The New Gold Playbook – 2024 In Gold We Trust Report

News

|

Posted 30/05/2024

|

2641

The annual In Gold We Trust Report is probably the most anticipated report in the gold world. The full version runs at 420 pages and even the ‘compact’ version is 37 pages long. Each year has a ‘theme’ and this year the learned folk at Incrementum are suggesting we have witnessed a new ‘play book’ or paradigm in what drives gold. Today we give a very abridged summary.

It starts with a salient analogy on how small changes sometimes have a big impact. At the end of the 15th century a change was made to the rules of chess in which the queen, which until then had only been allowed to move one square diagonally, was given freedom of movement and could now move any number of squares diagonally as well as laterally. Thus, the queen became the most powerful piece. The change in the rules meant that chess players had to adapt a new playbook. Chess remained chess, and yet it became a completely different game.

We have arguably seen a similar change to the ‘rules’ or playbook for gold. They predicted last year this breakout in gold witnessed since late last year, now at all time highs. The cup and handle formation we too have been watching unfold has broken out to the upside with little resistance above.

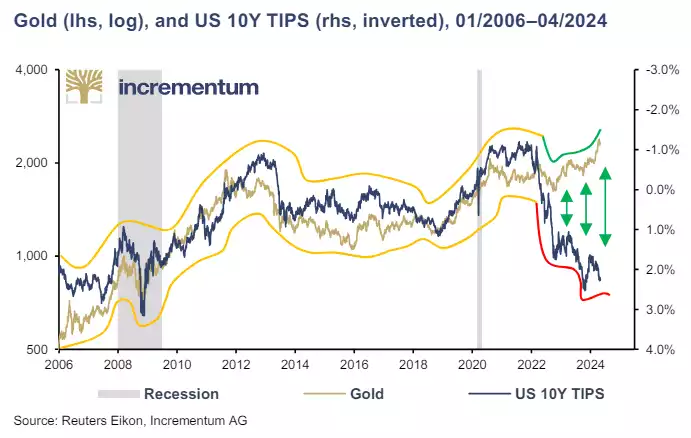

“What is remarkable is that all of this is happening in an environment in which, according to the previous playbook, the gold price should actually have fallen. The collapse of the correlation between the gold price and real interest rates raises many questions. In the old paradigm, it was unthinkable that the gold price would trend firmer during a phase of sharply rising real interest rates.

This longtime pattern is not the only one that can no longer be used to explain the gold price trend. There is considerable evidence that the old set of rules has become outdated in essential aspects, indicating that it is time to adopt the new gold playbook.”

You can see in the chart below how gold has demonstrably broken the correlation with real interest rates (measured using the traditional U.S. 10year TIPS).

“We are convinced that gold will experience the same substantial revaluation under the new playbook as the queen did in the game of chess. Gold is no longer a marginal figure, just another investment opportunity among many, but is increasingly standing out from the spectrum of investment instruments.”

“What is the root of the fundamental changes in the gold market? Structural changes have taken place at various levels in recent years. A decade of zero and negative interest rate policies has atomised all risk premiums and provided a systemic incentive for excessive debt. The situation has been exacerbated by the COVID-19 measures and the massive costs of the green transformation, which are estimated to run at least USD 100trn by 2050 – almost the equivalent of the world’s annual GDP. Since the beginning of the Ukraine war, there has also been a vast increase in military spending. Adjusted for inflation, global military spending rose by 6.8% to US$2.44 trillion in the previous year. This is the largest increase since 2009.”

