The “Inflation King”: Financial Assets v Hard Assets – Weimar Redux?

News

|

Posted 15/09/2023

|

2584

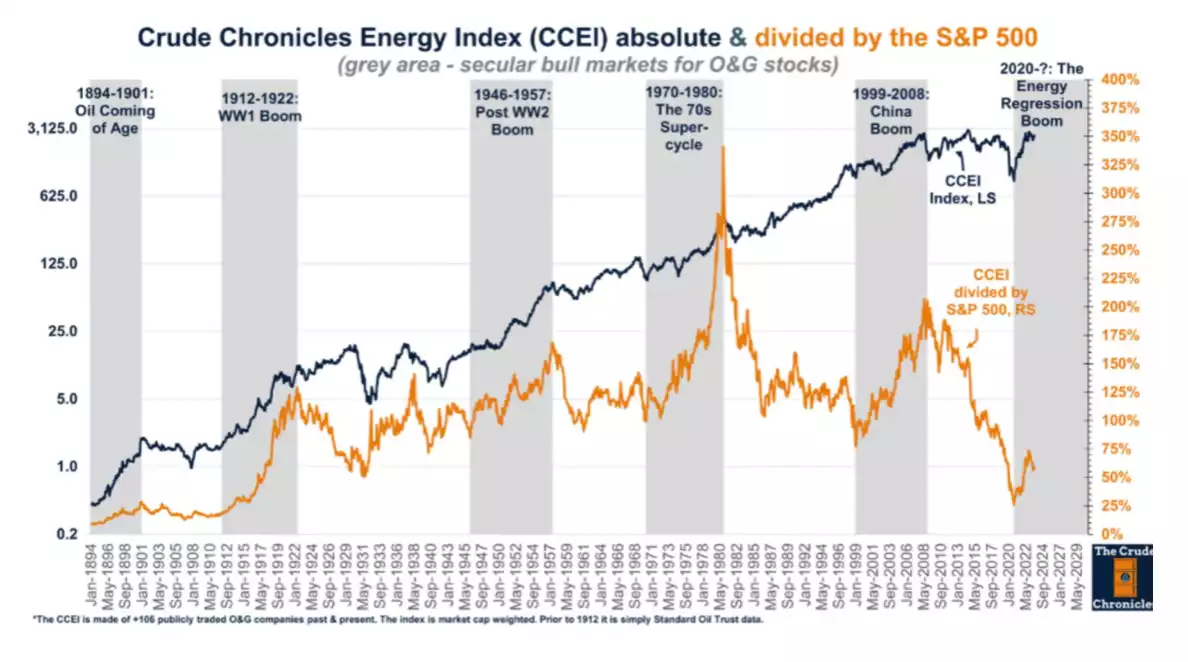

The chart below, which was reshared and analysed by Otavio Costa, shows the performance of energy stocks relative to the SP500. We can see that they have recently been at their lowest level in about 100 years. This means that resource industries have been left in the dust, at least compared to history.

Is this setting the stage for incredible investment opportunities in the commodities sector?

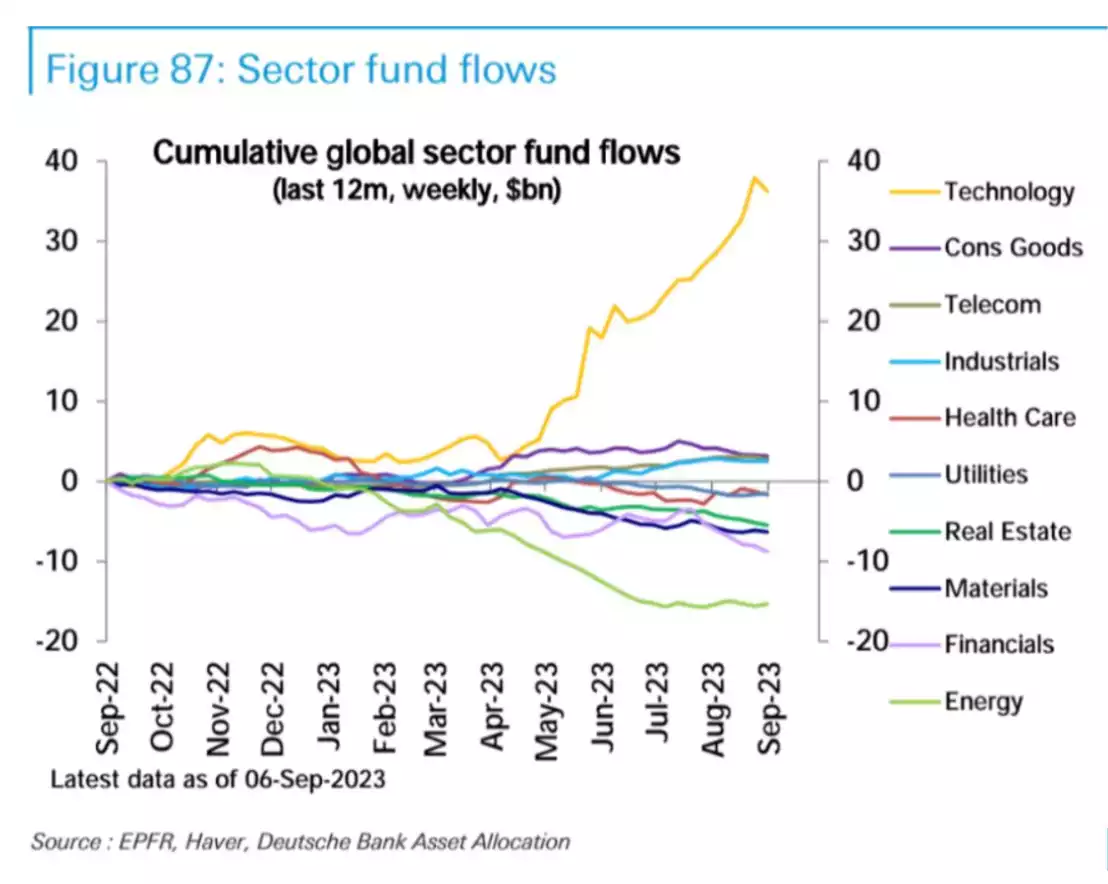

Let's also look at something on a shorter timeframe. The technology sector has had an extreme liftoff in capital flows compared to other sectors in just the last 1 year. Note the falls in energy and materials.

