The Post Debt Ceiling Liquidity Squeeze – Brace!

News

|

Posted 06/06/2023

|

8914

There is broad market concern right now about the looming $1.2 trillion replenishment of the US Government’s ‘bank account’ the TGA and how it could negatively impact US shares and the economy now that the debt ceiling "crisis" has been resolved. Well, ‘resolved’ in the way giving the crack addict more crack ‘resolves’ the drug addiction, but let’s go with their narrative…

Recent reports from market strategists spell this out. For instance, Deutsche Bank's Steven Zeng suggests that a sudden increase in the Treasury cash balance could result in a significant reduction in bank reserves, potentially obstructing the Federal Reserve’s QT policy.

Alternatively, consider Michael Hartnett's latest analysis. The Bank of America strategist predicts that "monetary policy, the big dog, is set to tighten in the coming months" and is the "primary reason we are not surrendering to risk despite price movement." Hartnett notes that after an $8.9tn increase in 2020, $4.3tn in 2021, then a decrease of -$1.1tn in 2022; global liquidity has risen +$170bn so far in 2023, January through April. However, it then contracted by $50bn in May and "is projected to collapse more than $1 trillion in the next 3-4 months".

Hartnett postulates that the financial conditions might get even worse, given the rising expectations of a Fed rate pause in June, now projected to be a 25bps hike by 26 July. In Hartnett's words, "2022 was the overt tightening of financial conditions, we think the 2023 H1 pause is temporary."

Yet, compared to TS Lombard economist Steven Blitz's recent observations, Hartnett's pessimism seems relatively mild. Blitz also expects a "powerful liquidity squeeze, as Treasury replenishes its TGA account" as rates rise to effect the required Fed balance sheet outflows. He predicts that "QT’s days are undoubtedly numbered – or at least put on pause." His crucial insight is that "the Treasury will switch from adding liquidity to the economy for the past five months to a substantial drawdown. This kind of shift can push a tottering economy into recession."

As markets struggle with the debt ceiling ‘resolution’ and brace themselves for the Treasury's massive fundraise, the real financial pain will begin.

Markets have witnessed similar situations, most notably in December 2021 when the substantial TGA replenishment marked the end of the cryptocurrency and stock bull market. However, this time, the scope is larger, and the Fed is concurrently shrinking the balance sheet. This combination slowed growth, increased real yields, and caused a liquidity squeeze that impacted equities in early 2018. In both events gold rallied as people exited liquidity fuelled risk.

In the end, it will be the Fed's responsibility to manage the upcoming liquidity event. And based on their own worry about inducing a recession, Blitz predicts the QT policy is likely to be paused. This shift from the Treasury adding liquidity to the economy to a considerable drawdown is exactly the kind of transition that can push a wobbling economy into recession.

However, this impending liquidity crisis could be the perfect catalyst for gold prices to skyrocket. As we've consistently stressed here at Ainslie

Looking at the scale of the economic storm that's brewing, TS Lombard's Steven Blitz asserts that the central bank's Quantitative Tightening (QT) will inevitably hit a roadblock amidst the downpour of Treasury debt issuance. He projects a mid-year recession, fuelled further by the TGA drain's conclusion.

However, as we've observed in times past, these ominous signs of a liquidity crash and economic downturn can actually be a golden opportunity for savvy investors. As confidence in traditional financial instruments wavers, the allure of safe-haven assets such as gold starts to sparkle brighter.

It's essential to remember that gold has been humanity's primary store of value for thousands of years. It has withstood economic upheavals, technological advancements, and socio-political shifts. Even today, in the world of cryptocurrencies and digital assets, gold has maintained its ground and continues to be seen as a reliable hedge against inflation and market volatility.

As the Federal Reserve's policies start to rattle the markets and the impending liquidity collapse begins to cast a shadow over the economy, gold may once again prove to be a strategic asset. Its historical performance amidst crises is well-documented. During the financial crash of 2008, when shares were plummeting, gold proved to be resilient. By 2011, gold prices had nearly doubled, offering significant returns to those who had sought refuge in this age-old safe haven.

And so, whilst we stand on the precipice of a challenging economic era marked by liquidity collapse, investors have the opportunity to turn this crisis into a wealth-building opportunity. You will note this article talks of liquidity tightening when we have been recently beating the drum about liquidity increasing!? The latter is a macro event we remain convinced of. This filling of the TGA bucket seems most certainly a real liquidity squeeze event. But like most ‘events’ they don’t necessarily last long. This event is also quite convenient for the Fed to pivot and start flooding liquidity into the market again (as we know they must). Its exceedingly hard to do so now amongst high inflation and in tightening mode. The loss of face would be potentially permanent. A liquidity squeeze that triggers a liquidity addicted financial market crash and recession is just the ‘event’ they can hang their hat on to once again make the money printer go brrrrrr. That is when gold should really shine, after already having protected you from the very same ‘event’ that starts it in earnest.

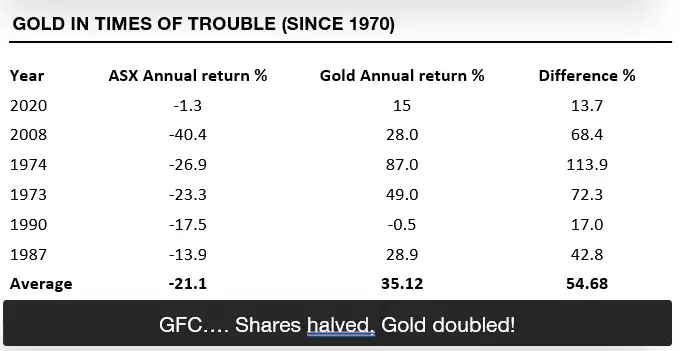

One of the more compelling pieces of evidence is the table below showing how incredibly gold performs in such ‘events’ or crashes.