The Hidden Traps Behind Australia’s ‘Awesome’ Unemployment Rate

News

|

Posted 22/08/2022

|

11665

Last week Australia printed what looked like great employment figures with the unemployment rate falling to just 3.4%. However just as we reported on that ‘awesome’ US NFP number (and discussed in GSS Insights here), a look behind the headline number is most important.

Whilst the unemployment rate did indeed drop from 3.5% to 3.4%, 40,900 jobs were LOST in that 1 month period. The drop in the unemployment rate was courtesy of the denominator, not the number of jobs. The participation rate, the number of people in or looking for a job, dropped another 0.4% to 66.4% which was far bigger in number than the 40,900 jobs lost.

The effects of demographics (aging Boomers leaving the market) and unintended consequences of COVID shutdowns and government interventions have seen the participation rate trending lower over the last 20 years. The impact of this on the economy is often overlooked. Real Vision’s Raoul Pal puts it into perspective from a US point of view:

“the labor force participation rate is super low because of demographics. So if the group of people in a job gets a 5% wage increase, half of the labor force is out of the job, so therefore, you have to half the total aggregate demand of the wage increase, which is 2.5% and not 5%”

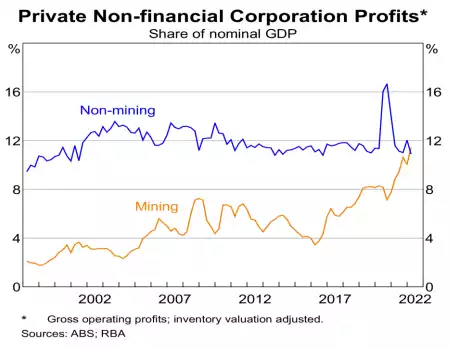

However we are now potentially seeing the effects of the first real serious inflationary pressures in that 20 year period come to the fore. Real wages are going backwards and have been for many months now. This was a real factor in the US figures where we saw a marked increase in multiple jobs being held just to make do. In Australia the argument that lower real wages means employees are missing out on profits being generated is true in only 2 sectors – mining and finance. You can see below that the perception that employers can readily pass on higher wages is false when you remove mining.

And so whilst there is an expectation that wages can simply go up to meet inflation, there is little ability from employers outside mining and maybe finance (banks). Many are wary too that rising wages causes a spiralling of the very inflationary pressures triggering the need. The other issue at play is productivity, which also has been dropping. From ABC News:

“Finally, Dr La Cava also concluded that, considering historically low levels of inflation (prior to the very recent spike in prices), matched with weaker productivity growth since 2000, workers were probably getting about their fair share of economic growth.

"Since 1995, the growth in real consumer wages has basically matched the growth in labour productivity," he wrote.”

Economic Prism’s MN Gordon recently explained the impact of this:

“The prerequisite for more consumption is not more money. It’s more production. The faster and more goods and services the economy produces, the faster and more each individual can consume. Production determines consumption.

This is a critical point. And it’s one the President failed to mention this week. Just one day prior to this week’s CPI report, the Bureau of Labor Statistics released its second quarter labor productivity report. The results were about as bad as they could possibly be.

In short, labor productivity decreased 4.6 percent in the second quarter of 2022. Output decreased 2.1 percent while hours worked increased 2.6 percent. This marked the sharpest decline in labor productivity since 1948 – roughly 74 years ago.

What this means is that people are working more and producing less. They are, in essence, working in reverse. Hence, there will be less goods and services to consume, which will further drive consumer price inflation.”

In the same interview with Raoul Pal, legendary economist David Rosenberg noted the underlying impacts of this.

“Well, there's something else that is going to feed into this because we're talking about the labor market. And I find it very fascinating, for example, that we get the GDP numbers for the second quarter. Private sector GDP was -0.7% annualized, but that labor input, aggregate hours worked was up 2.7%. So what falls out of that is -3.4% on productivity quarter on quarter. This will be the third decline in productivity in the past quarters, and it would mean that productivity in the world's most dynamic economy is -2%. When people say to me, so what do you make of today's GDP number, I said, I'll tell you what I make of it. It means productivity contracted again. You can count on your hands the number of times in the past 60 years that productivity was negative 2.0% year over year. And each time we were in a recession.”

There are many signals right now that the economy has peaked whilst central banks plough on with tightening. On the release of the Aussie employment figures last week, AMP Capital’s senior economist Diana Mousina is one of the few voices predicting rates will peak at 2.6% this year against the consensus of 3-3.5%. From ABC News:

"I think we're probably at that tipping point at the moment where the survey data — the consumer sentiment figures, business confidence numbers, leading indicators — are all starting to slow down,"

"Some of the leading indicators of employment growth have started to weaken as well, like hiring intentions, job vacancies.

"They're still running at a high level, but we were expecting to see some slowing in jobs growth, but I wasn't expecting to see a contraction."”

The signs of an economy turning bad, of ordinary Australians feeling the pinch of rising inflation and falling real wages with little sign of a wage rise are becoming clearer. What can’t be overlooked however is that even AMP’s Mousina are still looking at 2.6% by years’ end when we are currently at 1.85%, feeling the pain, and seeing our all important housing market teetering under the pressure on that current lower number.

The consequences of the coincidence of unprecedented, protracted easy monetary and structural demographic changes are unknown. A fully diversified wealth portfolio has never been more important.

This afternoon we welcome back Alex Hitchinson as a guest on Gold & Silver Standard Insights in what should be a fascinating dissection of today’s news.

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************