The Wealth Cycle Peak in Australia

News

|

Posted 05/07/2017

|

8900

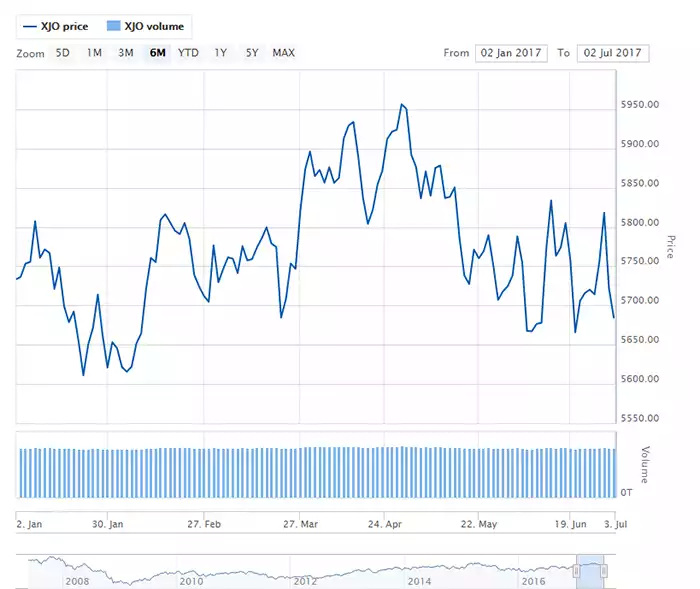

Yesterday we wrote about Incrementum’s concept of being on the precipice of a wealth transfer and it is worthwhile noting how this idea can be observed in Australia right now. Take Monday of this week where the first equity trading day of the financial year resulted in a significant fall to 5,684. The selloff was broad and included losses in consumer discretionary and healthcare sectors. Continuing what has been a sideways grind, the market importantly breached to the downside key support at 5,700 points.

Yesterday then saw a stellar reversal with the All Ords up 92 points thanks to the banks which heavily bias the Australian market. Tuesday’s index performance made up for the approximate 2.3% loss suffered in the few trading days prior. If this seems like moving quickly but getting nowhere it’s probably because it is. Taking a look at the XJO for the last 6 months shows a decidedly stagnant market

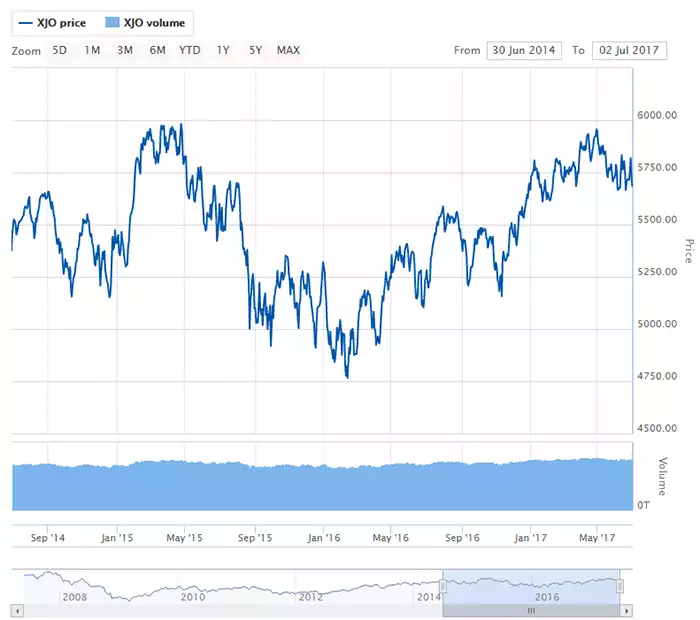

In fact investors have experienced little positive direction from the index over the last 3 years and it would not be unreasonable to conclude that the Australian equity market has for some time been signalling a lack of fundamental economic momentum supportive of further investment.

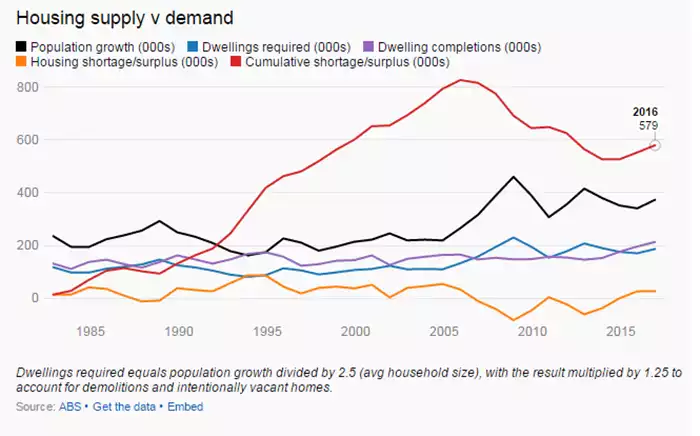

Shifting attention to housing and the alarm bells are now ringing clearly. A piece released on Monday by ABC business reporter Michael Janda took firm aim at the somewhat religious belief that Australian housing is fundamentally supported by a systemic supply shortage. The fact that such an article, the content of which would not be out of place on sites such as ZeroHedge, was published by the ABC is itself noteworthy in that that fallible nature of housing can now be considered a feature of today’s zeitgeist.

The article was predicated on the recent ABS release of the 2016 census data which resulted in an upward population revision and a consequential downward revision to the supposed housing shortage in Australia. This brings into question policy decisions that have firmly targeted the believed presence of a housing shortage. The many cranes that define the skyline of our East coast cities (some of which incidentally had to be imported from China to meet demand) and the discussions surrounding release of superannuation for the purpose of house deposits are just two examples exemplifying such policy. To quote Michael Janda, “Australia still has a massive dwelling surplus nationally. Using an admittedly simple, but conservative, methodology, it seems that in my lifetime the nation has built at least half a million dwellings more than it needed to house its growing population”.

To top this off, the Australian household debt to household disposable income ratio has now hit 190%.

Even when conservatively evaluated, one must dispassionately consider that recent census data undermining the fundamental premise behind the confidence in the speculative housing boom in this country is a troubling thought and very much supportive of the idea that housing as an asset class is cyclically due for participation in a wealth transfer.

Keep in mind the fact that housing is Australia’s only palpable answer to the demise in the mining boom as referenced by the RBA yesterday when they opted to remain neutral by leaving official rates on hold at 1.50%

“As expected, GDP growth slowed in the March quarter, partly reflecting temporary factors. The Australian economy is expected to strengthen gradually, with the transition to lower levels of mining investment following the mining investment boom almost complete.”

Note that as a consequence of the RBA’s decision, the Australian dollar fell through intraday support to finish only just with a 76 handle. Breaking this level will result in a subsequent support target at the previous low of 75.50. Note that this is good news for Australian gold holders.

The simple reality is that metrics are now supportive of the idea that traditional investment vehicles are at or near their peak and with precious metals as undervalued as they are today, they are poised to benefit the most from the next wealth transfer cycle.