The Great Bitcoin Reset

News

|

Posted 06/12/2022

|

12279

In the wake of one of the largest deleveraging events in digital asset history, the Bitcoin Realized Cap has declined such that all capital inflows since May 2021, have now been flushed out.

The Bitcoin market has seen considerable consolidation above cycle lows following a tumultuous series of weeks in the wake of the FTX debacle. We have seen a strong recovery of near 10%, bouncing from range lows of $16,065 to a high of $17,197.

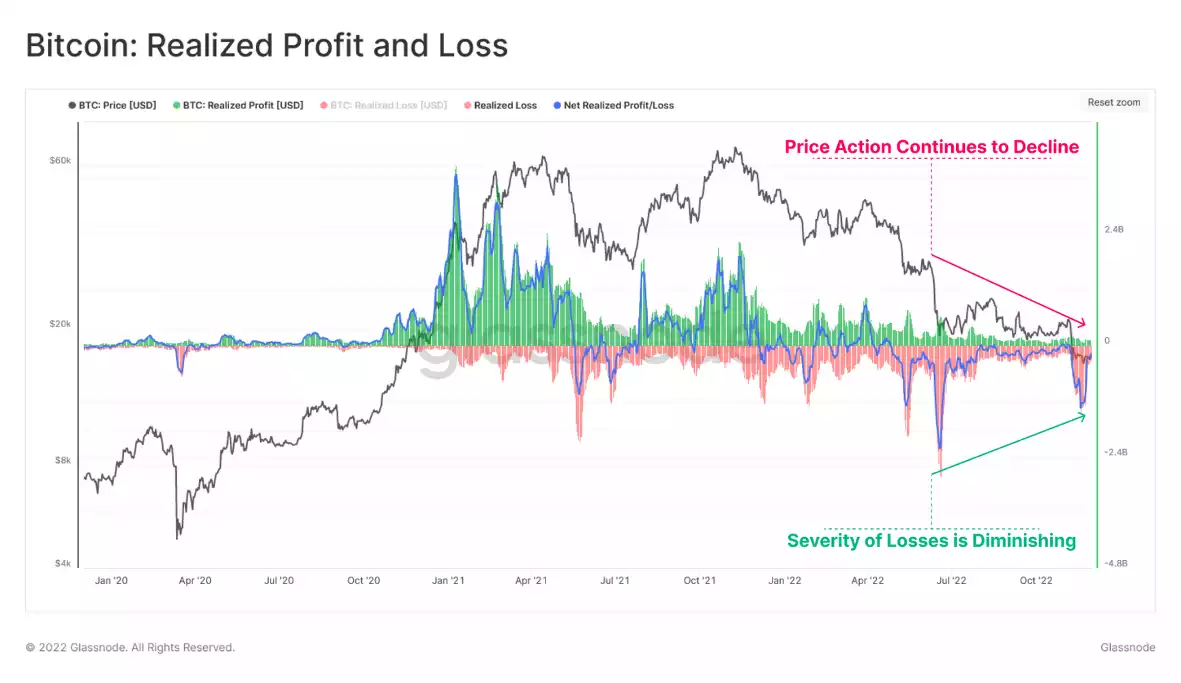

To begin our assessment, we shall inspect the magnitude of losses realized by all market participants throughout the turbulent deleveraging event in recent weeks.

Both the June 2022 sell-off, and the FTX implosion prompted investor capitulation events that are of a historical magnitude. The FTX event recorded an ATH one-day loss of -$4.435B. On a more positive note, when assessed with a weekly moving average, losses appear to be subsiding. The June Sell-off by comparison sustained over -$700M in losses each day for almost 2 weeks after the event.

