Tocqueville 4Q18 Gold Strategy Investor Letter

News

|

Posted 17/01/2019

|

6664

Together with Incrementum’s annual report, the Tocqueville Gold Strategy Investor Letter by John Hathaway of Tocqueville Asset Management is one of the most anticipated independent gold analyses going. Last week they released their Fourth Quarter 2018 report. Below are the key excerpts for bullion investors:

“US debt to GDP exceeds 100%, in the danger zone that has historically led most countries into a banana-republic-style sovereign-credit crisis, loss of currency value, and credit collapse. The ratio has hovered near the 100% level since 2013 without adverse consequences. Over the past year, the dollar has been generally strong relative to other currencies. However, we think that the risks are high that significant change is afoot; and if so, exposure to gold will prove timely.

For the record, gold outperformed equities in 2018, declining 1.6% vs. a loss of 4.4% for the Standard and Poor’s 500. As almost all investors can attest, the S&P index masked the full extent of the decline in equity markets due to high concentration of the index in a handful of stocks that outperformed run-of-the-mill stocks. Gold outperformed all currencies last year except for the Swiss franc and the Japanese yen. It also held its own against bonds, roughly matching the 0.9% increase in the US ten-year bond. Some points to consider:

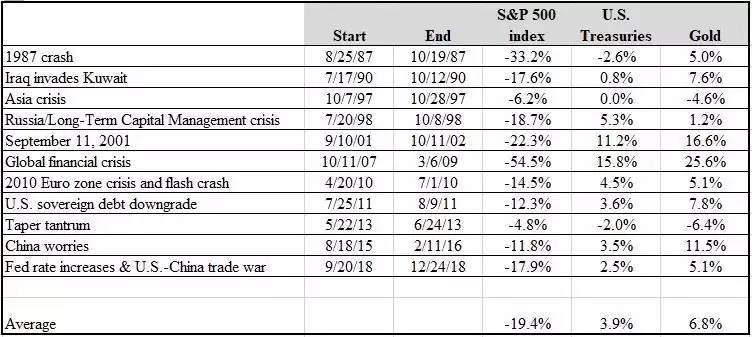

1) Gold has historically outperformed equities during periods of market stress. Counting 11 episodes beginning from the 1987 market crash, gold has increased an average of 6.8% while the S&P has declined 19.4%.

2) During six recessions since the 1970s, gold increased on average 20.8%.

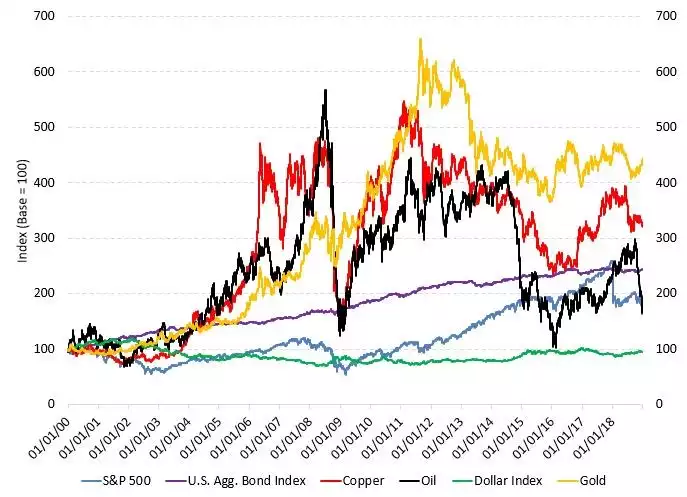

3) Since 2000, gold has outperformed bonds and equities despite a substantial drawdown from 2011 (see chart below).

Why 2000? Because, in our view, 2000 marked the dawn of radical monetary practice by world central banks. Under adverse scenarios for financial assets of short- and medium-term duration, gold exposure has been a winning strategy. And as we see it, gold has also been a winning strategy since monetary policy became unhinged nearly two decades ago.

4) In our opinion, equities stand at the cusp of a bear market that could last 3 to 5 years. Stan Druckenmiller (who averaged 30% returns for 10 years before retiring in 2010) shares this point of view at the 29-minute mark of this clip. The financial media define a bear market as a 20% fall from the previous high, in our opinion a superficial and misleading characterization. The real essence of a bear market is the shift in investor psychology from optimism to deep pessimism. Optimism is displaced by the unshakable belief that financial assets offer no upside, reinforced by repeated disappointment over a long period of time. A brief drop of 20% is insufficient to do this.

According to a recent Financial Times article (1/5/19), stock analysts are the most bullish in eight years, notwithstanding the severe price declines of the 4th quarter. The 1970s bear market was a protracted grind that destroyed investor confidence. Towards the end of the multi-year bear market in 1980, Lee Cooperman, then director of research at Goldman Sachs, declared that bonds were “certificates of guaranteed confiscation.” Stocks made no headway from 1966 to 1983, an almost 17-year-long sideways chop. There has been no protracted bear market since the 1970s. Few investors today appreciate the true nature of a bear cycle because they have never seen one.

5) A bear market of even lesser magnitude will, we believe, cause investors to turn to gold and other strategies to offset poor performance generated by mainstream strategies. See points #1-3 above.

