The Government vs the RBA

News

|

Posted 04/09/2024

|

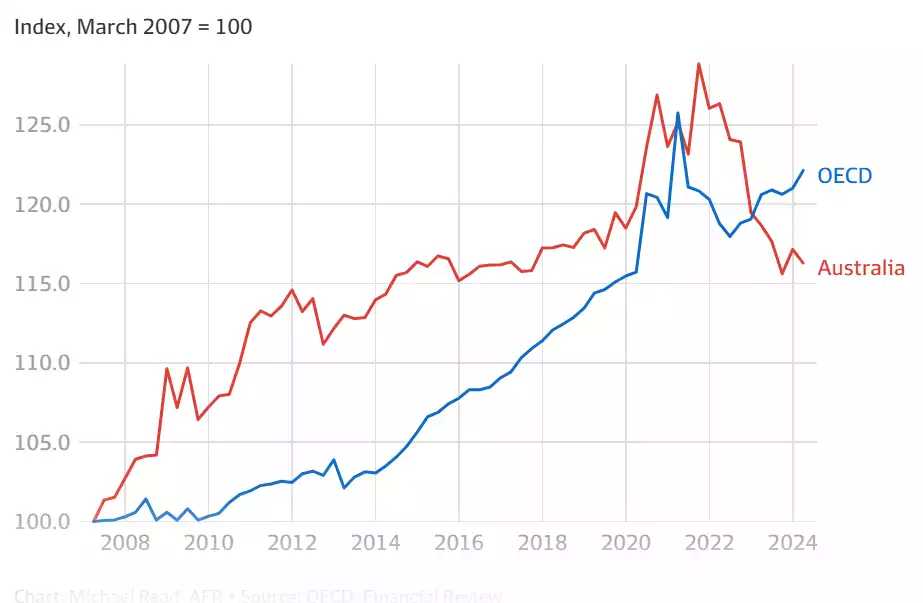

1352

Australia has seen the highest disposable income drop in the world in the last two years. It could be argued the main reason for this is mortgage rates climbing sky-high for the previous 20 years. Even so as we have bought houses at higher and higher prices driven in part by speculation, increased government taxes, and increased government-led migration, the RBA has somehow continually been blamed for the skyrocketing prices. Now that the RBA has increased mortgage rates to average, for some reason they are being blamed for this disposable income drop. No matter how many times Bullock and every economist in Australia keep highlighting to the government the issue is increasing government spending, running at 6% per annum next year, the government takes no feedback and returns the blame on the RBA and the average mortgage rates.

What is the Reserve Bank doing?

The Reserve Bank has 3 mandates that were set in 1959;

‘It is the duty of the Reserve Bank Board, within the limits of its powers, to ensure that the monetary and banking policy of the Bank is directed to the greatest advantage of the people of Australia and that the powers of the Bank ... are exercised in such a manner as, in the opinion of the Reserve Bank Board, will best contribute to:

- the stability of the currency of Australia;

- the maintenance of full employment in Australia; and

- the economic prosperity and welfare of the people of Australia.’

In 2010 following the financial crisis and the election of a change in Government, a revised mandate was issued The ‘charter’ of the Payments System Board is defined in section 10B(3) of the Act as follows:

‘the powers and functions of the Bank under Part 7.3 of the Corporations Act 2001 are exercised in a way that, in the Board's opinion, will best contribute to the overall stability of the financial system.

Now looking into that further – this appears to be interpreted by both the RBA and government as an inflation target.

‘The Governor and the Treasurer have agreed that the appropriate target for monetary policy in Australia is to achieve an inflation rate of 2–3 per cent’

