The U.S. Just Unveiled its Largest Job Revision Since 2009

News

|

Posted 22/08/2024

|

2446

In March, while much of Wall Street and many economists still trusted the data provided by the Biden administration’s Bureau of Labor Statistics (BLS)—despite its reliance on rushed and potentially inaccurate data from the Establishment survey—many remained sceptical. Now, finally, those sceptics have been officially proven correct.

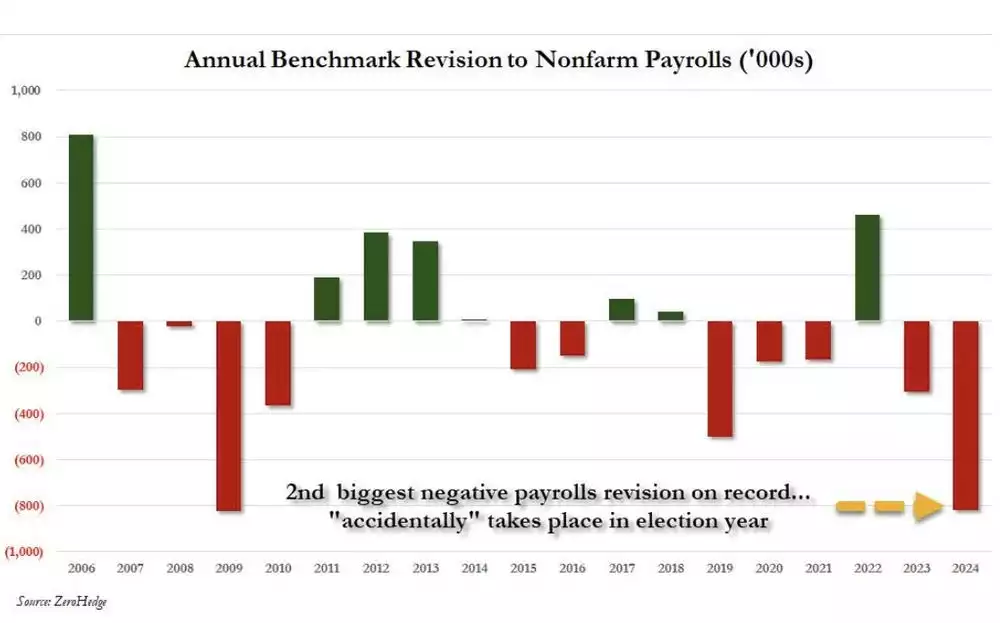

Last Friday the Bureau of Labor Statistics (BLS) made public its preliminary annual benchmark review which indicated a whopping 818,000 fewer jobs in March 2024 than initially reported.

This is the biggest decline since 2009, and it sheds doubt on earlier assertions of a strong labour market. Instead of around 242,000 jobs being added every month from April 2023 through March 2024, revised figures show an average monthly gain of just over 173,000 positions.

