The October CPI Just Shocked The Market

News

|

Posted 15/11/2023

|

2370

After months of market surprises, Wall Street got more of the same this morning with the largest CPI miss of the year, with inflation coming in even lower than expected.

After a couple of months marked by unexpectedly high inflation, the forecast for the October Consumer Price Index (CPI) was a significant slowdown from the previous month, dropping from 3.7% to 3.3% on the headline, along with the core CPI tipped to remain steady at 4.1%.

However, the actual results were astonishing, with the CPI falling short across the board. Both the headline and core prints were below expectations on both sequential and annual bases.

The headline CPI for October was 3.2%, missing the expected 3.3%. Month-over-month (MoM) CPI also failed to meet expectations, remaining unchanged at 0.0%, below the consensus of a 0.1% increase and significantly lower than the previous month's 0.4% rise.

A similar pattern emerged in core CPI, with the October MoM print at 0.2%, below the expected 0.3% and down from the 0.3% increase in September. Year-over-year (YoY) core CPI dropped from 4.1% to 4.0%, missing expectations for an unchanged print and reaching the lowest level since September 2021.

The Bureau of Labor Statistics (BLS) reported that the index for shelter continued to rise in October, offsetting a decline in the gasoline index and resulting in a seasonally adjusted index that remained unchanged over the month. The energy index fell 2.5% due to a 5.0% decline in the gasoline index, offsetting increases in other energy component indexes. The food index increased by 0.3% in October, and the core CPI index rose by 0.2%, driven by various factors such as rent, owners' equivalent rent, motor vehicle insurance, medical care, recreation, and personal care.

It is evident that core goods inflation has nearly vanished, with the remaining persistent inflation rooted in services, primarily housing. Core goods inflation had been negative for the past five months on a sequential basis, and energy played a role in keeping the headline CPI unchanged in October.

Housing prices, specifically the shelter index, increased by 6.7% over the past year, accounting for over 70% of the total increase in the all items less food and energy index.

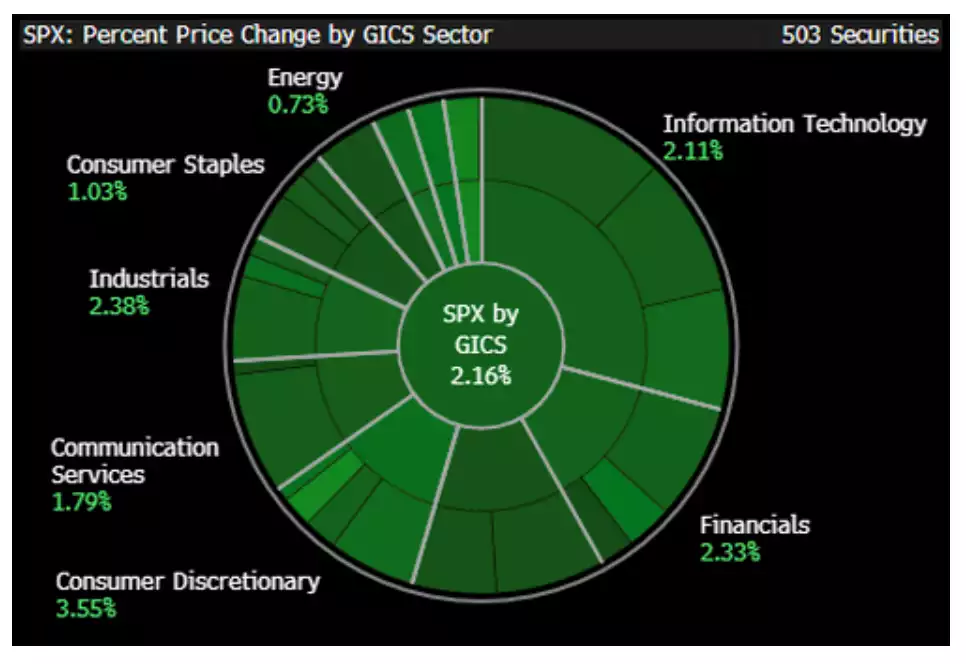

As far as the market reaction to all this, it was obviously extremely positive. About 95% of companies in the S&P 500 were green in the session, with the index as a whole up 2%.

While most analysts viewed today as a step in the right direction as it pertains to future rate cuts, other market analysts, such as Win Thin, global head of currency strategy at BBH, view this CPI quite differently.

“I’m not hanging up the ‘Mission Accomplished’ banner just yet. Transportation was a big downside factor (-0.9% m/m). However, food and beverages (0.3%), housing (0.3%), and services (0.3%) are still showing solid gains. 4 cuts by end-2024? Again, ain’t happening. The market sees what it wants to see. It’s been wrong on the Fed this entire cycle.”