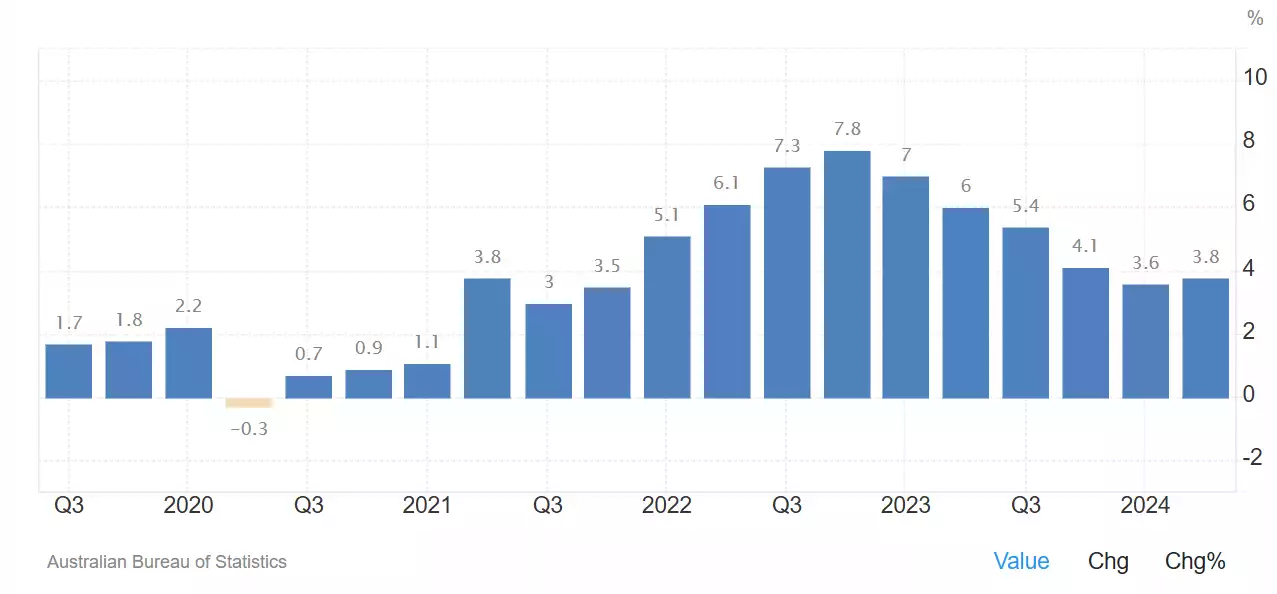

Now as our inflation continues to sit above 3%, currently at 3.8% and has not been below 3 since March 2021 no matter which way anyone should look at this, it’s not the RBA's fault. They have a target set with the government and if one part of the economy making up 20% of GDP wants to keep spending at 6%, inflation will continue. An in case you were wondering, that 20% of the economy increasing at 6% is the unproductive, rent-seeking government.

* Australian annual inflation QonQ Australia Inflation Rate (tradingeconomics.com)

Bullock and the Glass Cliff

A couple of weeks ago we discussed the glass cliff and Kamala Harris – with a brief mention of Michelle Bullock, the head of the RBA. As the government ramps up its attack on the newly appointed RBA chief – Bullock – the first woman to lead the RBA – is under attack from the government who appointed her to the poison chalice. Chalmers's recent statement criticised the RBA for ‘smashing the economy’ and saying, ‘I think it is self-evident that the interest rates rises… are slowing our economy,’ seems like a pointed blame game.

These comments come ahead of today's projected weak GDP figures, with some seeing our GDP dropping from 1.1% to 0.8% per annum. To put that in context if the government is growing at 6% making up 20% of the economy, it is contributing 1.2% to GDP – this means the rest of the economy is going backwards at a rate of 0.4%. To overlay inflation of 3.8%, Australia is going backwards at 4.2% per annum. The recent OECD figures show an even bleaker figure for Australian households, with incomes slumping 6.1% in 12 months from September 2023 when adjusted for inflation.

If this GDP is in line with forecasts, it would mark the weakest annual result since the 1990s, excluding the COVID-19 government-forced blip.

Solidarity with Bullock

Several economists and commentators have recently come out in defence of Bullock and the RBA, identifying the real culprit. Judo Bank chief economist Warren Hogan recently started blaming bracket creep and inflation for the drop in disposable income.

Some of his more pointed statements;

‘I think this is a political strategy heading into the election. You know, it's the blame game. Don't look at us, look at them.

“But I don't know if it's going to work because it's not what's happening. The Treasurer talked about economic volatility and higher interest rates hurting household incomes, well, the reality is it's actually inflation and bracket creep.’

Hogan identified that bracket creep in a high-inflation environment had stripped AU$50 billion from households in the last 2 years, with the tax cuts this year giving back AU$25 billion whilst costing households AU$31 billion.

Angus Taylor, Shadow Federal Treasurer statement also argued the government was to blame for the current state of inflation saying in a Sky News Interview;

‘He's fighting, of course, the Reserve Bank. He's been fighting the Productivity Commission. He's been fighting Peter Dutton, he's been fighting his own mentor, Paul Keating, over his superannuation taxes’

“But the one thing he's not fighting is the one thing everyone wants him to deal with, which is his own home-grown inflation.’

Even Natalie Barr on Sunrise attacked Chalmers for his recent statement yesterday with her question;

“Is this an attempt for you to shift the spotlight?”

It appears the government spin gig is over, with fewer and fewer believers.

The Spin isn’t working

As more and more people in Australia wake up and stop blaming the RBA for the government's mess, remember the RBA and Bullock have a mandate for financial stability, which was defined by the government as inflation at 2-3%, if the government spends at a rate higher than this how can they (or you) blame anyone except for them.

Government spending, Government taxation levels and Government red tape are destroying Australia, the RBA is just a tool, not a government.