The Tail of Treasury

News

|

Posted 24/04/2024

|

3881

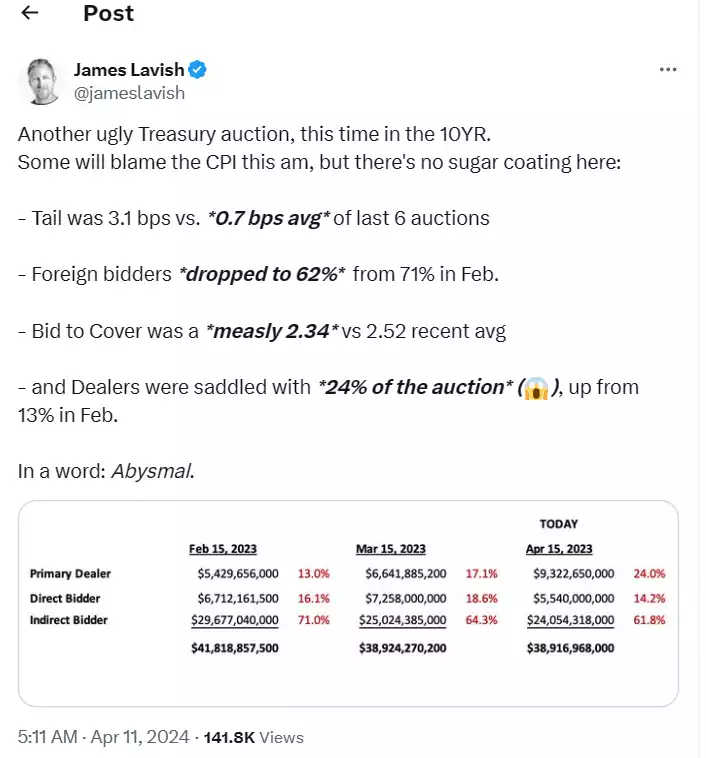

The tail of treasury auctions appears to be getting larger with primary dealers taking a greater and greater share of the auctions. The larger the tail, the higher the spread over the cost of funds. The higher the interest rate the cheaper the bond (and the cheaper all existing bonds become), therefore these auctions are devaluing current USD bonds. The higher the spread the riskier the perceived (or real) asset. With an estimated $11 trillion in USD bond auctions this year in the U.S. – what does this mean for this ‘safety asset’?

In addition to these measures, U.S. actions concerning Russian-owned U.S. treasuries are likely to lift the real risk of owning these assets, which again will devalue the bonds. How can the U.S. drive investors into these assets? One strategy could involve lowering interest rates, or crashing the stock market, or both…

The Russian Confiscation

The U.S. and G7 are currently looking at ways of using locked up Russian owned U.S. and Euro treasuries, giving them to Ukraine so they can fight Russia with their own wealth.

Yellen who appears to be trying to appease China with the prospect, having visited China twice this year personally as well as sending Treasury parties for meetings with their Chinese equivalents recently stated, ‘This is a humanitarian and moral imperative, and also an economic war, given the war’s significant negative impact on economies around the world’.

We will just say this, it’s one thing to sanction and take away the ability of a country such as Russia to use their wealth to fund a war, it is arguably a moral hazard to take their wealth and give it to their ‘opposition’ to fund a war to destroy them. This hazard is in its own rights a U.S. default and it is therefore no wonder Yellen is treading carefully around China and ensuring they have ‘buy in’ before undertaking this default, as it creates an even greater counterparty risk – not only do you lose your wealth, but we will use your wealth to destroy you if you do the wrong thing by the U.S. measure.

Sensibly, both France and Germany have raised concerns about such a move as it could set dangerous precedents, but the U.S. Treasury continue to bulldoze the prospect into the G7 with Yellen stating Western officials were evaluating the risks but expressed confidence they could be mitigated.

