The Next Fed Chairman

News

|

Posted 07/08/2025

|

1287

Last week, Federal Reserve Governor Adriana Kugler announced her resignation from the Federal Open Market Committee (FOMC), opening the door for a new appointment. With Chairman Jerome Powell’s term up for reappointment in May and tensions between him and Trump rising, markets are watching closely. Many believe Trump’s next appointee could become the next Fed Chair in 2026.

In a CNBC interview, Trump said the shortlist is down to “two Kevins”—with Chris Waller assumed to be the third. So, who are the final contenders, and what could this economist showdown—reminiscent of The Apprentice—mean for the US economy and the dollar?

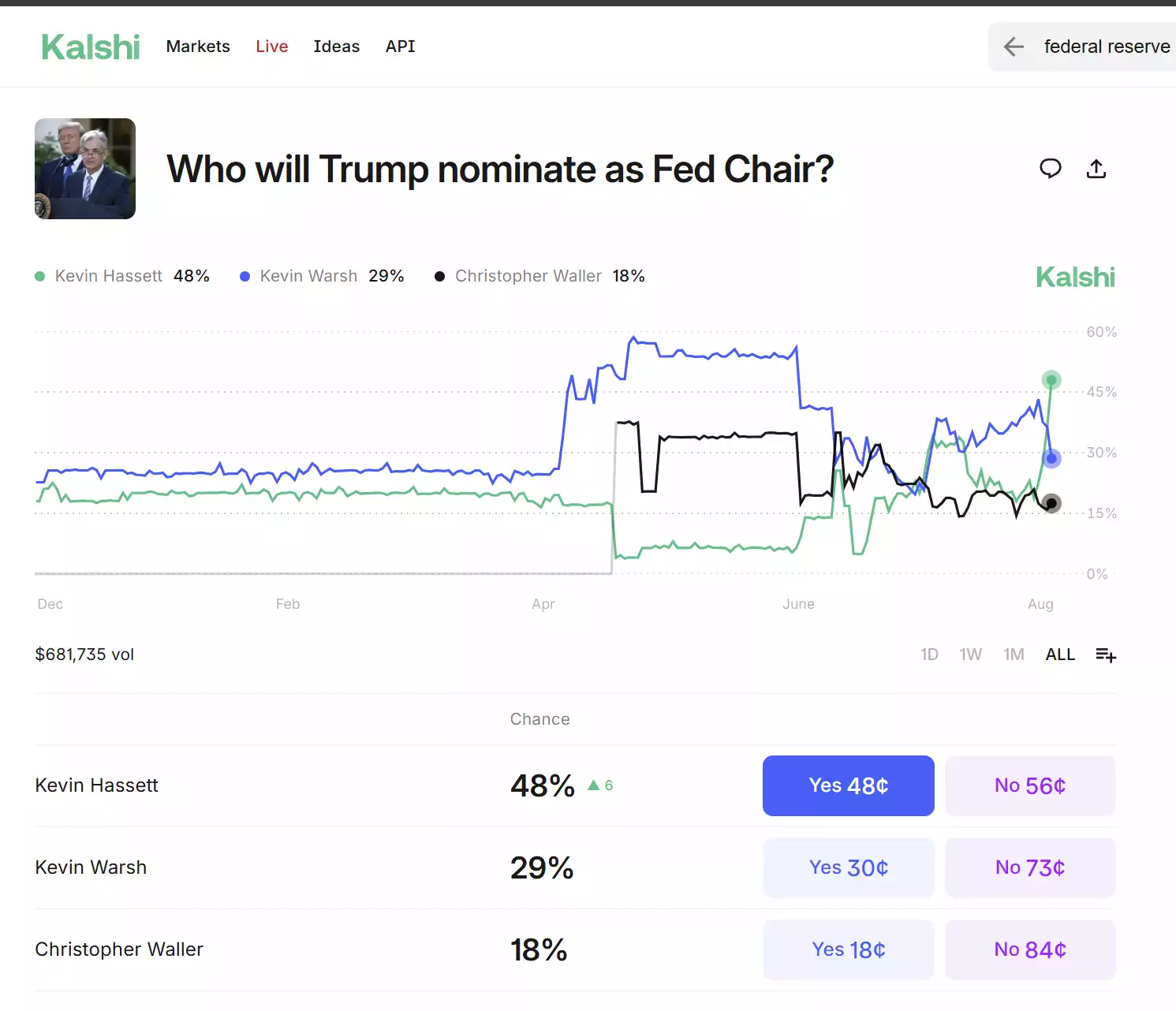

What do the betting markets say?

