Three Banks Gone… And Counting?

News

|

Posted 14/03/2023

|

11381

This week has been significant for the digital asset industry as three major banking institutions servicing the space entered liquidation or receivership within a week. Silvergate announced voluntary winding down, while Silicon Valley Bank (SIVB) was closed and put into receivership by the FDIC, making it the second-largest US bank failure in history. Signature Bank New York (SBNY) was also closed. Despite this setback, investors are seeking safety in two major assets, BTC (Bitcoin) and ETH (Ethereum), suggesting a preference for the most trustless assets in the market.

These events highlight the need for trustless assets in the digital asset industry. Large digital asset firms and stablecoin issuers, including Circle, were impacted by the closures. Circle, the issuer of USDC, notified of $3.3B in cash held at SVB, leading to a temporary breaking of the $1 peg. Deposits are expected to be returned in full, either by reserves or via FDIC and US regulators' deposit guarantees.

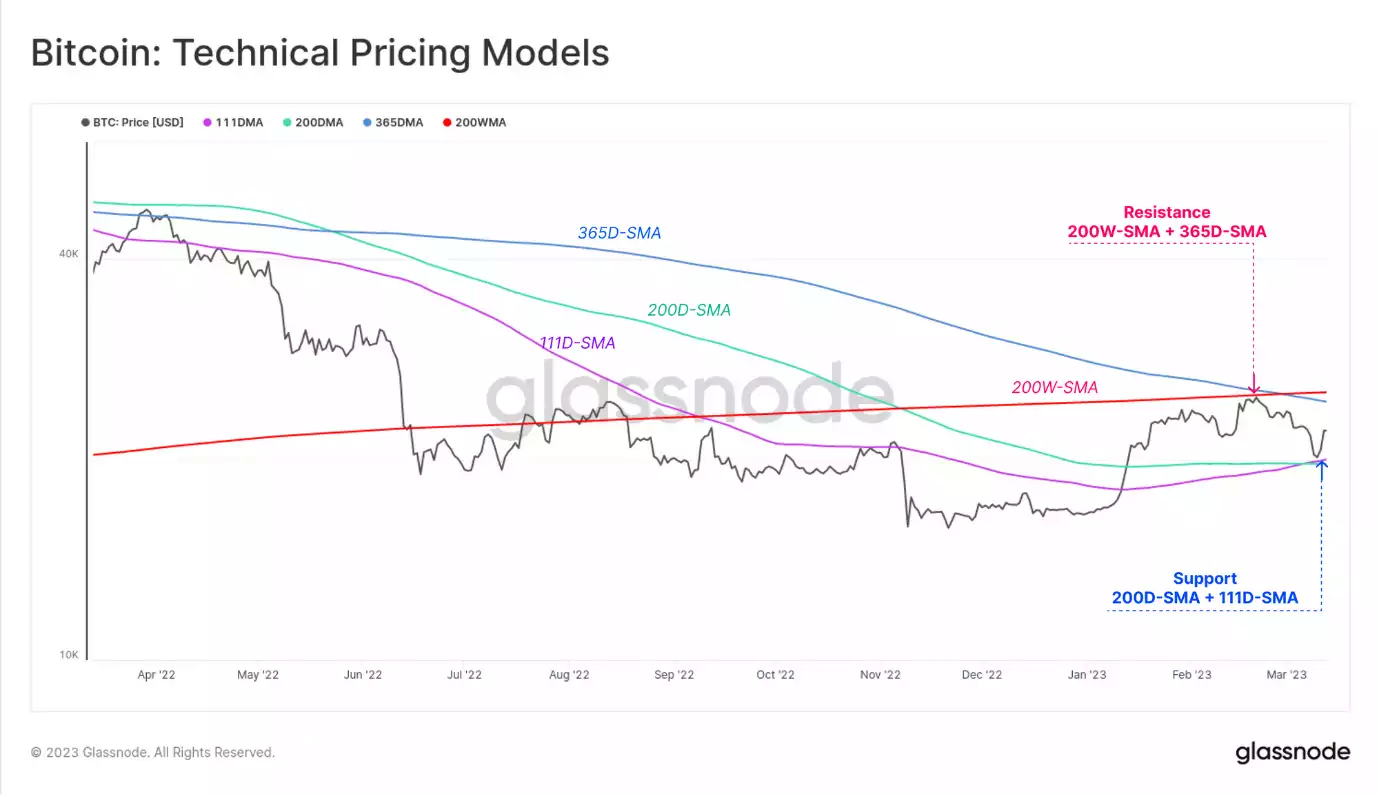

In terms of market analysis, Bitcoin prices are currently trading between several popular technical analysis pricing models. In February, prices encountered resistance at the 200-week and 365-day moving average, which was around US$25.0k. However, prices have recently rebounded off the 200-day and 111-day average, which is approximately $19.8k. This is the first cycle in history where BTC has traded below the 200-week MA, indicating new territory for the market.

