The Platinum Bull Case

News

|

Posted 26/08/2022

|

9917

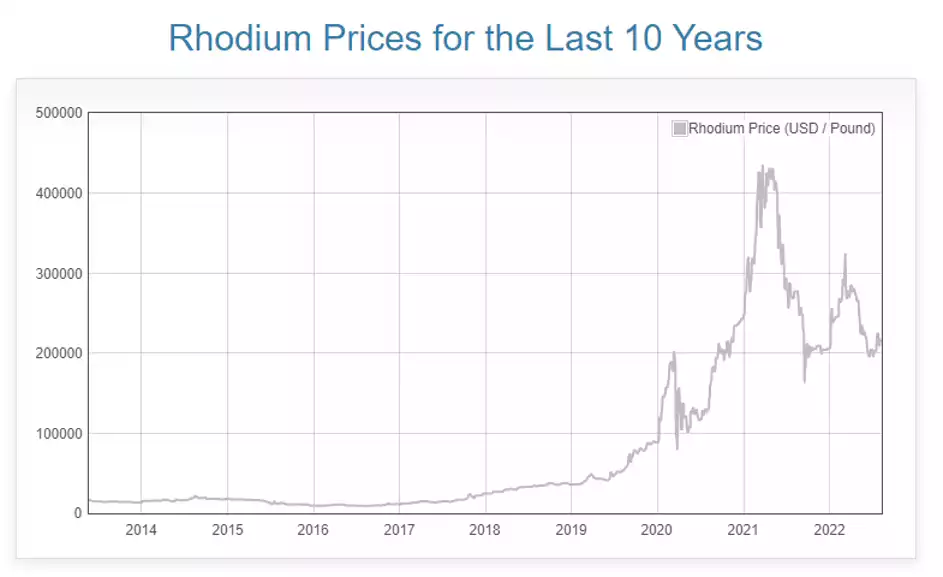

Long term supply and demand fundamentals remain positive for platinum, while the price has lagged. Platinum is largely mined and refined in South Africa, Zimbabwe and Russia, all countries facing a range of internal and external challenges. Annual mine production of platinum is less than a 10th of that of gold, and is estimated to be seven times rarer on the earth's surface than the yellow metal. With such limited supply, platinum may be set to ‘do a rhodium’.

Platinum is used today in catalytic converters in cars, jewellery, investment and a wide range of niche industrial uses. Incredibly rare, this dense, chemically-stable, gray-white metal has an occurrence of only 0.003 parts per million in the earth's crust. Platinum is so rare, in fact, that its annual mine production is less than 1/15th that of gold. Its extremely high melting point (1,768°C), as opposed to gold (1064°C) has made it more difficult to be used as “money”. It does share all of the other marks of ‘sound money’ in that it has a limited supply, fungible, and doesn’t degrade in the natural elements. Platinum has only been used in recent history once for the purpose of currency. From 1828 - 1845, the Russian Empire primarily issued the 3 Rouble “Nikolai” following a major deposit of the “new Siberian metal” in the Ural Mountains in 1828.

3 Rouble “Nikolai I” (0.995 platinum) circulated in Russia from 1828 - 1845

As we covered late last year, platinum is the big winner from the “Green Hydrogen” economy increasingly on the radar of world governments seeking to add alternative energy sources to their power grid. Industry titans such as Twiggy Forrest are calling for greater investment in this long term source of energy. Hydrogen on its own is a powerful fuel, a common component in rocket fuel, but technical challenges, such as long-term storage, have held it back from large-scale use. With an abundance of hydrogen, making up 75% of all physical existence no less, the technical challenge comes in isolating and storing the hydrogen energy in fuel cells. To do so, the hydrogen passes through fuel cells’ platinum catalysts, which store the energy. Over time, this process wears the platinum down which requires more and more platinum.

