This Recession Will Be Like No Other

News

|

Posted 19/04/2023

|

9462

While many are anticipating an upcoming recession, the expected nature of it is rarely discussed. The combination of high inflation, low economic growth, and a FED with questionable decision-making leaves those trying to protect their portfolio against economic ruin with an extraordinary challenge.

We discussed last week how the latest US CPI figures were already baking in a recession, and how once energy prices return to baseline (as a consequence of OPEC+ tightening supply) we could again continue to see elevated inflation.

Today we will discuss Bloomberg Macro Strategist Simon white’s ideas for how to best position your portfolio in the event of what he believes to be a truly unique recession coming up.

“This will not be a run of-the-mill recession, with equities potentially holding up better than in previous slumps, and fixed income assets unlikely to offer the same degree of protection due to elevated inflation.”

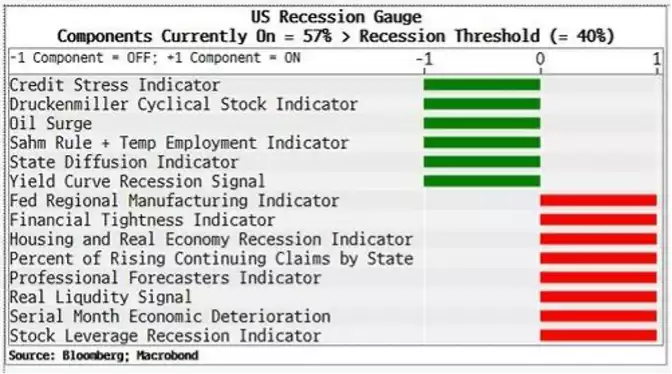

His recession gauge indicator, which considers a wide range of market and economic data, recently triggered.

The key takeaway from his discussion is that government bonds are likely not going to be the usual safe haven they have been in the past, and the standard rotation into defensive assets will be less effective.

Of course, our RBA would know firsthand how poorly government bonds have performed in recent times, given they lost over $36 billion between 2021-2022 as a direct consequence of their bond buying program to stimulate the economy (when interest rates rapidly increased the bond valuations just as rapidly decreased).

Additionally, under traditional circumstances, growth stocks outperform value stocks due to lower borrowing costs. However, in a recession with elevated inflation, increased borrowing costs reduce the ability of growth stocks to access capital and continue sustained growth, meaning already established value stocks could become preferable.

The portfolios that hold the following traits is what Simon believes will best position you to weather the economic turbulence and consistent elevated inflation.

- Low Exposure to overbought sectors.

- Increased exposure to currently lagging, lower duration sectors such as energy and pharmaceuticals.

- Limited longer duration fixed income exposure, mainly including government bonds.

- An increase in commodity allocation, including precious metals and other real assets.

- An overall portfolio that is structured to benefit from higher volatility.

Clearly, White is favoring a portfolio consisting of real assets. Which makes sense given during the recession of the 1970s, commodities were the best performing asset class and the only one to deliver a positive real return. Bonds, credit and equities all underperformed relative to the high inflation at the time.

Whatever the outcome for our national economic future, it is obviously best to plan ahead, and given the turbulent circumstances of the modern economy, it is probably reasonable to assume that the impending recession will itself be very unique to say the least.

**********************************************************************************

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************