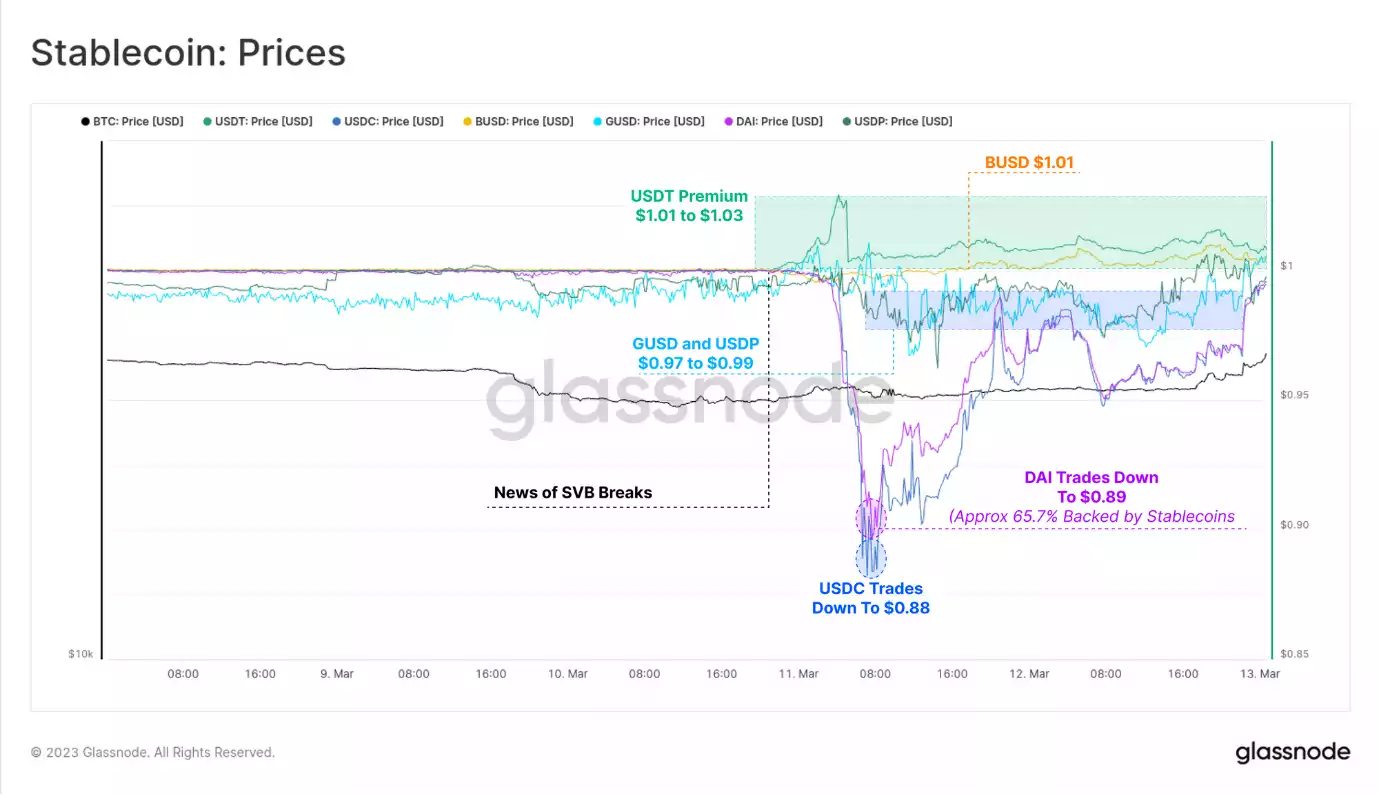

In the past week, we have seen significant volatility in stablecoin prices, which can be attributed to fears of partial un-backing of USDC. This comes after the collapse of the LUNA-UST project, which has caused concern among investors and traders alike.

As a result of these developments, USDC traded down to $0.88 and DAI at $0.89 due to DAI's 65.7% backing by stablecoin collateral. This is a significant drop in value for these stablecoins, which are typically considered to be safe havens in times of market turbulence. However, the backing of stablecoin collateral has been called into question, leading to increased volatility and uncertainty in the market.

Gemini's GUSD and Paxos' USDP also deviated slightly below their $1 peg, further highlighting the instability in the market. Meanwhile, BUSD and Tether traded at a premium, with Tether seeing a premium of $1.01 to $1.03 for most of the weekend.

Which stable coins have performed the best? The Gold & Silver Standards AUS & AGS tokens.

Unlike other stablecoins that are backed by fiat currency or nothing at all, Gold and Silver Standard (AUS and AGS), our gold and silver-backed tokens, are the most transparently backed tokens in the digital asset industry. At any time, you can audit the blockchain to see that the number of tokens minted correlates to the amount of gold and silver held in the Reserve Vault. Each bar on the database is checked by a globally respected assurance firm to ensure both the weight and serial numbers recorded on the database match what is stored in Reserve Vault. A report of factual findings is produced for anyone to see at any time – available on goldsilverstandard.com

AUS

AGS

Let's more generally look at how the digital assets market is handling the big news.

