Trump’s Tariffs Spark Global Market Turmoil

News

|

Posted 27/11/2024

|

1215

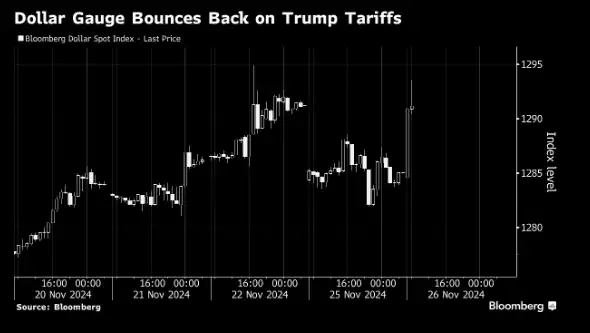

Markets dropped this week on the back of Trump's tariff announcement, he not only set China in his sights increasing tariffs by 10% but is now targeting Canada and Mexico. This is an indication of ‘Classic Trump’ – telling everyone what he’s going to do and then doing more, setting us up for another fun 4 years on the market. On the back of the announcement, gold, the Australian dollar, the Canadian dollar, and the Mexican peso dropped, with the Bloomberg Dollar Spot Index gaining 0.7%.

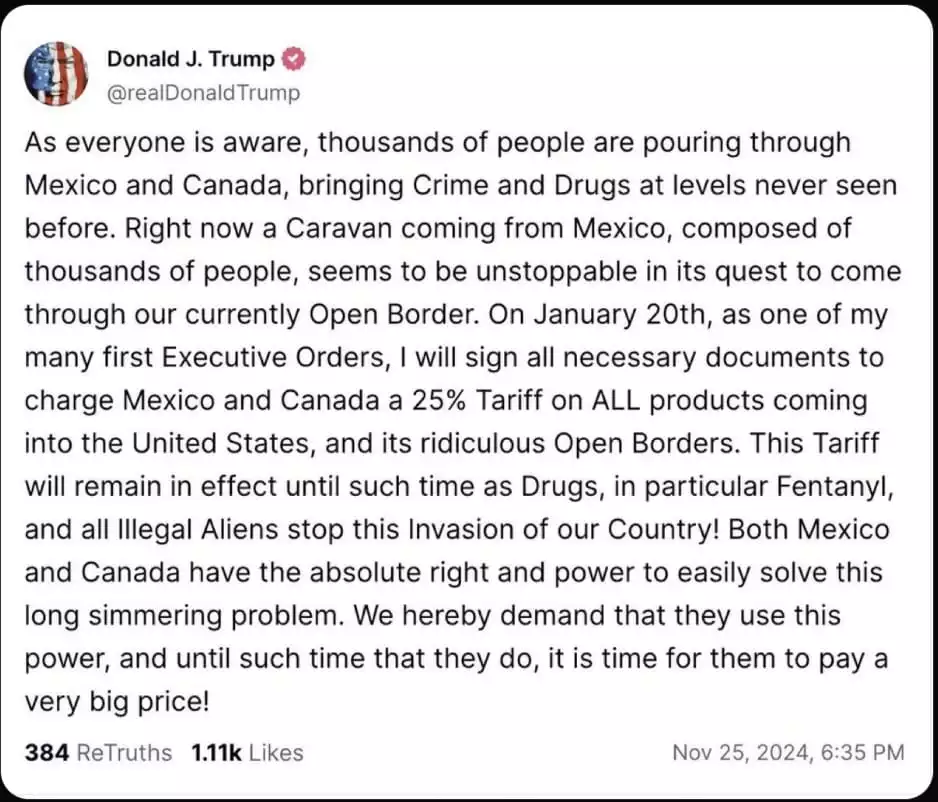

Canadian and Mexican Tariffs

Trump, in a Truth Social post, proposed the surprise tariffs on Canadian and Mexican goods, suggesting they were necessary to address the influx of people and illegal drugs from those countries. He also stated that he would sign documents to impose a 25% tariff on all goods imported from Canada and Mexico.

Following the announcement, the dollar strengthened against all Group-of-10 (G10) peers, while Bitcoin and gold declined.

