Who says the RBA isn’t Political?

News

|

Posted 24/02/2026

|

745

The former RBA Governor has recently delivered pointed criticism of successive governments, arguing that fiscal handouts have fuelled inflation and contributed to higher interest rates.

As head of the Reserve Bank, you are expected to remain politically neutral and independent. Yet avoiding clear commentary on the inflationary impact of government spending simply leaves room for political spin.

Now out of office, Philip Lowe has been more direct, stating:

“I hope the government turns out to be more ambitious than it currently looks like it will be because if it doesn’t and productivity growth remains weak, the supply capacity of the economy will remain weak. That means that demand growth must remain weak and real wage growth must remain weak. That’s the fundamental problem.”

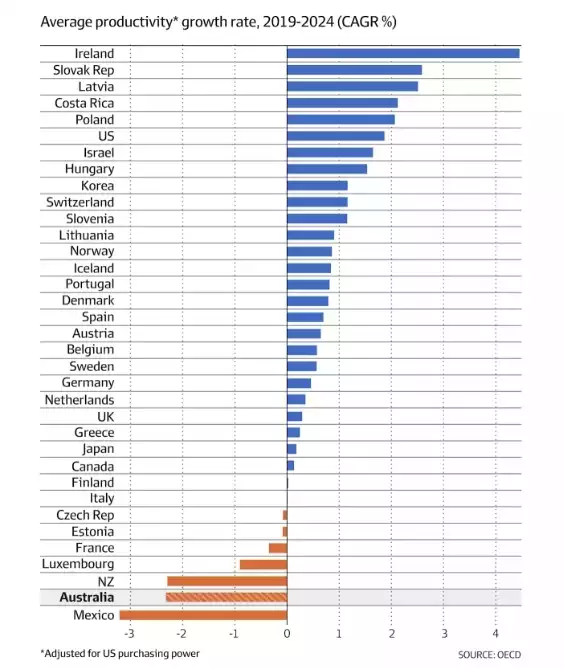

This brings us back to productivity, where policy settings matter and where Australia is falling behind.

Productivity broken down

Productivity growth is driven by two key inputs, labour and capital. Australia is currently struggling on both fronts.

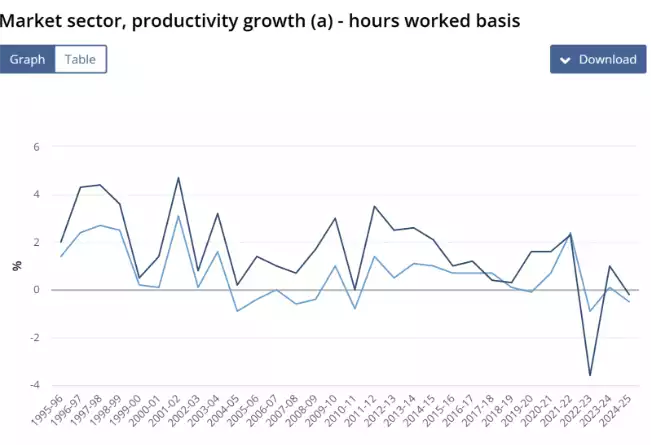

The latest Productivity Commission bulletin reported that multifactor productivity fell 0.5% in 2024–25. Deputy Chair Alex Robson noted:

“There are many possible reasons for Australia’s recent poor track record of MFP growth. One possible reason is slowing accumulation of human capital. While our labour force continues to grow, we also need a skilled workforce that can adapt to changes and meet employer demands.”

The Australian Bureau of Statistics measures Quality Adjusted Labour Input, or QALI, as:

“QALI adjusts labour input to account for important dimensions of labour quality such as education and work experience.”

In 2024–25, QALI rose 0.7%, yet overall labour productivity declined 0.2%. More workers alone are not enough. Capability and capital intensity matter.

On the capital side, the picture is similar, particularly once the mining sector is stripped out.

Barrenjoey Chief Economist Jo Masters observed:

“The mining sector is very productive, but it hasn’t been continuing to grow its productivity. We haven’t been investing much in the mining sector, and some of the mines that we’re still using are coming towards the end of their lifespan.”

Since the pandemic, overall productivity growth has averaged just 0.1%, with mining contributing 1.2%. Outside of mining, momentum has been notably weaker.

Government responsibility for declining productivity

Technological change is accelerating globally, yet productivity growth remains subdued. This disconnect is not unique to Australia, but domestic policy settings play a significant role.

Several areas stand out, regulation, the expansion of non-tradeable services, taxation and competition policy.

First, regulation and innovation.

Regulation has not kept pace with technological change. When firms consider investing in new equipment or processes that fall outside existing regulatory frameworks, uncertainty increases. That uncertainty can delay or deter investment. If firms proceed regardless, additional compliance costs reduce the net benefit of innovation.

More regulation often means more human input and higher overheads, not necessarily higher output. Regulatory inertia can dampen productivity gains.

Second, growth in non-tradeable services.

Non tradeable services are those that cannot be exported due to their physical nature or delivery constraints.

Consider sectors such as childcare, disability care or fitness instruction. In many cases, society does not want efficiency gains that reduce service quality. A shorter gym class or fewer carers per child may technically improve output per worker, but at the cost of outcomes.

Government spending has increasingly concentrated in these labour-intensive sectors. Commonwealth expenditure has risen from around 19% of GDP historically to closer to 29% when healthcare, childcare and programs such as the NDIS are included.

When a growing share of GDP is directed towards hours of care, productivity gains become inherently more difficult. These sectors are essential, but they are not easily scaled through capital deepening.

Third, taxation and investment.

Australia’s tax system remains complex and comparatively high for business investment.

In November 2025, OECD Secretary General Mathias Cormann stated:

“In order to boost investment and hence productivity and growth, Australia needs to have another look at its business taxation arrangements and how they compare with other OECD countries like the United States and the United Kingdom.”

Low investment translates directly into weaker capital deepening, limiting gains on the capital side of productivity.

Ireland provides a clear contrast. Over the past decade, it has delivered strong productivity growth, supported by a corporate tax rate of 12.5%, compared with Australia’s 30%. For multinational firms allocating capital globally, that differential is material.

Finally, competition policy and concentration.

Productivity growth began to slow in the 1990s as industry concentration increased. Mergers and acquisitions have reduced competitive pressure in many sectors, both globally and domestically.

Less competition often means less innovation and less incentive to invest, reinforcing the productivity slowdown.

So, what is the solution?

Government efficiency must improve, ensuring regulation evolves alongside technology rather than constraining it.

Policy settings should encourage business investment rather than rely on higher taxation to fund expanding expenditure.

Without stronger productivity growth, Australia faces a simple trade off. We either accept weaker demand growth and subdued real wage gains, or we address the structural issues holding productivity back.

Productivity is not an abstract economic concept. It is the foundation of sustainable income growth, living standards and long-term monetary stability.