The Silent Squeeze: Surging Interest Rates, Stalled Wages, and the Looming Threat to Australian Homes

News

|

Posted 03/07/2023

|

7294

At Ainslie Bullion, we've been a part of numerous economic cycles, bearing witness to countless booms, busts, bubbles, and recessions. With each turn, a pattern emerges. The ebb and flow of the financial tides, while unpredictable in its exact movements, carries a certain inevitability that the shrewd investor can learn to navigate. The current state of the global economy has us poised on the edge of a precipice, with the spectre of stagnating wages and soaring interest rates casting long shadows.

Many Australians remember, some with a bitter sense of déjà vu, the harrowing era of the late 1980s when interest rates soared to 17%. It was a time that saw family budgets squeezed and countless dreams of homeownership dashed against the rocks of financial reality. Today, we find ourselves in a somewhat parallel situation. The only difference is that instead of high interest rates, it's a lethal combination of stagnating wages and a sharp rise in interest rates, a double whammy that threatens to destabilise Australian homeowners.

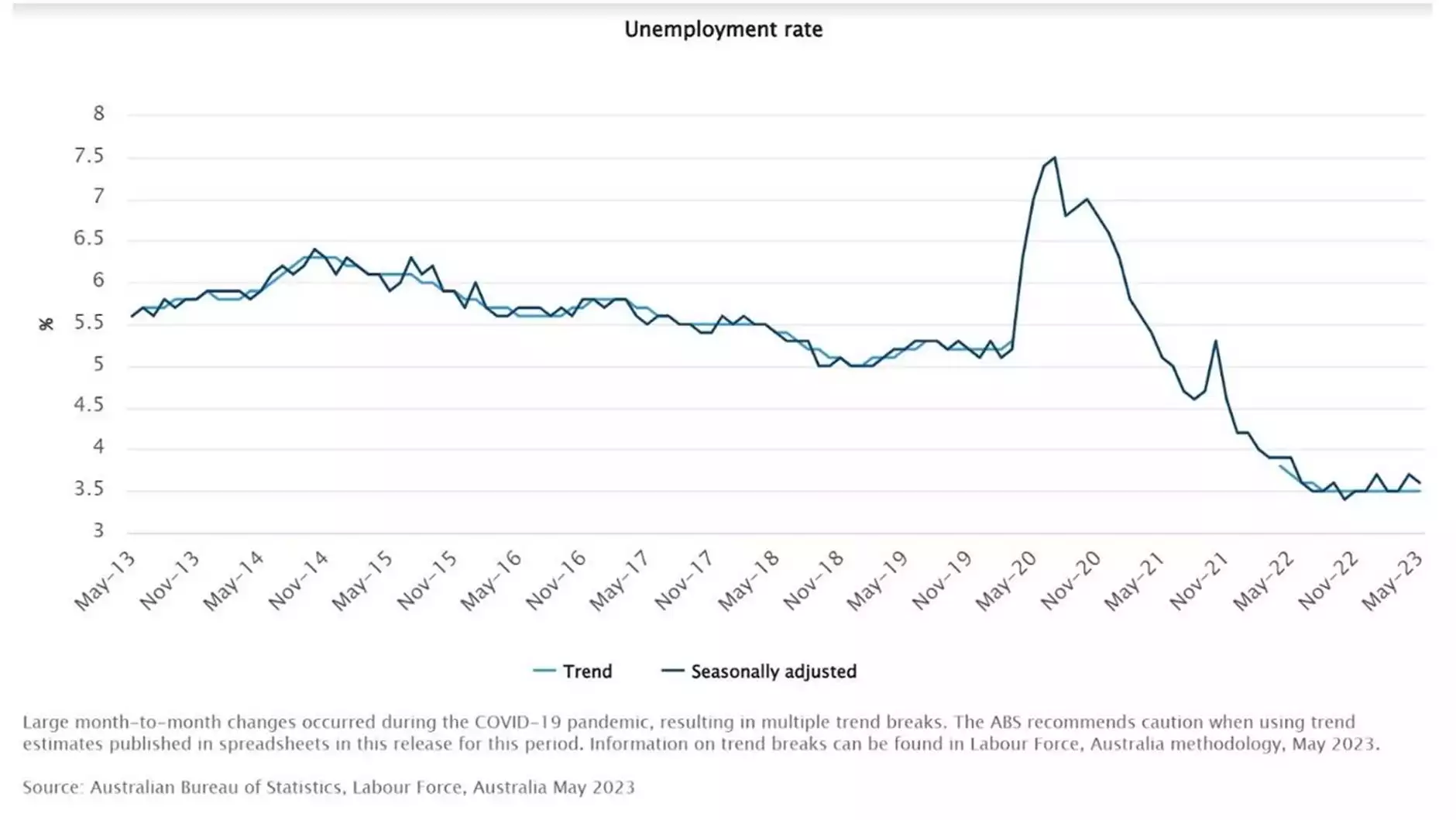

Currently, despite historically low unemployment rates and a cash rate far lower than in 1990, the ANZ Consumer Confidence Index reflects a pessimism akin to the dark days of the 1990-91 recession. It is not a question of high unemployment or a flagging economy, but rather the dread of eroding purchasing power and inflating mortgage servicing costs that hang heavy over Australian households.