Kugler’s departure was called a “pleasant surprise” by Trump, offering him an opportunity to appoint someone more aligned with his economic agenda, despite the Fed’s supposed independence. Powell, also a Trump appointee, was originally seen as a continuity candidate, following in Janet Yellen’s footsteps after being nominated in 2017.

Initially, Treasury head Scott Bessent was considered a likely contender, but he’s ruled himself out. As Trump put it on Squawk Box:

“Well, I love Scott, but he wants to stay where he is... I asked him just last night, ‘Is this something you want?’ ‘Nope. I want to stay where I am.’ He actually said, ‘I want to work with you. It’s such an honour.’ I said, ‘That’s very nice. I appreciate that.’”

With Bessent out, the field narrows to Kevin Hassett, Kevin Warsh, and Chris Waller. According to prediction platform Kalshi, Hassett leads with 48%, Warsh follows with 29%, and Waller trails at 18%. In Trump’s words:

“I’d say Kevin and Kevin—both Kevins are very good.”

Kevin Hassett: The Front-Runner

Kevin Hassett is a long-time Trump economic adviser and currently leads the White House National Economic Council. He also played key roles during Trump’s first term and the 2024 campaign. Hassett is a supply-side economist who consistently supports Trump’s economic policies.

While the White House may favour a Fed chair sympathetic to its agenda, it’s aware of the importance of central bank independence. Trump learned this the hard way when markets sold off following his threat to fire Powell—a move he later walked back.

Concerns around transparency and independence resurfaced recently when Trump removed the head of the Bureau of Labor Statistics (BLS) after unexpected revisions to labour data. When asked about the controversy, Hassett said:

“As an economist, not a politician, I believe that when data raises questions for policymakers, it signals a need for greater transparency.”

If appointed, Hassett is likely to:

- Advocate for lower interest rates

- Align closely with Trump’s economic goals

- Push for improved data transparency

His policies would likely weaken the USD in the short term due to lower rates and political alignment, but pro-growth strategies could strengthen it longer term—assuming inflation stays contained.

Kevin Warsh: Always the Runner-Up?

Warsh was the youngest-ever FOMC appointee and nearly became Fed Chair in 2018 before Trump chose Powell. He was also considered for Treasury Secretary before Bessent took the role. Having often been the runner-up, could this be his moment?

Warsh is a vocal critic of the current Fed, particularly its shifting policy stance.

“It’s not just about a person, it’s about an approach to economics... I’m troubled when I see them moving the goalposts... That’s not good for the institution, or the economy.”

He also blames the Fed’s post-COVID bond buying for driving inflation and supports using the balance sheet more actively to combat price rises. As a monetary policy hawk, Warsh would likely favour higher interest rates.

If appointed, Warsh is likely to:

- Oppose further quantitative easing

- Maintain higher interest rates

- Support a stronger USD in both the short and long term

Chris Waller: The Insider Contender

Chris Waller has been on the FOMC since 2020, nominated by Trump. His term runs until 2030. He recently dissented in the Fed’s decision to hold rates steady—a move some saw as a calculated bid for attention. UBS’s Paul Donovan described it as:

“An excited jumping up and down and shouting: ‘Pick me, pick me,’ in the general direction of the White House.”

Despite this, Waller typically votes in line with Powell and represents a “steady hand” approach. He’s likely to keep policy tight until there’s a clear and sustained decline in inflation, but would pivot quickly if there’s a trade or employment shock.

If appointed, Waller is likely to:

- Maintain current policy trajectory

- Keep rates elevated until inflation slows

- Be neutral to slightly bearish for the USD, especially in a falling-rate environment

Why It Matters for Gold

With the USD trending lower, the identity of the next Fed Chair will shape its trajectory. A dovish pick like Hassett could accelerate dollar weakness, while a hawk like Warsh might offer some support. Either way, ongoing uncertainty and any erosion of Fed independence are typically bullish indicators for gold.

The Fed may not be a reality show—but for investors, the outcome of this political theatre could have real consequences.