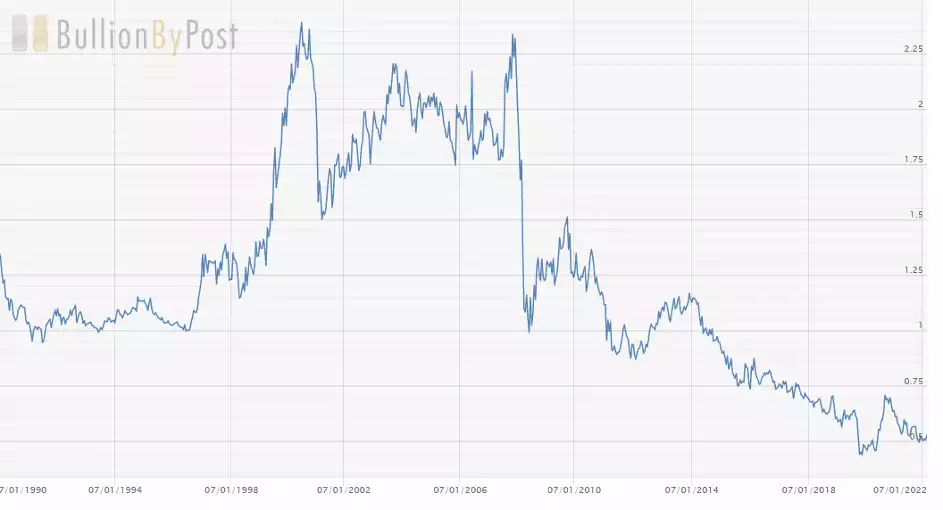

While Platinum doesn’t have the same monetary chops as gold, it is approximately seven times rarer in nature. This differential of platinum being rarer but gold more revered has seen the two historically sit at parity with Platinum reaching highs of well over double the gold price in the year 2000 and 2008. Coinciding with the major market sell-offs more broadly.

Since a strong period in the early 2000s, platinum has underperformed but may well be set for a reversal. At present, Platinum sits approximately 50% below gold, after returning back to the downtrend after breaking out above the long term resistance line.

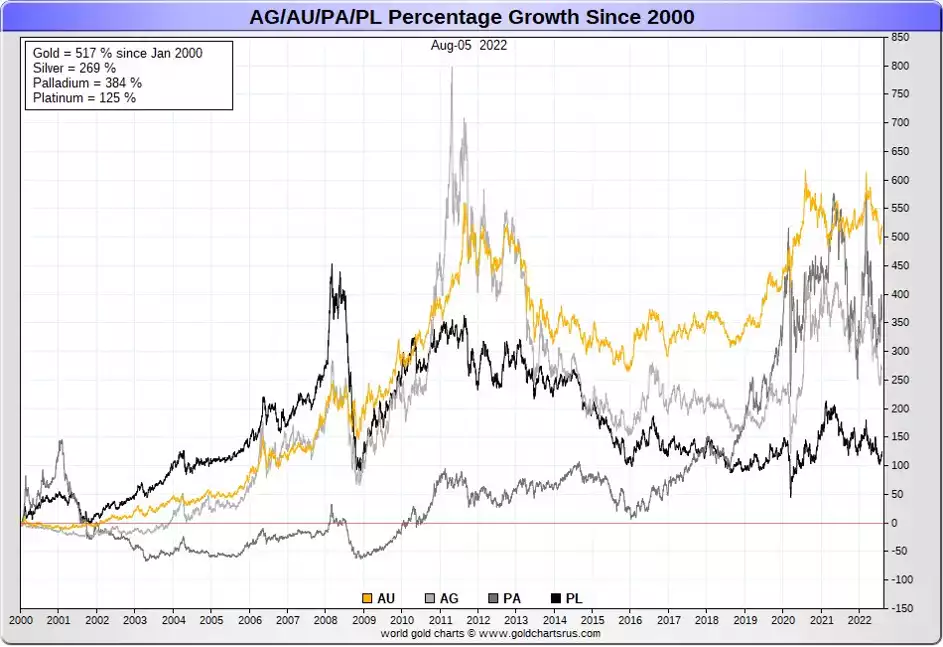

Another way to see how far beneath the mean platinum has been, is to compare the performance of each of the three precious metals in percentage terms. Gold has put on 517% since Jan 2000, Silver 269% and Platinum has just been trying to keep up but is ‘only’ 125% up since the birth of the new millenia.

The only question now is whether or not we see platinum, with its continued industrial and monetary demand, doing a rhodium blast off followed by a sustained elevation.

Platinum is recognised as a precious metal and as a result doesn’t attract any GST when sold in its pure bullion form. Visit the platinum section of Ainslie Bullion to see the whole range: Platinum Ainslie Bullion.