The “Time in the market” Myth

News

|

Posted 26/06/2018

|

7178

Yesterday’s article set the scene for a reminder of some fundamentals in managing risk and return in financial markets. If you want a 5 word summary of yesterday’s article it is that the – US sharemarket is historically overvalued. That’s not subjective, its fact.

So in this context we see a great article again from Real Investment Advice about some of the myths around investing. Their opening paragraph:

“The “mantra” of “this time is different” is always uttered during ebullient periods in the stock market when “investment risk” is ignored and the pursuit of gains is all that seems to matter. It is during these times where markets “only seem to go up” when statements such as “investing is about ‘time-in’ the market rather than ‘timing’ the market” are made. Such statements are generally regretted in the not-so-distant future.”

Regular readers will recall our Financial Maths 101 article talking to the fact that if something falls 50% you need to make 100% on what’s left to get back to even. To wit:

“The “power of compounding” ONLY WORKS when you do not lose money. As shown, after three straight years of 10% returns, a drawdown of just 10% cuts the average annual compound growth rate by 50%. Furthermore, it then requires a 30% return to regain the average rate of return required. In reality, chasing returns is much less important to your long-term investment success than most believe.”

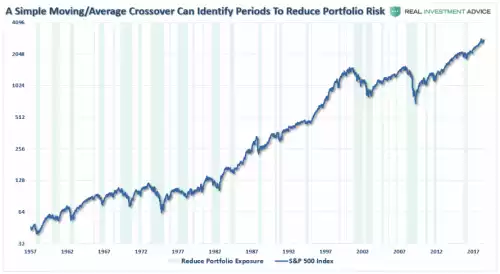

The main thrust of the article however is about reading the time proven signals and acting accordingly. They are at pains to say it doesn’t mean sell everything, just reduce exposure and move some to safety. On the day after the Dow crossed below its 200DMA for the first time since Brexit, it is topical to look at the correlation of such simple moving average crossovers and price:

You can see quite clearly what pain you’d miss on heeding the beginning of each warning signal nearly every single time.

They then debunk the myth of “missing the 10-best days in the market.” pointing out it is far more important to avoid the 10 worst days per the chart below:

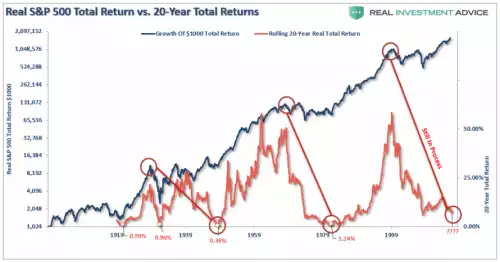

The other problem with the “time in the market” mantra is when you simply run out of time… Something particularly relevant for super funds… Addressing the myth of “There has never been a 10- or 20-year period that had negative returns.”…

Or drilling down on that 20 year total returns (including dividends to remove that argument) you can see there were 4 previous periods of negative return over 20 years ‘staying in’ and we are seemingly headed to possible a 5th..

Each of those 4 previous periods occurred when the starting 10-year cyclically adjusted P/E ratio was above 23x earnings. We are currently over 30x…

This all goes to support our mantra of uncorrelated balance. Forget that this is the S&P500 and we live in Australia, we all know the US sneezes we get the cold saying. Our trademark is “Balance your wealth in an unbalanced world”. At a time when valuations are at nosebleed levels, disruptive trade wars afoot, geopolitical uncertainty abounds and the market at the crossroads where central banks are starting to unwind a decade of monetary stimulus amid an unprecedented mountain of debt… it doesn’t get much more ‘unbalanced’. Don’t get caught in those “worst 10 days” without your hedge.