International U.S. Treasury Reluctance

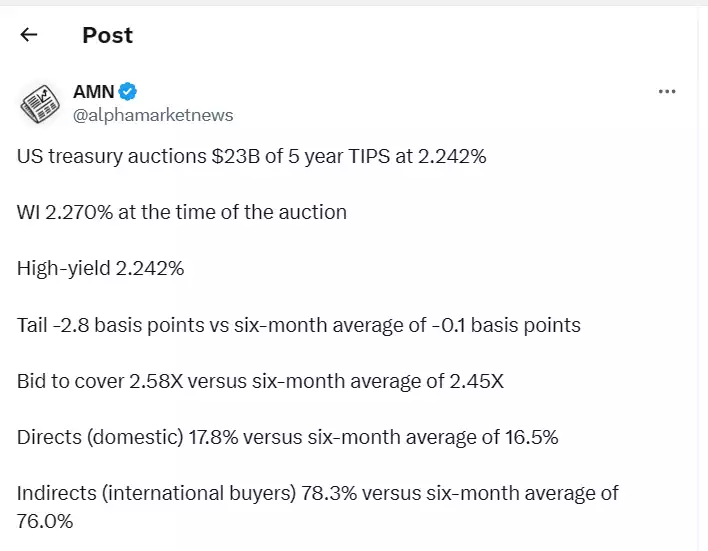

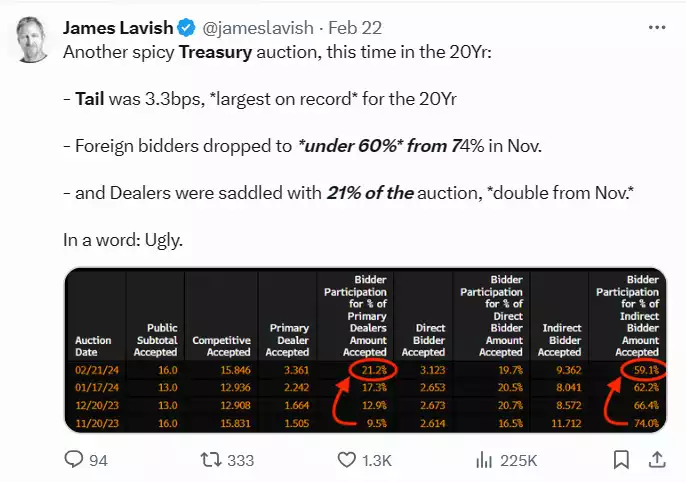

The USD is the main form of trade in the world and as deficits grow within all countries so does the need for more USD. But with sanctions, confiscations and now potential weaponisation of these bonds – the search for an alternative to the USD will become more necessary for ‘grey’ countries who do not want to conform with the U.S. world police state. The ongoing search for alternatives to USD bonds is reflected in the decreasing participation of these countries in bond auctions. This trend is evident in the recent data from the 20-Year UST auction, where the proportion of foreign bidders fell to below 60%, down from 74% in November 2023.

Again this reluctance will grow the tail – saddling primaries with more and more UST, increasing the spread and decreasing the value of all USTs.