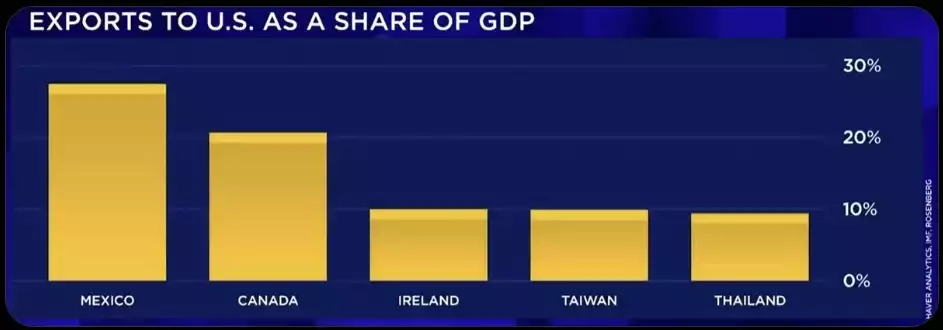

Whether or not Canada or Mexico has enough time to turn this announcement around will be anyone's guess, though Canada probably has an easier job. Canada exports to the U.S. as a share of GDP of around 20%. It was estimated that Canada’s GDP would drop by 2.4% year on year with a 10% tariff, so this announcement will hit home to an economy barely staying afloat, much like Australia the growth is due to government expenditure and huge immigration numbers.

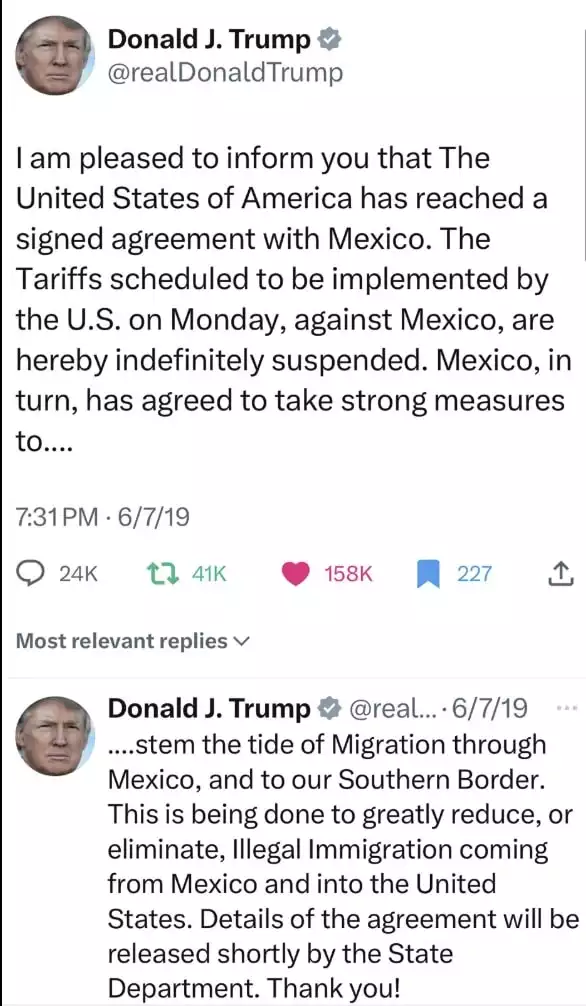

In 2019 Trump proposed a similar tariff on Mexico but it was stopped within a couple of days of implementation as they agreed to take stronger measures at the border – likely this will happen again before the implementation date.

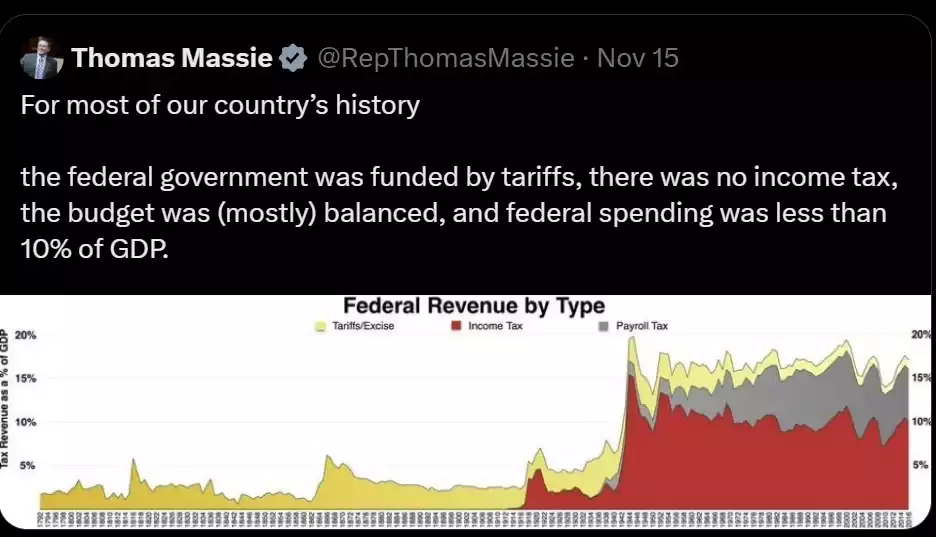

Up until 1913 tariffs were the only source of funding for governments, and the 1913 income tax aimed to only capture the super-wealthy. Since the introduction of income tax, the government's size has grown from 10% of GDP to 36.2% of GDP nearly 4 times the size it was 100 years ago.