Over the past decade, Australians have seen their real wages stagnant, with the pressures of inflation eroding the hard-earned gains of previous years. Since the second quarter of 2021, this has been aggravated by the inflationary pressures outpacing wage growth, leading to a decrease in real purchasing power. This setback, which has affected everyone but hit mortgage holders especially hard, has erased the growth of the past 14 years.

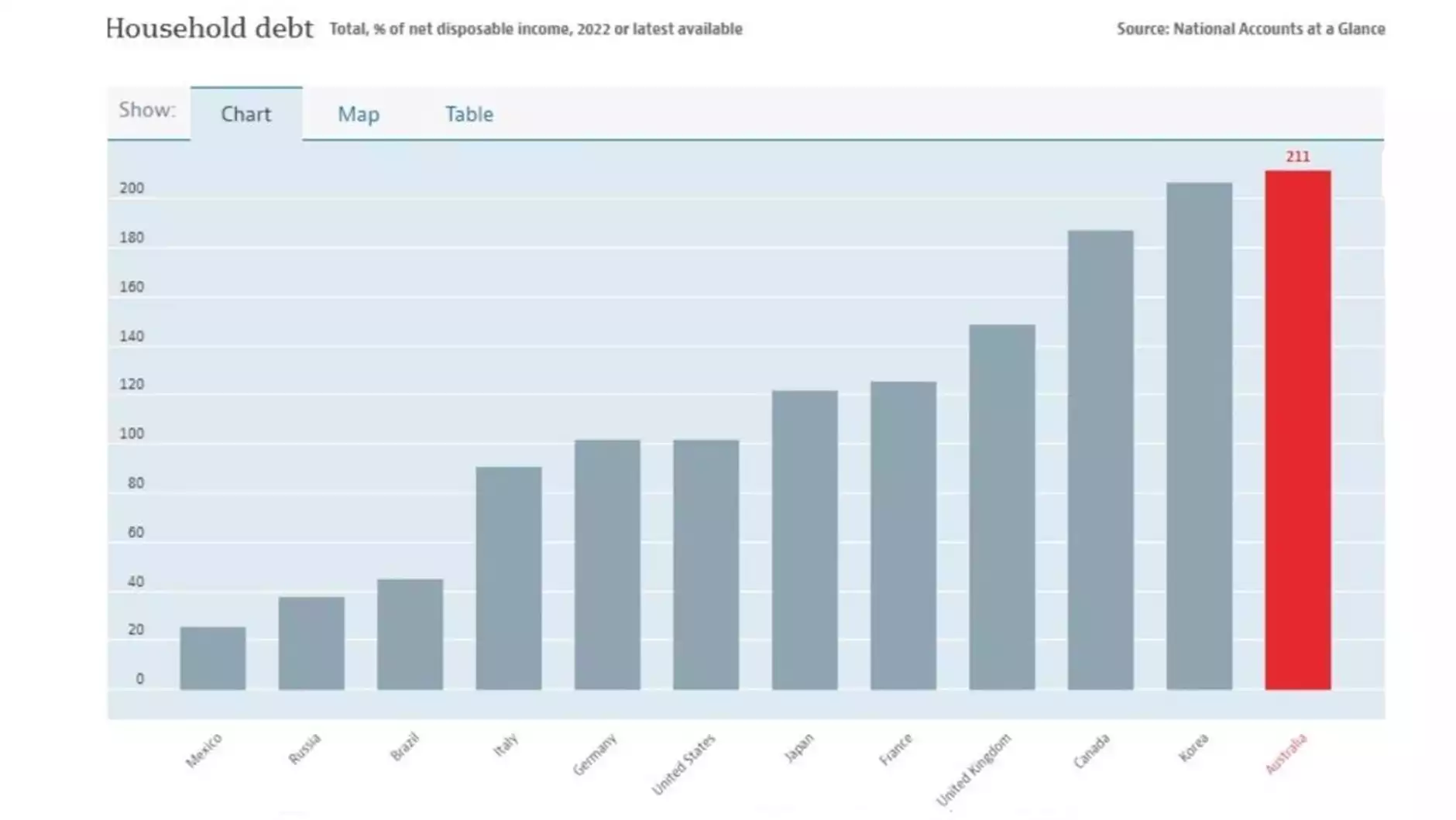

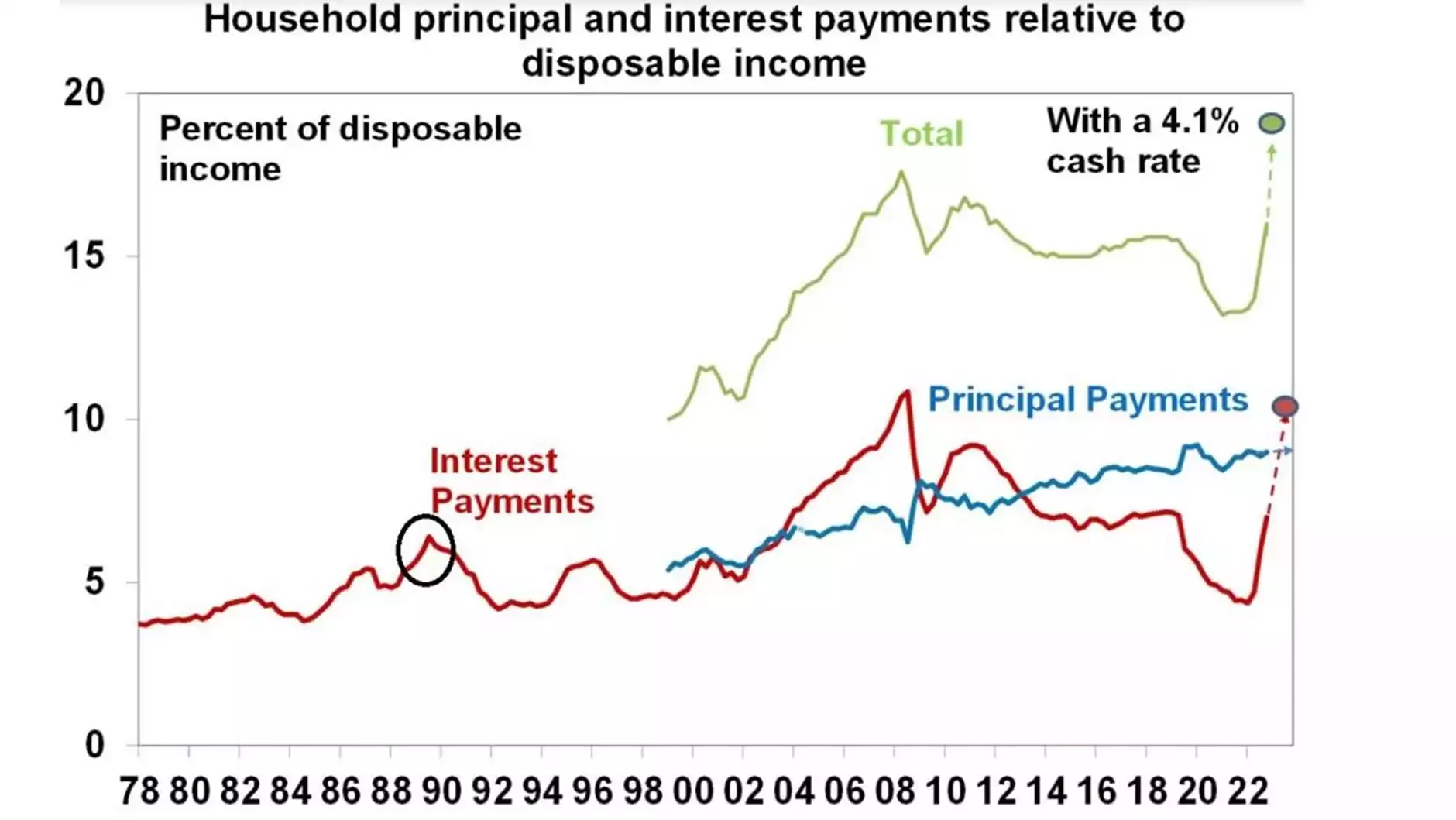

While the memory of 17% interest rates still elicits a shudder, it’s not the rates of today but the quantum of debt that poses the most significant threat. Since 1990, the amount of mortgage debt Australians hold has skyrocketed. From under 50% of household disposable income in 1990, the debt-to-income ratio has soared to 211% by 2021, higher than any developed G-20 nation and more than double that of the United States.

This drastic increase in debt has escalated the burden of interest repayments on households. It’s no longer about the interest rates themselves, but the sheer volume of the debt they are applied to. In the current climate of rising interest rates, the financial strain is set to hit record highs.

Looking at the international stage, it becomes clear that Australia's current economic situation is not an isolated issue. Global monetary policy decisions also impact the trajectory of Australia's financial landscape. For instance, a divergence in interest rates between Australia and other nations can put pressure on the Australian dollar and add to inflationary pressures.

However, amidst these challenges, there is an undervalued bastion of security: precious metals. Gold and silver have stood the test of time as a store of value, especially during periods of economic uncertainty and inflation.

In essence, the present situation does pose significant challenges for Australian homeowners and investors. But, as we've seen in the past, such challenges also bring opportunities. As the age-old adage goes, 'In the midst of chaos, there is also opportunity'.