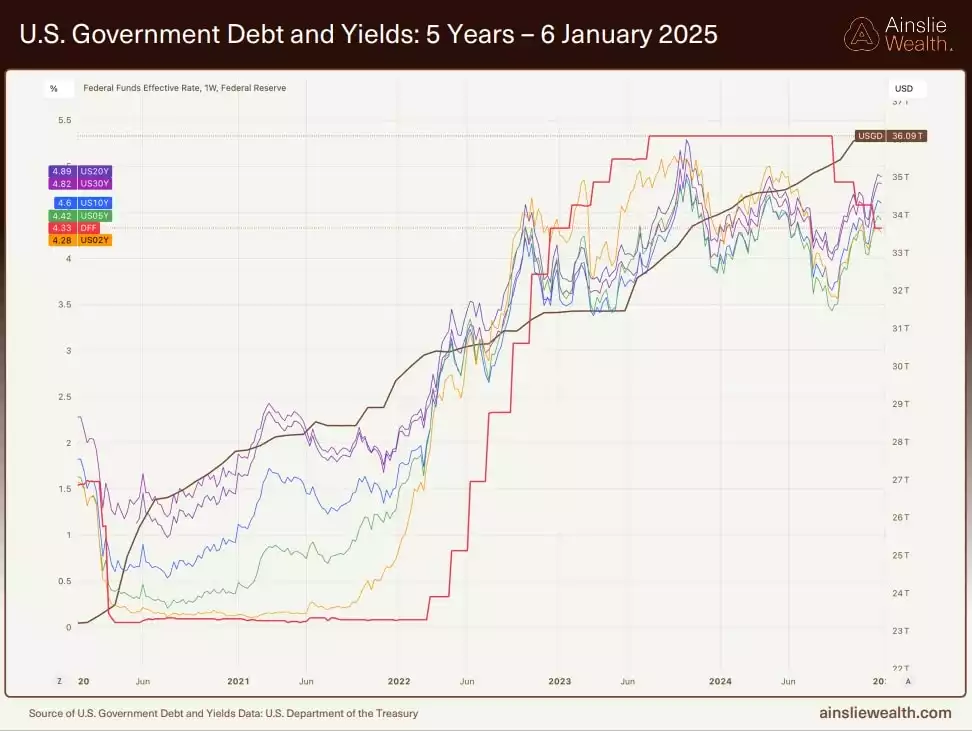

Ever since the U.S. Fed started cutting interest rates in September 2024 – in celebration that inflation had been defeated - the US bond market has been yelling out “too early” in disagreement. Bond yields have risen sharply as a result, pricing in a potential resurgence of inflation. This has resulted in bond collateral values dropping, which is the blue-chip collateral held by U.S. banks.

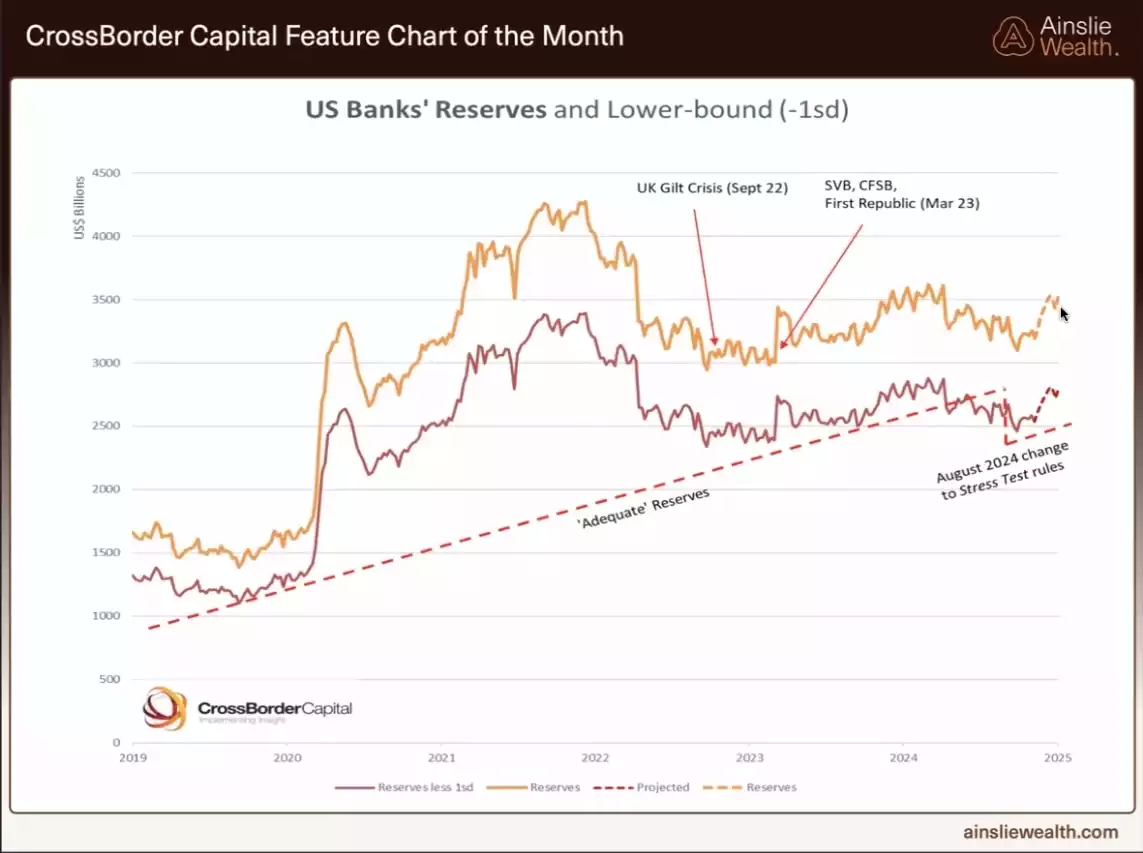

While the banking sector collectively fell below the usual adequate reserve requirements as a result of this policy decision by the U.S. Fed, it appears the adequate reserve levels were quietly reduced in August, a month before the Fed started cutting rates - structurally weakening the U.S. banking sector, prior to the rate cutting cycle.