Tariffs will increase inflation as the economy adjusts to them, but by reducing or eliminating income tax, this inflation will be absorbed by the higher take-home wages. Tariffs are a simpler taxation system, much like GST or VAT with easier collection mechanisms making taxation management easier and potentially reducing cost within the government. By putting tariffs on goods Trump hopes to promote more manufacturing in the U.S. as more goods are produced there, creating jobs and manufacturing opportunities. Such tariffs have failed in the past in places like Argentina due to the ‘laziness of industry’ but as the U.S. is a much larger economy this ‘laziness’ becomes harder and less likely.

The argument against Tariffs

The U.S. and the world have been fighting inflation since Covid and the introduction of tariffs will initially create inflation. The speed of adjustment in the economy to a proposed reduced income tax and onshoring of manufacturing will dictate how big and how long the inflation story will be.

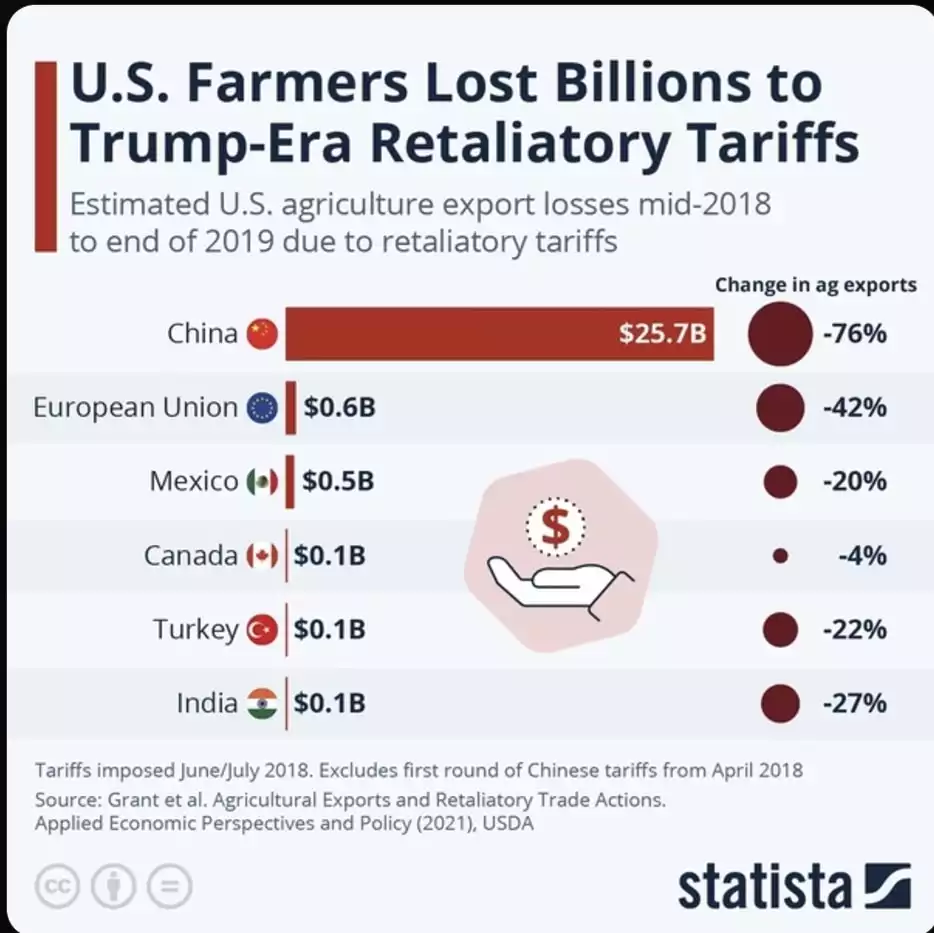

By implementing tariffs, the proposition of retaliatory tariffs becomes real. In 2018, with the introduction of the China Tariff, U.S. farmers' export losses to China were estimated at US$25.7 billion in 18 months.

Finally, tariffs are argued to cost more regardless of whether manufacturing specialisation and larger manufacturing sites supplying the global economy rather than a nation are deemed more efficient.

So, will Trump do it? Or will Mexico, Canada and China be able to stop this threat from becoming a reality? And if they are introduced will this again bring on the Golden Era of the 1890s some economists are arguing, or will this be the start of more inflation? Time will tell but this is just the start of 4 years of ‘Classic Trump’.