The Geopolitical Showdown

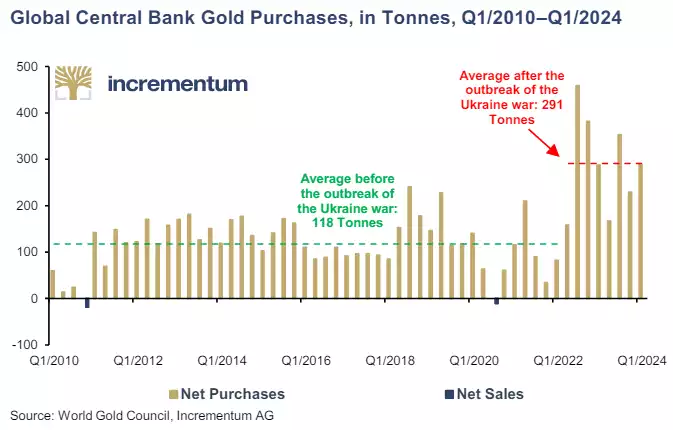

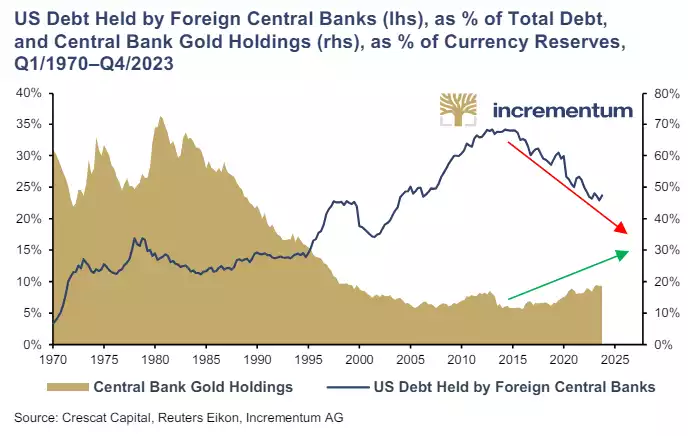

“Amid one of the most challenging geopolitical tensions in decades, there is a return to gold as a neutral reserve asset. This is particularly evident in the record gold purchases by central banks. In the In Gold We Trust report 2022, “Stagflation 2.0”, we pointed out that the sanctioning of Russian currency reserves by the U.S. and the EU would “go down in monetary history”. And furthermore that “gold, as a neutral monetary reserve, will emerge as one of the beneficiaries of the troubling conflict between East and West”. As expected, one of the consequences of the momentous sanctions decision of February 26, 2022, is that international central banks have massively accelerated their gold purchases.”

“The freezing of Russian currency reserves impressively demonstrated to the world that debt-based currency reserves are ultimately just a promise and can be converted into worthless database entries in a moment in the event of a conflict. The uniqueness of gold as a neutral reserve currency without counterparty risk is now being rediscovered. The structural increase in central bank demand is a key piece of the new playbook, mainly because central bank demand is relatively less price sensitive. One could say that central banks have put a floor under the gold price.

Now, the geopolitical showdown is entering its next round. While the war in Ukraine continues to rage, the Middle East has become an additional arena of extraordinary geopolitical tension”.

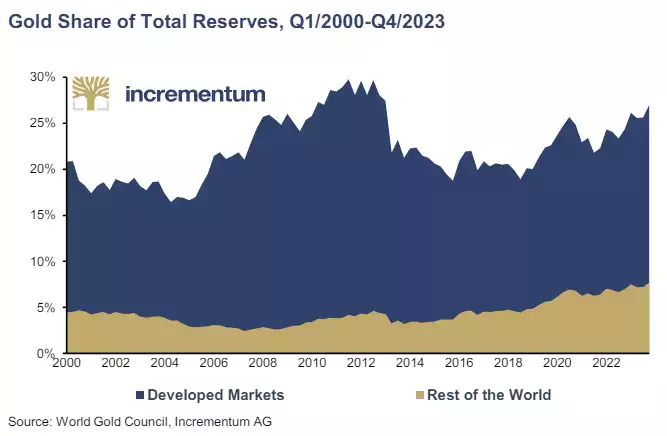

Emerging markets (up-)rising

“In 2024, around half of global GDP will be generated by emerging markets, compared to just 19% in 2000. Two-thirds of global GDP growth in the last 10 years was generated by the emerging markets. The majority of emerging markets have a much greater penchant for gold than the industrialized nations. This will feed a natural, long-term growth in demand for gold.”

