Trump or Biden – Gold the likely winner

News

|

Posted 02/11/2020

|

9113

You may or may not be aware of a little election taking place tomorrow. The last saw a wild whipsawing of markets including gold. Whilst that was a ‘shock’ win, with the majority now believing Biden will win this time, there is a very real risk of Trump bringing home another shock win. That means the market has likely priced in one scenario when another is very possible. There is also the issue of a protracted legal battle and/or broadscale civil unrest and further social dislocation. This election, maybe more than the last, could see heightened volatility in markets as the news unfolds. One analyst who publicly called the Trump win last time and recently also went public with a high conviction call he will win again is Jim Rickards. In terms of what he sees for gold in this election:

“Regardless of which candidate wins, gold will also win.

If Trump wins, it’s reasonable to expect additional deficit spending along the lines we have already seen.

The Fed will have to monetise this debt to keep interest rates from rising. That debt monetisation will increase inflationary expectations, which drives the dollar price of gold higher. A Trump victory may also produce more Antifa-style violence in reaction, which increases the safe haven appeal of gold.

If Biden wins, not only will there be more stimulus-style spending, but there will be enormous pressure to enact the Democratic Party platform that includes guaranteed basic income, free healthcare, free tuition, free childcare, open borders and the Green New Deal.

These programs will cost tens of trillions of dollars that will also be funded with huge deficits and debt monetisation by the Fed. The inflation signal will be even stronger under Biden than Trump and gold prices will rise predictably.

Finally, a disputed outcome in which the Electoral College is a 269-269 tie, or in which results are not final because of disputes over mail-in ballots, will certainly spark a rally in gold as a safe haven in tumultuous times.”

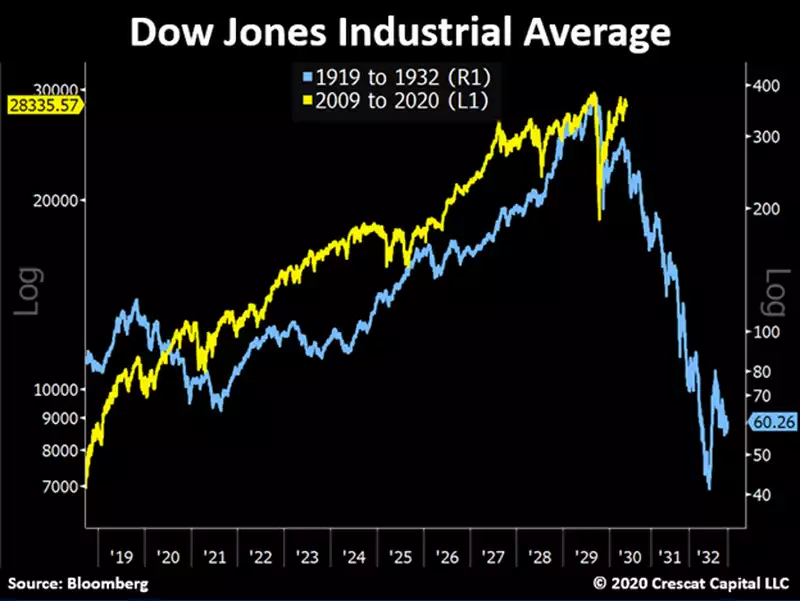

If we look at US equities markets right now we remain in that eerily similar pattern to what existed in the lead up to the Great Depression:

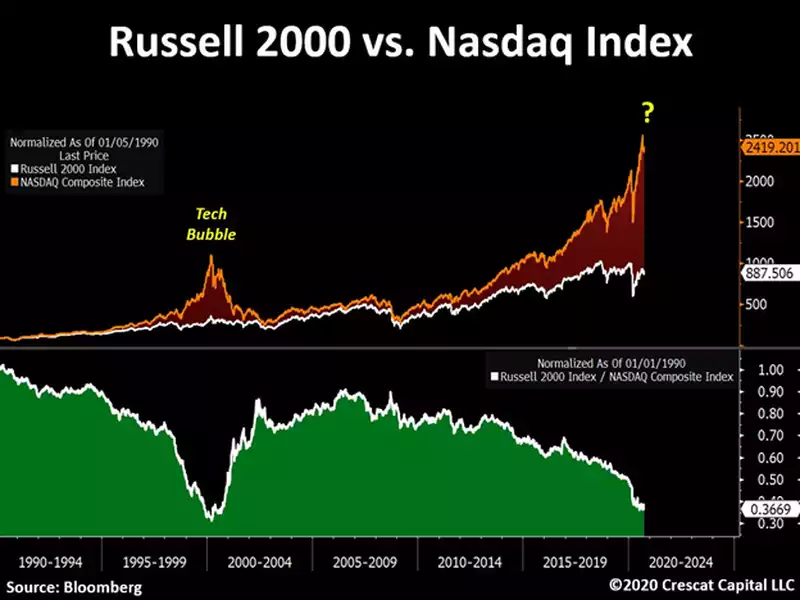

Something will be the trigger that causes the big unwinding of this bubble. To further illustrate the concentration of this bubble it is interesting to compare the tech heavy NASDAQ with the small cap equities Russell 2000 index. The latter is seen to be more illustrative of the ‘real economy’ as it strips out the concentration of the FAAMG’s. In terms of the ‘prick’, Biden has been on record that he will heavily tax the big tech companies, a message seemingly not heard or disregarded by all those piling in to them. Maybe that is just because that is blind passive money or maybe they are still seen as the least dirty shirt in the basket regardless of sky high valuations. Either way the chart above in the context of the chart below looks decidedly fragile as the ratio of Russell 2000 to NASDAQ reaches near all time lows and set to retest the tech bubble levels that saw the NASDAQ fall 80% thereafter.

Fragility and high volatility are not great bedfellows and, again, either way we look likely to see a high level of volatility in the coming days and maybe months.

Remember there was no stimulus package passed before the election and now there won’t be the chance for the new administration to pass one before February next year. The US is getting smashed right now with the 2nd wave and there is no safety net there for months, coinciding with possible heavy civil unrest. It is a cocktail best watched from afar and with your wealth well hedged.