Trump, Harris, and Gold

News

|

Posted 05/11/2024

|

2278

A new report has analysed the prospective terms under Trump versus Harris, the big election policy topics and how this may impact the price of gold in the next 4-year presidential term.

Federal debt

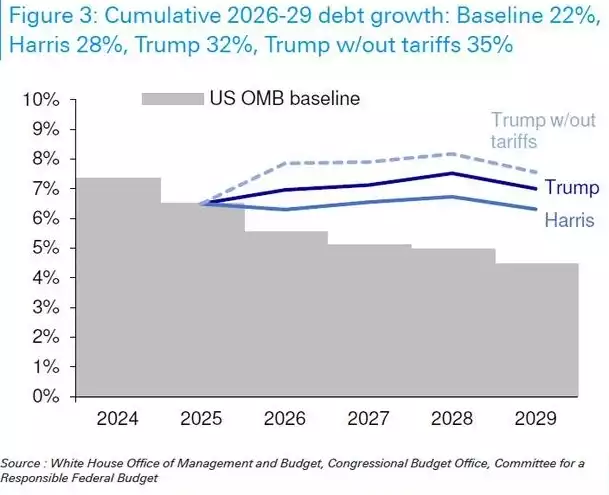

Government spending and national debt are expected to rise under both candidates and grow faster than baseline projections by the Congressional Budget Office (CBO) and the White House Office of Management and Budget (OMB).

A potential Trump budget is expected to incur its largest new costs through the extension of some parts of the Tax Cuts & Jobs Act and the ending of taxation of social security benefits and overtime income. The biggest savings would come from tariffs on foreign-made goods.

For Harris, the potential budget would incur its largest costs from extending the Tax Cuts & Jobs Act (but less than under Trump) and the expansion of the Child Tax Credit and Earned Income Tax Credit schemes. The largest source of new savings from her administration would come from an increase in the corporate tax rate and higher taxes on capital gains and dividends.

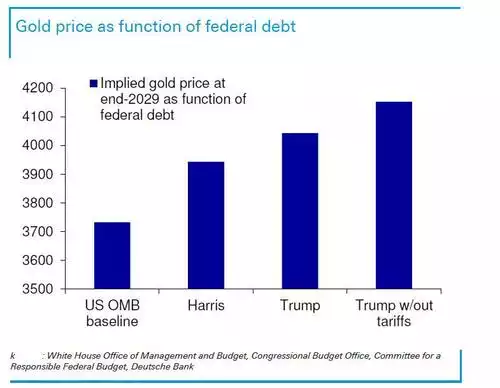

The cumulative impact of these measures over the four budgets through to 2029 as compared with the Office of Management and Budget (OMB) baseline is 7% for a potential Harris administration, 10% for a potential Trump administration, and 14% for a potential Trump administration without tariff revenue. Given that the model finds that gold has a 1-for-1 sensitivity to federal debt changes, this would imply the equivalent impacts for gold valuation at the end of 2029.

Including the 1.4% annual fixed model increase in gold price, and benchmarking to a presumed end-2024 gold price of US$2,700/oz, the 2029 year-end gold price forecasts are shown below. Both candidates are good for gold and the modelling predicts that the greater rise in federal debt under Trump will result in great gains in the price of gold during his term.

Immigration policy

On immigration policy, Trump's stance is seen to represent a disruption to the status quo that favours gold. To facilitate deportations, former President Trump has cited the Alien Enemies Act of 1798, and by the letter of the law, it requires the precondition of a declared war, invasion, or predatory incursion by a foreign nation or government. Unless there is a Red sweep in the coming days, though, we may see Congress step in to reduce executive power as Democrat critics have already branded mass deportation as overreach. Also, if deportations did occur under the act, it would likely be a slow process since the law provides for a "full examination and hearing" in US courts prior to removal.

Foreign policy

The analysts see another clear divide that favours gold on foreign policy under a Trump victory. His public statements indicate a different approach to foreign policy as compared with the status quo of Harris' approach. Key differences include Trump's proposed halt to US aid to Ukraine and his sceptical approach to NATO.

On China, Harris has suggested that the U.S. should 'de-risk', not decouple from China and that the two countries should "maintain open lines of communication to responsibly manage the competition between our countries" according to the Council on Foreign Relations. Also relevant to China is that the Trump Administration in 2020 rejected China's territorial claims in the South China Sea.

On Iran, Trump has historically held a more antagonistic stance, withdrawing from the JCPOA nuclear deal in 2018 and reimposing sanctions on Iran's crude oil, which he may seek to do again. Harris would likely favour a different approach. In 2018, she criticised the US withdrawal from the JCPOA and in 2019 spoke of rejoining the JCPOA.

On Ukraine, former President Trump has criticized the scale of US security assistance, implying that he would seek an end to US aid if he were elected, and has asserted that he would quickly arrange a negotiated end to the war. By contrast, Vice President Harris would likely continue to provide aid to Ukraine and has promised to "stand strong with Ukraine and our NATO allies."

In summary, the analysts of this report believe that gold's first reaction to the election result will be positive on a Trump victory mainly due to greater uncertainties attached to policy departures from the status quo, aided by more elevated federal debt growth and likely ignoring the complexities of the tariff impact on gold. The proposed tariffs have been left out of this article because they were judged by analysts to have a very ambiguous impact on gold.

On the other hand, a Harris victory would result in a reduced risk premium, but any selloff in gold is expected to be short-lived it would be balanced by Asian import and central bank demand.