The New Austerity Dollar

News

|

Posted 31/10/2022

|

10345

Some of you may have seen the jump in the Aussie Dollar after the budget. Pre budget the Aussie was hovering around 63 AUD to USD but post budget the Aussie jumped to a high of 65.22. The cause for this was due to the Australian government’s ‘austerity’ budget with pullbacks in fiscal stimulus. Unlike the UK Truss governments fiscally reckless budget that punished the pound in the bond market, seeing it collapse to a 37 year low, the Aussie dollar rose on the news – but for how long? As of today its erased most of its gains back to 64.

So is the Austere Government in Vogue?

Rishi Sunak is currently preparing the UK for budget cuts of 50 billion pounds in an austerity budget leaving many fearful of a return to the ‘age of austerity’ 2010-2016 under David Cameron. The budget that will be announced on the 17th of November is trying to use new austerity measures to significantly reduce the borrowing costs of the UK government which rose dramatically under the Truss tax cut announcement and nearly caused a UK bond market meltdown. This has seen the pound recover to pre Truss levels and UK borrowing costs reduce.

- Source - tradingview

But will Austerity Work?

We have written a lot about the RBA and Federal Government creating an environment of Fiscal expansion and Monetary contraction which are somewhat counter balanced but not exclusive solution. We have also written about the worldwide fiscal shocks occurring due to the Ukraine war and energy prices as well as climate change and food prices. So has the Australian Government finally worked out that the RBA does not have enough powder in its keg to respond to these shocks?

The Australian government was rewarded with the Aussie dollar gaining against the USD after the budget – this takes pressure of the RBA as inflation moves against rises in the currency. However this appears to be short lived and the Aussie dollars appears ready for another downward slide.

In the budget the government acknowledged in this budget that energy prices will rise 56% over the next 2 years – going against the Albanese promise of reduced power prices for households ($250 by 2025). They have also reintroduced fuel excise tax which has lifted the bowser price around 20c per liter since the 1st of October. So without directly dealing with the Global Energy fiscal shock the government has put Australia under greater economic downside pressure. Throwing austerity into the budget without dealing with the direct issue, which we all know is the gas gouging by international gas companies we are in for a larger slowdown.

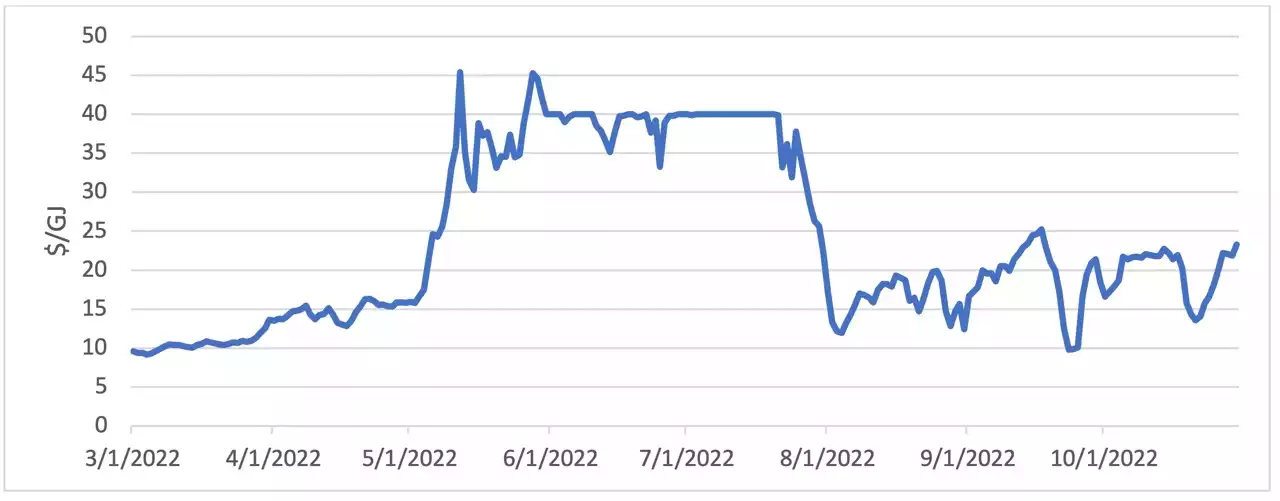

We make the following interesting observation that every time the media starts taking offense to the price and putting pressure on the government through articles the gas price has moved down from around $20/Gj to $12/Gj such as the article ‘Into this air: Why is Australia facing a gas crisis? In the Sydney Morning Herald on the 24th of July. Alternatively every time the government has thrown its hands up in despair, such as in the budget the price or with the recent supply Heads of Agreement the has moved back to the range of $20/Gj

On the 29th of September on signing of the Heads of Agreement on gas supply, the price jumped from around $10 on the 25th of September to $21 on the 29th and after the Federal Budget was announced, gas moved up from $13 on the 21st of October to $23 on the 30th of October – where it currently sits. So the question needs to be asked are gas companies are taking advantage of the governments throwing up of their hands?

On the 29th of September on signing of the Heads of Agreement on gas supply, the price jumped from around $10 on the 25th of September to $21 on the 29th and after the Federal Budget was announced, gas moved up from $13 on the 21st of October to $23 on the 30th of October – where it currently sits. So the question needs to be asked are gas companies are taking advantage of the governments throwing up of their hands?

With tomorrows RBA meeting and the widely held consensus they will still raise interest rates 50Bp has the government done enough to deal with the Global Fiscal Shocks?

Without directly dealing with the energy crisis and throwing indirect fiscal austerity measures such as taxes onto Australia the government is only prolonging the pain Australians will feel as we enter what appears to be a global recession or at least a global slowdown. Rather than being able to take advantage of a global energy price boom, Australians have been sold out, and 6 months from the first shock the government is still looking for solutions. According ‘The Age’ today 28% of voters believe the budget is good for them and 80% of Australians are calling on the Federal Government to put price caps on these energy giants not tax them at the expense of Australian manufacturing and Australian jobs therefore breaking another election promise of increasing wages. Just as onshoring has become a trend since the Global Pandemic, and we voted in a new government on the promise of a ‘Manufacturing Revolution’ the government continues to fumble what should be a great economic boom bought on by our huge reserves of natural resources.

You can clearly see this ending inevitably in a lower AUD and therefore higher AUD gold prices, particularly with the historical turn to gold in times of crisis boosting the USD spot price as well.