The REAL Chinese gold numbers

News

|

Posted 11/12/2014

|

5316

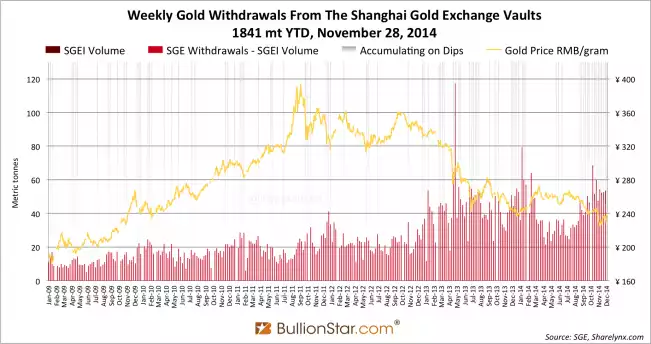

The main stream press seem to still look to Hong Kong imports as the gauge for Chinese imports despite the government changes to allow direct imports to Shanghai and Beijing. So sensationalist stories of declining gold demand in China are just plain wrong. The most accurate gauge is via the Shanghai Gold Exchange through which all gold to China passes (including their own supply). Those numbers tell a very different story. Total demand (excluding foreign trades) to end of November is about 1840t after another 46t in the last week. China is also the world’s largest producer of gold, and if looking at how much is imported that number plus domestic scrap recycling needs to be subtracted leaving about 1,212t imported up to the end of November. Analyst Koos Jansen is predicting of 1350t imports for 2014, another all time recording, surpassing even 2013. Add India’s surging imports and you’ve basically accounted for all non Chinese gold production before central bank, investment, and jewellery demand. You will also note (looking carefully) the Chinese’s knack for buying on the dips…. Are you?