Shorter and Shorter bond duration

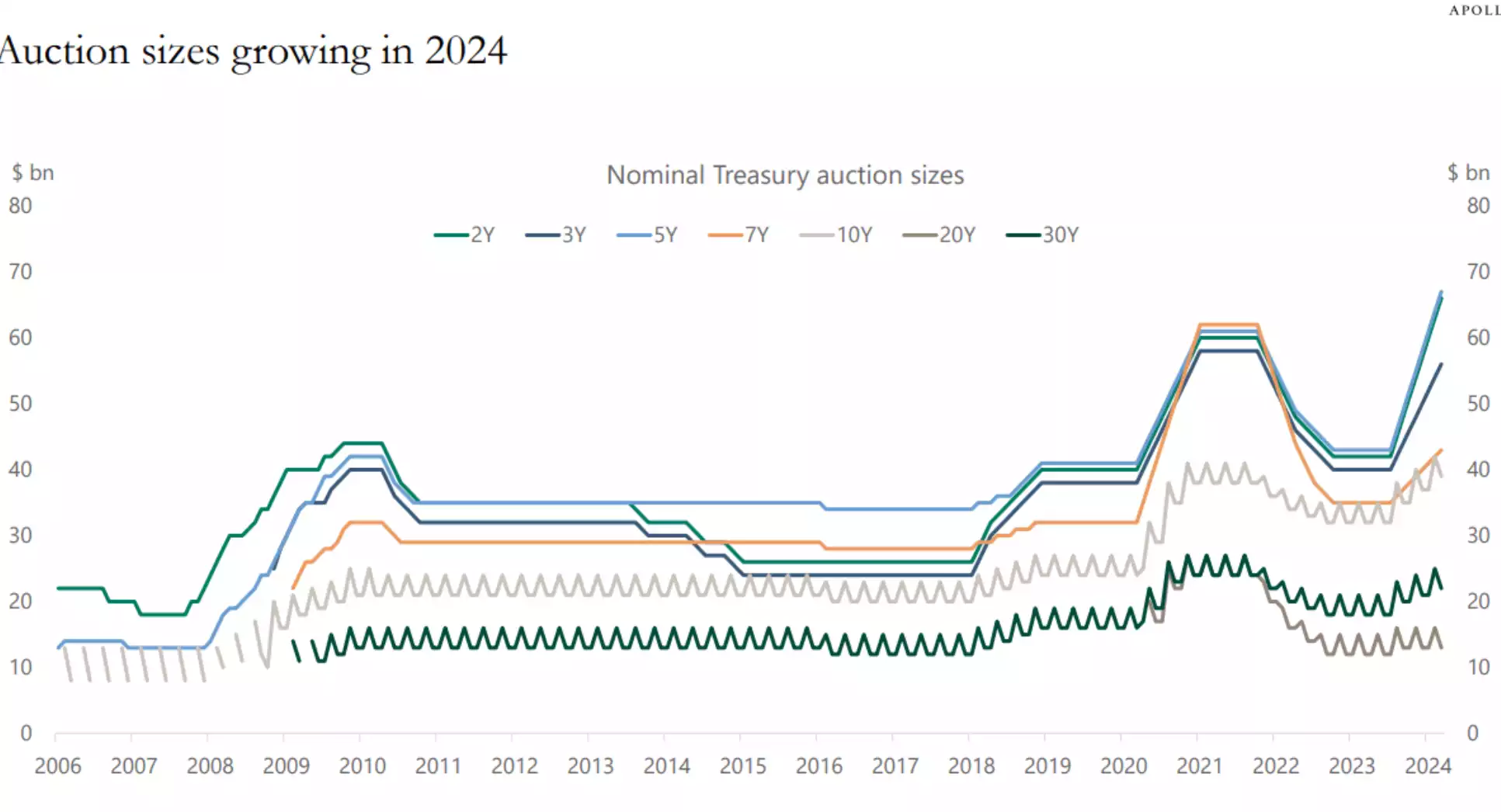

In the next 12 months – with U$1 trillion added every 90 days, and around US$7 trillion worth of low-rate bonds maturing the auction sizes are increasing. Interestingly 10–30-year bonds auctions are not increasing in size, with the brunt of new auctions in the 2–5-year term at the same rate.

By reducing the term, the U.S. Treasury is hoping to reduce the tail due to so much uncertainty within the UST market.

Additional uncertainty stems from the Federal Reserve frequently changing policies over short periods, which obscures the direction of interest rates and further dampens demand due to poor signalling. This lack of clear strategy leads to increased hesitation among buyers.

As Martin Loh, senior macro strategist at State St Global Markets, has pointed out has meant ‘Demand is not as robust as it was before’ for these bonds.

What will the U.S. do?

The U.S. Treasury is currently trying its hardest to hold the treasury market together, through shorter duration bonds, international campaigning and growing geopolitical risk (The U.S. would argue this is not them…). But continued deficit spending, poor Federal Reserve signalling and weaponisation of U.S. Treasuries is playing against this market and increasing the perceived risk in this traditional safe asset. This leaves very little options for the U.S. except to eventually lower interest rates, albeit after they have crashed the price of treasuries allowing them to buy cheaper, and resell at a higher price – but if the tail keeps growing this option will not be available to them…