A few cuts later and the U.S. Fed claims to be on board with the bond market, overtly communicating concerns for inflation returning in 2025, and an intention to pause rate cuts.

While many look at this as a policy error by the U.S. Fed, cutting too early, the pre-emptive moving of the goal posts for the banking sector suggests that they knew exactly what the likely consequences of their policy would be on U.S. banks, ahead of time – and felt compelled to proceed with rate cuts regardless – even in an environment of strong employment and economic conditions.

So, if the Fed was expecting this outcome, why did they proceed with rate cuts?

It could be that they are currently between a rock and a hard place, managing inflation and surging government debt, within a liquidity fuelled economy - and are running out of options in their bag of tricks to manage it. Alternatively, one might speculate on a potential, long-term, controlled demolition of the private banking sector, as plans for a central bank digital currency continue gaining momentum.

While the Fed’s jawboning about limited cuts in 2025 wasn’t sufficient to calm the bond market’s falling collateral values, December’s inflation figures released the other night have provided the first signs of a sigh of relief for the bond market and the banking sector.

Core CPI rose 0.2% in December, below the 0.3% consensus forecast and bringing the annual measure to 3.3%; and Headline rose 0.4%, as expected, bringing annual inflation to 2.9%. The softer core inflation will come as a relief to bond market participants, reducing U.S. bond yields and bumping up collateral values for now. Fed policy over the upcoming months will be critical to avoid a tantrum in the U.S. bond market and major issues in the banking sector.

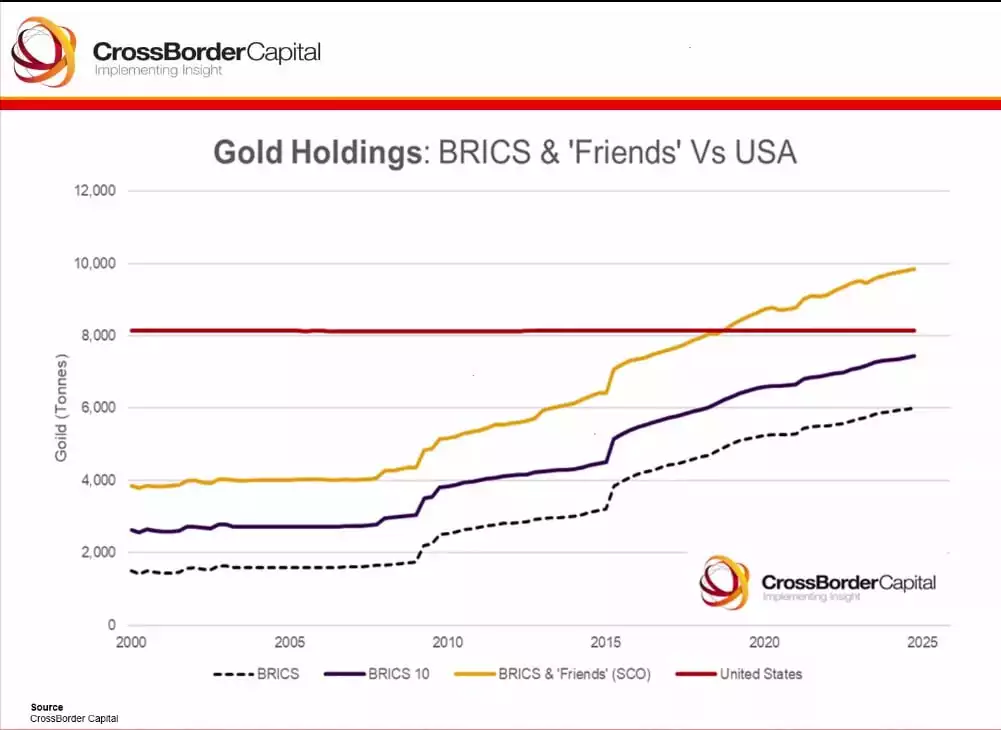

With all this uncertainty in the financial sector and an increasingly precarious banking sector - gold has continued to see strong upward price action, as demand outstrips supply. Central banks hold large reserves, BRICS nations continue stockpiling, and astute investors are reading the writing on the wall.

Whether it is a financial market collapse due to a bond market tantrum, a banking collapse due to inadequate collateral - or simply untamed inflation proliferating this decade – gold, being decentralised, limited in supply, with intrinsic value, and no counterparty risk - is one of the only assets that protects against the multitude of growing systemic concerns, and the price action clearly reflects this.

With these systemic concerns baked into the cake, it appears that gold’s macro bull run has only just begun, with the upcoming decades potentially leading into a fundamental repricing of this highly in-demand asset - of which there is simply not enough to go around.

Watch the Ainslie Insights video discussion of this article here: https://www.youtube.com/watch?v=21nc7OKYOJM