Trump Assassination Attempt: Market Reactions

News

|

Posted 15/07/2024

|

2071

There may be a potential rise in volatility, and gold could benefit from the uncertainty. Gold has already broken major resistance. Data hints at Trump’s polling numbers rising. Also, why are some Republicans supporting Biden?

Investors may expect increased market volatility on market open after the shocking assassination attempt of Donald Trump. If the results on markets are anything like they were after his debate with Biden, one can expect the U.S. Dollar to rise, and treasury yields to increase. One asset that does trade 24/7 is Bitcoin, which may be a spoiler for the reactions of remaining markets once they open. It has already had a sharp rise after the news and confirmation the former president was okay.

Why might the markets react as Trump having a higher likelihood of winning? Surviving such a horrific act makes it difficult to see a political candidate as the aggressor. Ronald Reagan - the last U.S. President to beat an assassination attempt - rose 22 points in the polls afterward. Biden and other global leaders have since rushed to denounce the attack and express relief that Trump was okay. Billionaires Elon Musk and Bill Ackman also voiced support for Trump immediately following the incident.

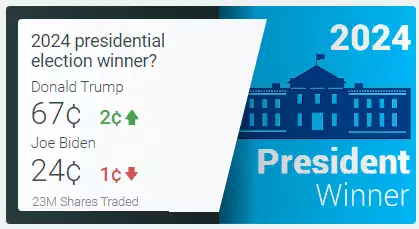

Data from the service PredictIt has supported this theory and shown an increase in support immediately after the incident which shocked the world:

Under a potential Trump administration, market analysts are predicting a more aggressive trade policy, reduced regulation, and a loosening of climate change regulations. Investors are also expecting an extension of corporate and personal tax cuts that are set to expire next year. This could also mean larger budget deficits.

Stock prices have been on the rise, with both the S&P 500 and Dow Jones Industrial Average hitting record highs on Friday. The S&P 500 has risen 18% this year. A Trump presidency could propel this further as Trump has always been heavily supportive of the stock market.

Goldman Sachs analysts have noted that in the last 20 years Republican victories have generally improved CEO confidence, consumer sentiment, and small business optimism. They also noted that the rise in sentiment alone could lead to higher levels of investment and consumer spending.

Republicans Rooting for Biden?

Over the weekend, rumours have been swirling that Republican PACs have been suing to keep Biden in the race. This is a very strong sign that Republicans see Biden as potentially the easiest competitor for Trump to trounce.

The Democratic House leader met with Biden over the weekend and published a very passively-critical sounding statement. This may be another strong warning sign for Biden that support will be heavily redirected to another candidate.

If the Democrats wish to put all their weight behind another candidate, they must hurry as it could take time to build momentum for the individual. One positive flip side is that it would also shield that candidate from media scrutiny. They could pop up with heavy support and leave little time for Republican attacks to derail them. It’s clear that the pressure is on from Biden's peers to find someone capable of tackling Trump.

Gold's Upcoming Reaction

Last week, gold performed an impressive breakout clean above a major price ceiling. It has since retested this level and bounced strongly back upward the following day.

Short-term sentiment may be hard to predict. Instability is a major catalyst for gold strength. If all markets react to the weekend events as a higher chance of a Trump victory, and investors equate that with Trump replacing Jerome Powell with a dove, then that could further propel gold upward in the medium-term.