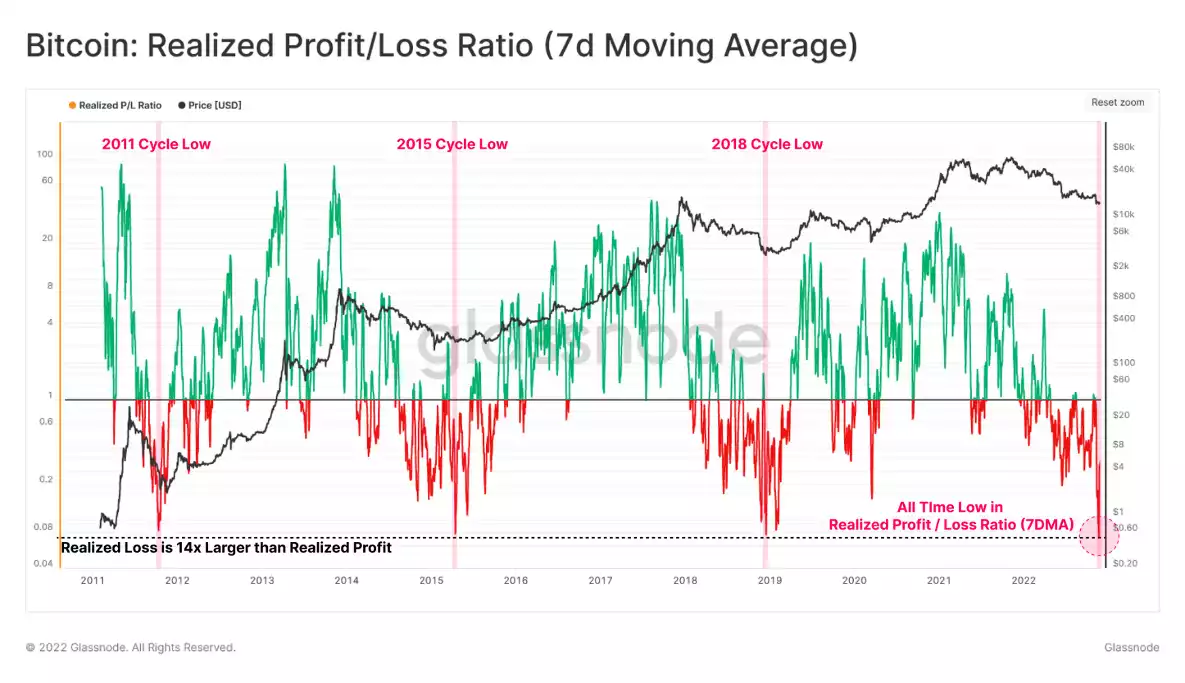

We can supplement this analysis by inspecting the ratio between realized profit and realized loss. Here we can observe that the ratio between realized profit / loss has recorded a new all-time low. Previous examples of extremely low Realized Profit/Loss ratios at this level have historically coincided with a macro market regime shift.

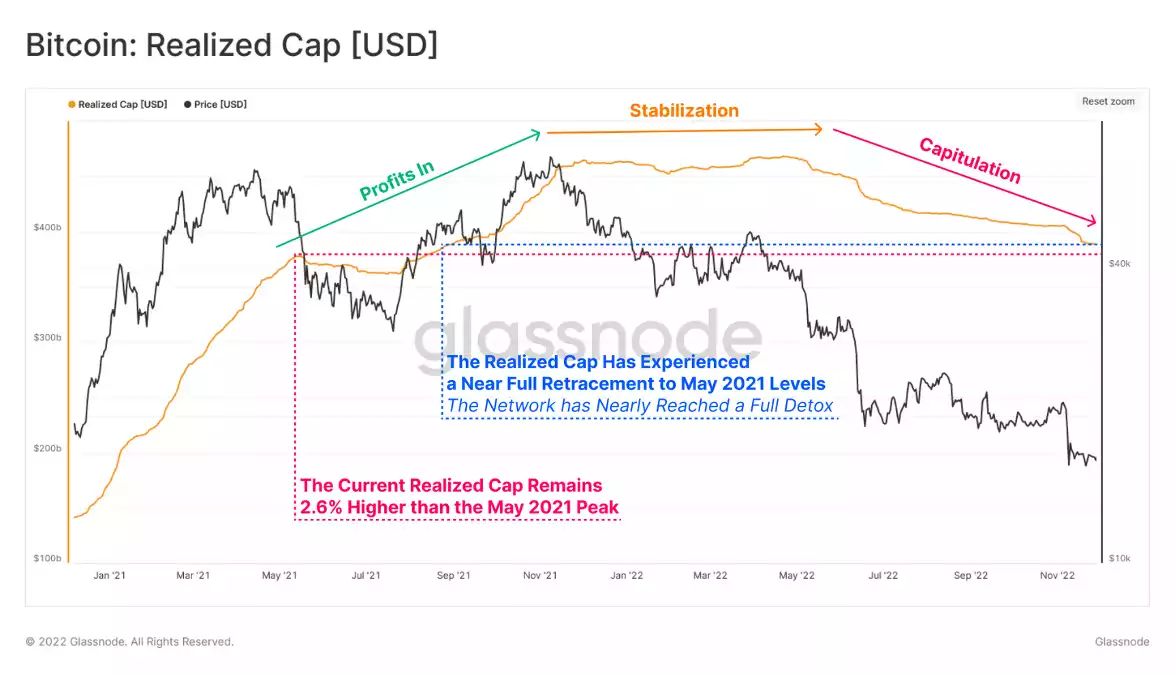

Next, we can inspect the Realized Capitalization metric, which displays the net sum of capital inflows and outflows into the network since inception. We can use this metric to assess the severity of capital outflows from the network after the market cycle peak.

A significant rise can be seen in the Realized Cap following the sell-off in mid-2021. This can be interpreted as market participants taking significant exit liquidity on the rally higher, and thus realizing profits, and increasing the Realized Cap.

Following the LUNA collapse in May 2022, a significant capital outflow can be seen, as investors who bought near the market top began realising their extraordinarily large losses.

The exuberance experienced during the 2022 rally to the ATH has almost fully retraced, suggesting a near complete detox of this excess liquidity.

Lastly, we can compare the current cycle to all previous major bear markets, measuring from Realized Cap peak, to trough, as a gauge for relative capital outflows:

- The 2010-11 saw a net capital outflow equivalent 24% of the peak.

- The 2014-15 experienced the lowest, yet a non-trivial capital outflow of 14%.

- The 2017-18 recorded a 16.5% decline in Realized Cap, the closest to the current cycle of 17.0%.

By this measure, the current cycle has seen the third largest relative outflow of capital. More importantly, we have eclipsed the 2018 cycle outflow, which is arguably the most relevant given the current maturity status of the market.

The realized loss experienced by Bitcoin investors across the past 6 months has been historic in magnitude. Profitability stress is starting to diminish after the event, but has resulted in a complete flush out of all excess liquidity attracted over the last 18-months. This suggests that a complete expulsion of the 2021 speculative premium has now occurred.

In conclusion, it is evident that the level of realized financial pain across Bitcoin market participants throughout the last 6 months has been nothing short of staggering. However, the severity of losses does appear to be diminishing over recent weeks and those remaining are ‘strong hands’, implying a bottom of sorts is beginning to form.