Otavio notes that a decrease in inflation has potentially been a major factor in the surging valuations of tech companies. This chart also supports the historical pattern of "waves" of inflation. The slowdown of consumer prices carried on to bloated stock valuations of tech companies, and we should be ready for more volatility when macro forces continue their cycles.

That being said, a lot has changed in 100 years. We now have the internet, AI, smartphones, and other luxuries hardly imaginable 100 years ago. Maybe tech companies will keep rocketing and commodities will be left further behind, but at what point does competition over dwindling resources outweigh highly-complex luxuries? At what point does one need to choose affordable food over an AI generated video clip? Let's take another look at history:

Who is this?

If you have forgotten, or have not heard, this is Hugo Stinnes. In 1920s Weimar Germany, he became the richest man in the country and earned himself the nickname the "Inflation King". One might also call him a "Commodity King" because he foresaw the hyperinflation of his country's currency and allocated vast sums of money to commodities. He purchased as many hard assets as he could, even taking out large loans to do so.

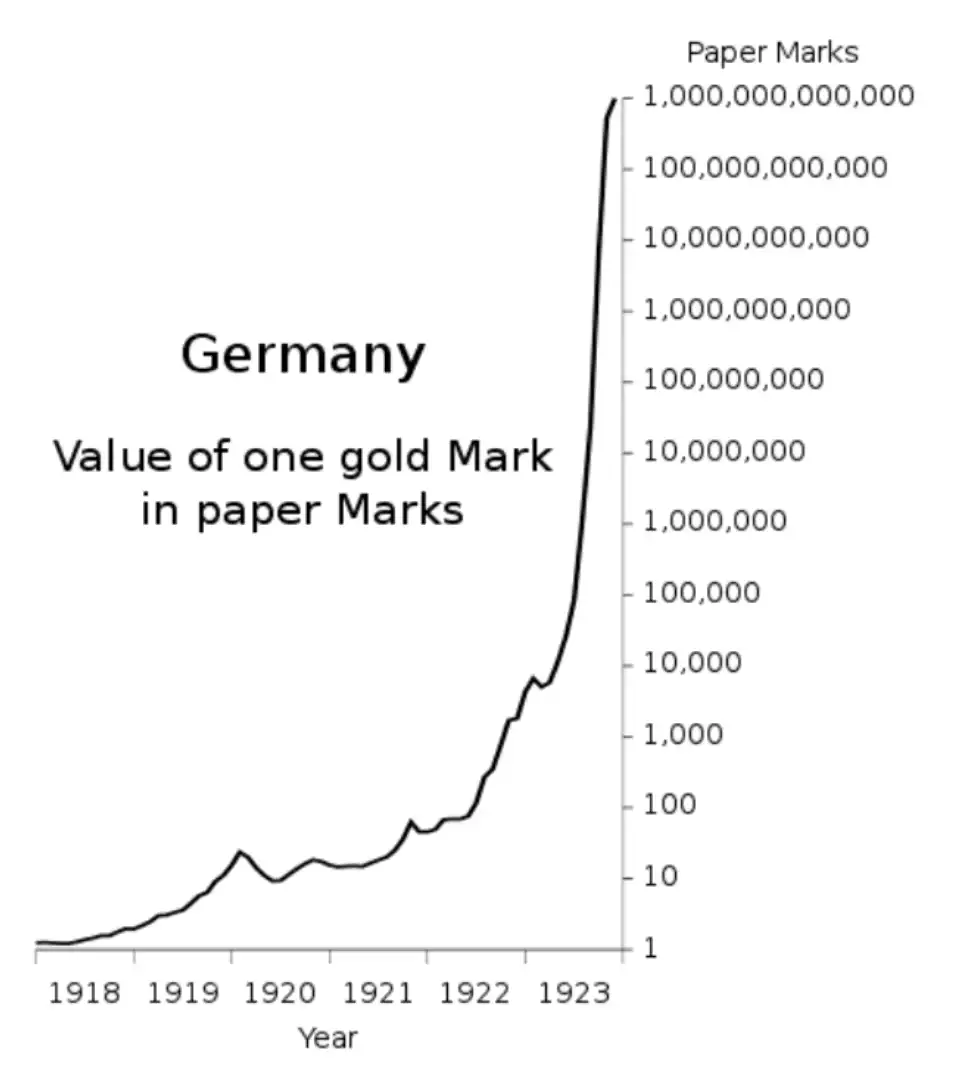

When extreme inflation, and then hyperinflation set in, the cost of living skyrocketed and society began to collapse. At the same time, Hugo's wealth was anchored in commodities and skyrocketed past everyone in the country. This shows that when inflation cycles start to get dangerous, money tends to find its way back to the things that keep people alive and things that have limited quantity.

The other benefit Stinnes received was that the astronomical inflation also made his debts incredibly easy to pay. He simply held on to what was scarce (commodities) and avoided what was constantly being created and devaluing (currency). The chart above of gold VS the paper currency illustrates this best.

Looking at the three charts in this article, do you anticipate a further long-term rise in tech, or a commodity reality-check?