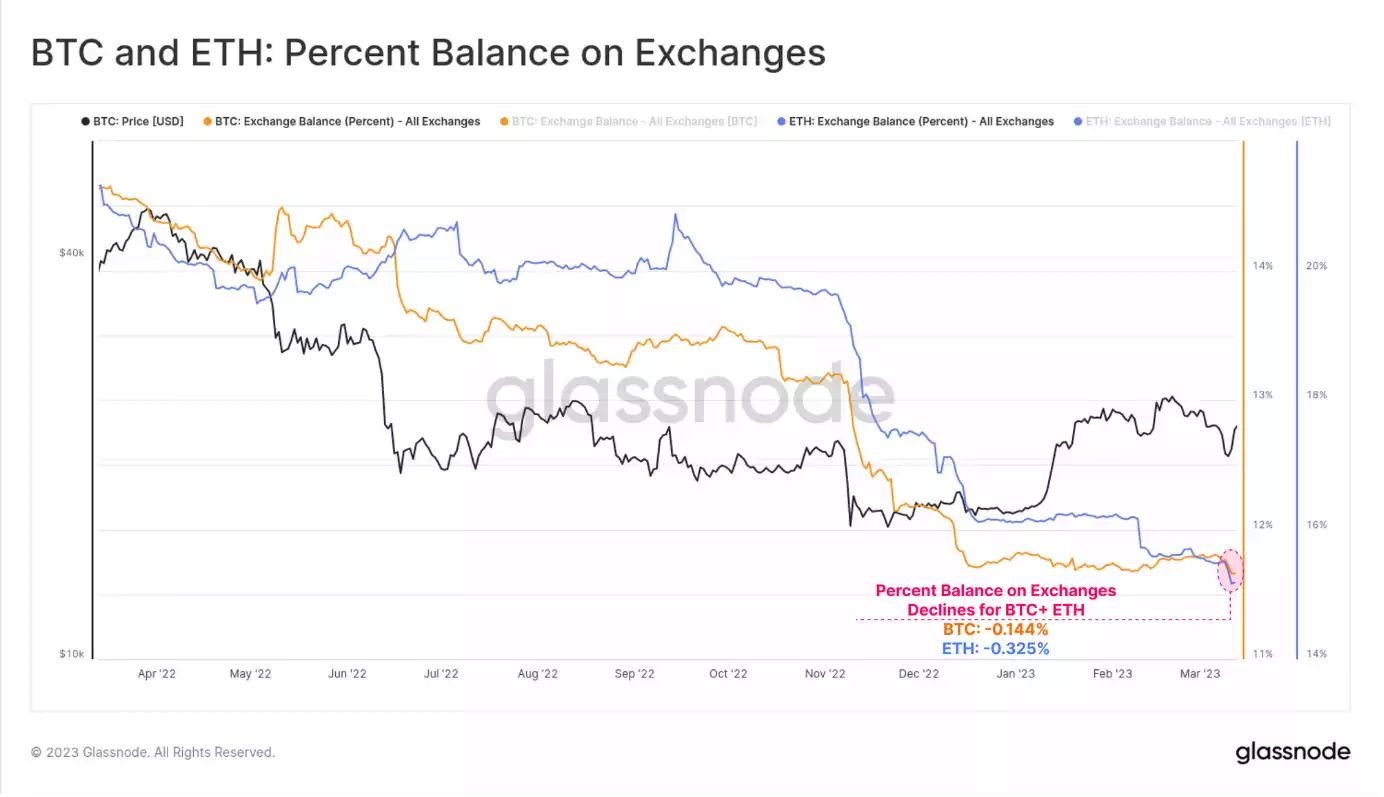

The failure of Silicon Valley Bank has caused a significant impact, leading to notable outflows in both BTC and ETH. However, amid this uncertainty, investors sought refuge in BTC and ETH as a safe haven. This trend has been observed previously in times of market turbulence, where investors flock to safe assets such as precious metals or stablecoins.

Interestingly, approximately 0.144% of all BTC and 0.325% of all ETH in circulation were withdrawn from exchange reserves as people realise they need safe custody of their assets. This highlights the importance of self-custody and securing one's assets with a trusted and reliable storage solution.