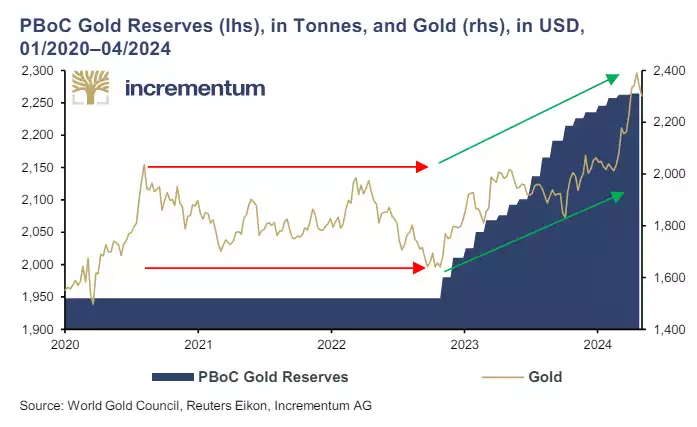

They then go on to talk at length of the rise of BRICS as “increasing economic and political importance of emerging countries has been apparent for many years. It seems that dissatisfaction with the prevailing international order is growing day by day”. Arguably none of the BRICS are more important than China, who’s central bank (PBoC) have been on a buying spree coinciding with that gold price low point of late 2022.

This joins the inflection point of global central banks decreasing holdings of U.S. Treasuries and replacing them with gold.

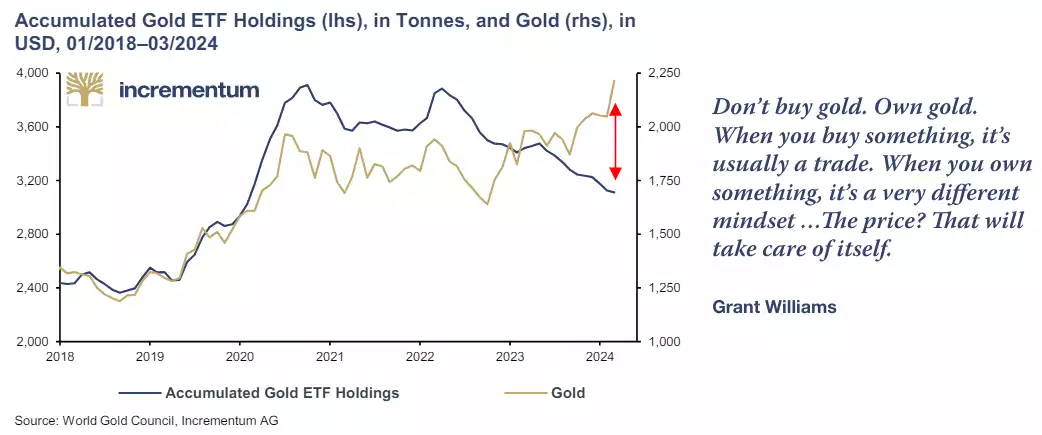

All the while the ‘West’ via the synthetic derivative vehicles of ETF’s, have been offloading on the old playbook of ‘high real rates sell gold’.

The contrast with China is stark:

“One of the most important factors behind the recent gold boom is undoubtedly the enormous demand from China. Chinese demand for gold is no longer being fuelled solely by the PBoC, but increasingly also by Chinese private investors. The financial situation in China could be summarised as “shrinking pool of investment opportunities meets high liquidity”. Now that the Chinese real estate market, traditionally used for retirement provision, has hit turbulence, there is a substantial need for alternatives.”

And so, in summary…

“Consequently, a key element of the new gold playbook is that the Western financial investor is no longer the marginal buyer or seller of gold. The significant demand from central banks and private Asian investors is the main reason why the price of gold has been able to thrive even in an environment of rising real interest rates.”

It would be remiss not to revisit one of the best memes ever in this regard.