Many factors could lead to higher precious-metals prices, including (but not limited to) a fundamental change in investor psychology due to a bear market; loss of confidence in public policy; sweeping political change; possible loss of the dollar’s status as the world’s principal reserve currency; favorable supply-and-demand factors; and unwelcome geopolitical developments. However, these factors are speculative, debatable, hard to predict, uncertain as to timing, and might require analysis too esoteric for most to bother to tackle.

That is not the case for the relationship between US debt and GDP. Here we have an easy-to-understand, highly visible metric that in our opinion makes the likelihood of much higher gold prices seem inescapable. The magnitude of the debt relative to GDP – the productive resources of the US economy that underpin the creditworthiness of that debt – now stands at 105.7% (Q3, 2018), a level at which there is significant risk that it will begin to outgrow GDP. The potential acceleration of debt relative to GDP would have inescapable consequences, the most important of which is the loss of value of the US dollar, the currency in which it is issued.

Famed investor Ray Dalio recently predicted a 25% decline in the value of the US currency over the next few years. We share that opinion, as so stated in our previous letter, “Disorder In the House”. Dalio did not specify against what the dollar would decline. A fall of that magnitude against other leading currencies such as the euro, yen, and RMB would disrupt world trade and be highly contentious. In our opinion the only realistic possibility is gold. A rise in gold translates to a fall in the value of the dollar.

Why now? Politicians and pundits have forecast a debt crisis for years without its materializing. We see the immediacy of the issue arising from a combination of a recession, more fiscal stimulus, a fall in tax receipts, and a rise in interest rates that would drive the debt/GDP ratio higher with a suddenness that would alarm creditors, especially foreign governments, that until now have routinely purchased US debt.

The dollar’s reserve status for international trade settlements makes the potential repercussions of such a collapse a matter of global significance. National Security Advisor John Bolton stated on November 1, 2018, at an event hosted by the Alexander Hamilton Society, “It is a fact that when your national debt gets to the level that ours is, that constitutes an existential threat to the society, and that kind of threat ultimately has a national security consequence for it.”

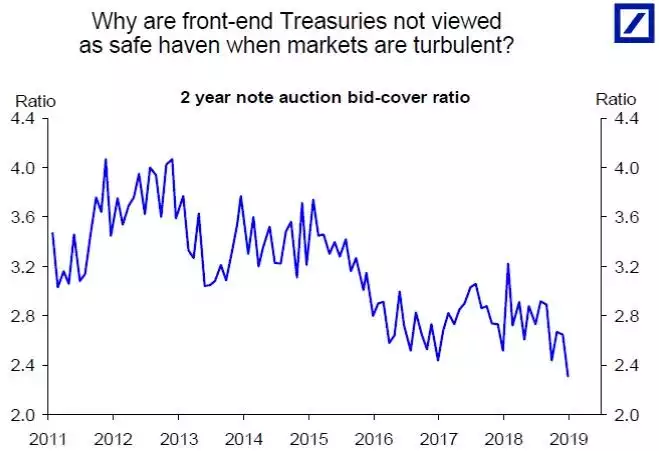

A telltale sign of eroding US credit is the steadily declining bid-to-cover ratio for two-year note auctions, suggesting to us that investors are beginning to sniff out credit issues under circumstances when demand for these notes should be particularly robust. According to Torsten Slok, Chief International Economist for Deutsche Bank,

‘With the emerging view that the Fed in 2019 could begin to cut rates, we should…have seen plenty of demand for two-year notes. Maybe there is simply too much supply of Treasuries even in a situation with worries about the economic outlook and a lot of safe haven demand driven by declining stock prices?’ (see DB Chart below).

In simple math, US debt is projected to grow at 5%, assuming no recession over the next 5 years (consensus forecast by Statista). We do not believe that any credible economist would claim our economy could sustain that pace in real terms.

A recession, or even a significant economic slowdown, would drive the pace of debt growth well in excess of 5%. Seventy percent of government spending is on automatic pilot due to untouchable entitlement programs. Drastic tax increases will not erase the deficit; more likely, they would slow economic growth. Interest on the debt adds to the seemingly irreversible growth of entitlements. Even at ultra-low rates, FY 2019 interest payments are on pace to exceed the 2018 record by 25%. Half of US debt matures within 3 years at a weighted average coupon of 1.83% (Strategas). A 1% rise in interest rates would add $160 billion to the Federal deficit. Even a small rise in interest rates would thus seem to have the potential to expose the fragility of US creditworthiness, as it would become increasingly obvious that the US is paying interest through debt issuance.

Gold exposure, in our view, is the antidote to unknown adverse repercussions stemming from a sovereign-debt crisis. Gold has always protected capital from currency debasement. We believe it will prove to be a winning strategy in a bear market. Depressed gold and silver mining stocks have historically generated massive upside against a backdrop of systemic risk concerns. The tide of easy credit and risk-taking appears to be receding. The US is beginning to sport a debt-to-GDP ratio worthy of any banana republic. Therefore, we believe that exposure to gold is both timely and potentially rewarding.”