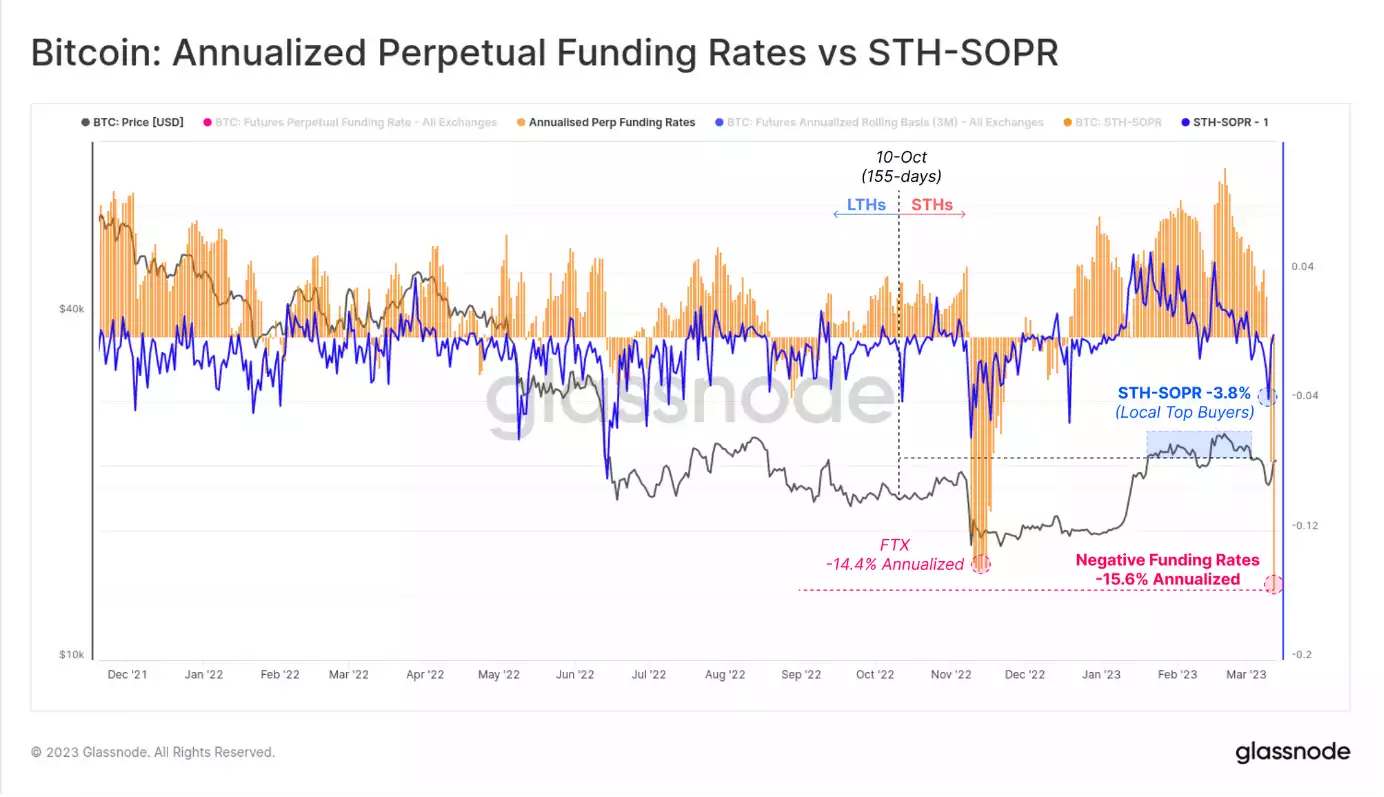

The chart presented below overlays the on-chain response of STH coins with the futures market response, highlighting the correlation between the two markets.

This indicates that STH coins are generally in profit, except for those who acquired coins near the local highs. The STH-SOPR metric indicates a large realised loss (-3.8%) dominated by local "top buyers," which suggests that those who bought at the market's peak are currently underwater.

It is worth noting that STH-SOPR and funding rates reflect different but meaningfully large sub-sets of the BTC market. One represents the spot/on-chain market, while the other represents the leveraged futures market. This differentiation highlights the diversity of market participants and the various strategies they employ.

Most importantly, this shows that the majority of coins spent this week were from local top buyers who realised a loss just before futures entered a steep backwardation, and traders opened speculative short positions. A powerful rally pushed BTC back above $22k and ETH above $1.6k, catching much of the market off-guard. This rally coincided with the news of bank deposits being guaranteed.

To summarise the crazy week:

- Three banking institutions in the US have shut down

- Stablecoins experienced a deviation from the $1 peg over the weekend

- Investors have been transferring stablecoins into exchanges and taking custody of BTC and ETH instead.

YET AGAIN we learn that you cannot rely on untrustworthy centralised entities to custody assets. Ainslie has been operating since 1974 and our simple and robust (by design) purchasing and storage methods have proved to the test of time. We understand the importance of rigid custody, offline and outside the financial system. When you purchase crypto from Ainslie, you either take full custody of it yourself or put it into a cold storage account with us.

If you have a crypto storage account with Ainslie, your funds are in their own fully allocated, segregated cold wallets, verified and held in Reserve Vault. We do not touch your crypto until YOU decide to sell. You could leave your crypto assets with us for a lifetime, and they will not be touched without your authority. You are not an unsecured creditor; they are YOUR assets.

You can also choose to have your funds loaded onto an Ainslie Cold Wallet – which we print for you in-store. This gives the FULL custody of your crypto assets to you. We produce your wallet in front of you (for the avoidance of doubt) on an offline computer and give you the only copy to take home. Put simply, there is NO online footprint of your keys.

Trust – hard to build, easy to break. Ainslie is built on trust. Ainslie means trust. We will continue to provide world-class asset custody solutions, built on the ideals for which we have operated for almost 50 years.

So if you are looking to purchase crypto, consider an Ainslie Storage Account or visit our Brisbane and Melbourne offices to take full control of your digital assets.