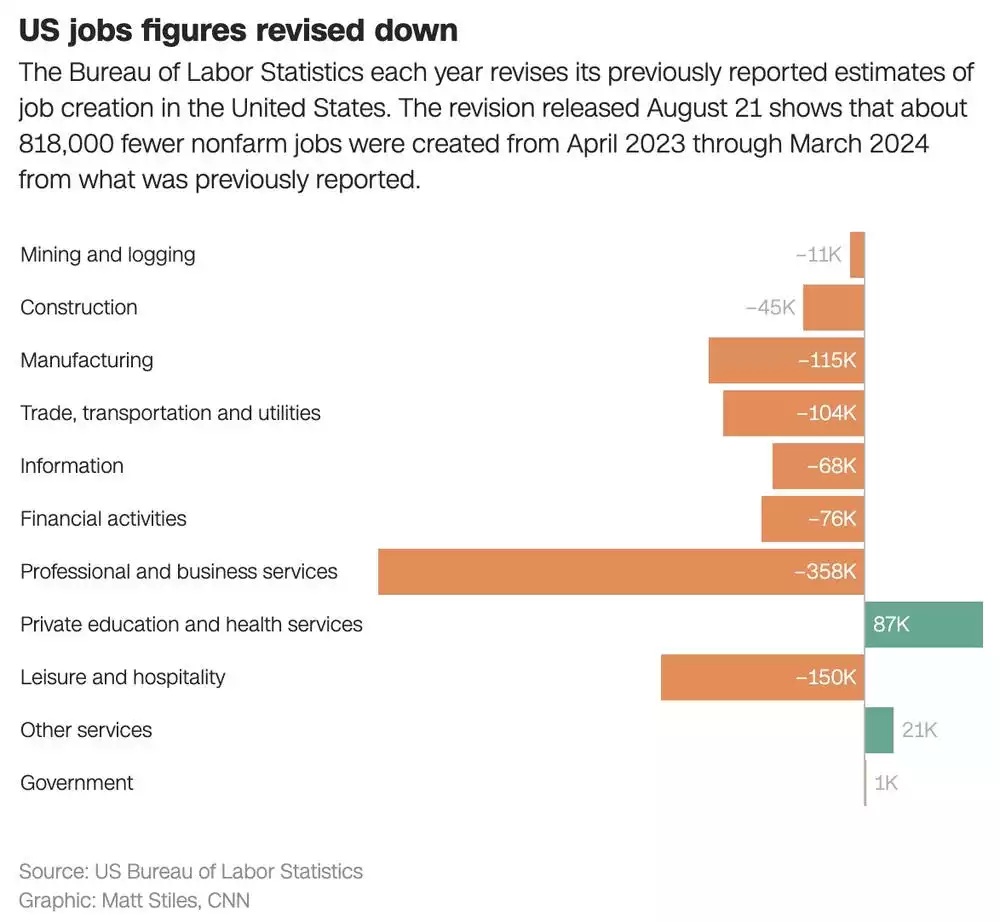

The private sector was mostly affected by these adjustments with professional and business services losing as many as 358,000 positions (1.6%). Losses in leisure and hospitality stood at 0.9% or a further reduction of 150,000 posts while manufacturing decreased by another 0.9% (or lost about 115,000 positions during this time frame). The information industry also experienced substantial downward revision of its payrolls which contracted by approximately two percent representing some decrease of 68,000 jobs.

These revisions have important ramifications for the perception of the American economy. More specifically, it of course makes rate cuts even more likely, validated by equity markets finishing the day slightly higher (S&P and Nasdaq up roughly 0.5% each). The Bad news is good news storyline seems to be making a mild comeback.

According to many economists, job growth overestimation is due to methodological challenges associated with BLS’s so called “birth-death” model which tries to account for new business formation and closures. They argue estimates used here are less reliable due to changing business dynamics caused by COVID-19, which results in an overstatement of startups and an understatement of firms shutting down.

However, many believe the more likely reason, is that this is no coincidence. Standard election year data manipulation so the current government looks significantly more favourable than intended, is the more likely cause.

Given these announcements have such massive impacts over economic policy, narratives and future national decisions, you would think greater care would be taken in getting the most accurate numbers to make the most informed decision (which clearly isn’t the case).

Torsten Slok, chief economist at Apollo Global Management, surprisingly disagrees that these revisions are significant at all.

”Telling me that over the last 12 months it wasn’t 160 million, it was only 159.2 million is not making too much of a difference to how the Fed and financial markets are thinking about the economy,” Slok said in an interview .

While the current revision is preliminary, with final figures expected in February 2025, it has already sparked debates about the true state of the U.S. labour market. Some economists caution that these revisions are part of the normal process of refining economic data, while others argue that they highlight significant issues with how employment figures are initially calculated and reported.

As the Federal Reserve prepares for its upcoming meeting in Jackson Hole, Wyoming, these revelations will likely play a key role in shaping discussions about the future direction of U.S. monetary policy. The labour market’s apparent softness may push the Fed towards cutting rates, but the full implications of these revisions (and possible motivations) will continue to unfold as more data becomes available.