The Gold to Silver Ratio Over 100 Years - A Centennial Trade

News

|

Posted 17/10/2024

|

13933

The gold-to-silver ratio tells us how many ounces of silver give us one ounce of gold. When this ratio is high - silver is objectively undervalued, as priced in gold. The active precious metal investor will buy silver when the ratio is high - with the view of trading it in for gold - as it reduces.

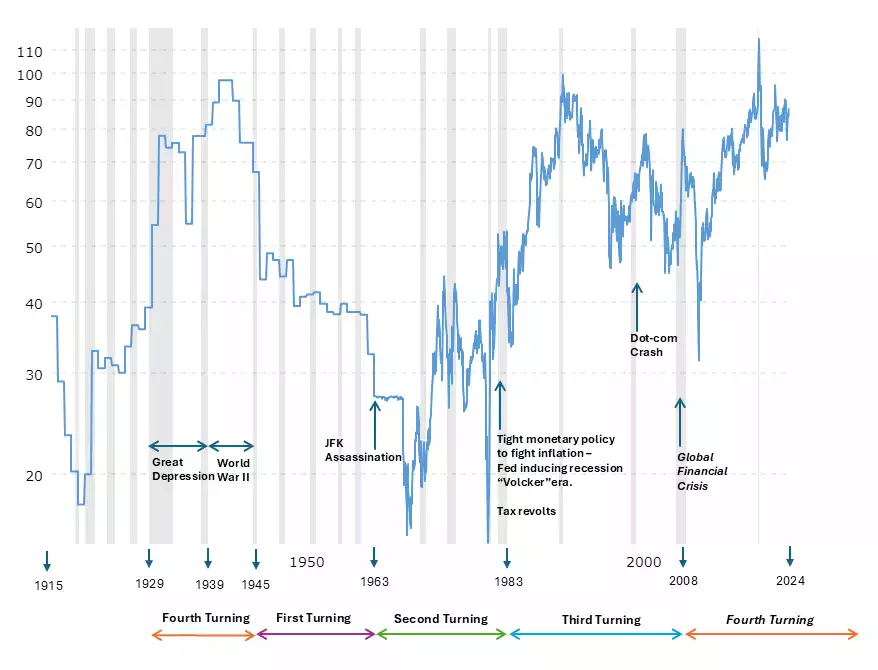

The chart below shows the Gold to Silver Ratio from 1915 to 2024

To contextualise this data - it has been overlaid with the 4 “turnings” of society.

The “Four Turnings” is a thesis formulated by historians Neil Howe and William Strauss in 1997, suggesting that society moves in 80-year macrocycles - made up of 4 sub-cycles, each lasting about 20 years - called “turnings”. Every turning has its own generational archetype, specific role, and predictable result. The transition from one turning to another is catalysed by crisis. We can see on the chart above - that the Gold to Silver Ratio falls off - as we transition from one turning to the next.

Why does this happen?

During the transition, catalysed by crisis - we see broad-based, systemic and financial turbulence. During this time, investors seek safe haven assets to shelter from the storm. Assets that are decentralised, not connected to any government or financial institution, with a proven track record over millennia - such as gold and silver – are the investments of choice. This causes a significant price increase in both gold and silver - leading to the crisis – with gold outperforming silver, initially. However, after the crisis - as gold and silver have been increasing in value due to the demand, while most other markets are collapsing – the average retail investors start truly believing the precious metals bull run - which drives speculation.

With a smaller market capitalisation and lower liquidity, this speculation causes serious price increases in silver. This means that once precious metals enter a secular bull run - silver leads the way, now outperforming gold - and this causes the gold-to-silver ratio to reduce. This is an opportunity for each generation to simultaneously - capture significant capital growth - while securing a hedge against systemic collapses. Getting both - shelter from the storm and capital growth - while most other markets are struggling - is a gift provided by silver to each generation - once every turning (20 years).

However, what's profound - is looking at the Gold to Silver Ratio during the transition from one macro-80-year cycle to the next - towards the end of each fourth turning - which is where we are today. Notice how the previous fourth turning was catalysed by The Great Depression, which started in 1929 – and 80 years later – the current fourth turning began, catalysed by The Global Financial Crisis in 2009.

As we transition from one 80-year cycle to the next - from the old world into the new - amid societal changes, chaos and financial collapses - the gold-to-silver ratio drops off at a scale, unseen for 100 years. Given that we are currently in a fourth turning - approaching the culmination of an 80-year cycle - we can expect chaos across finance and culture to continue into the end of this decade - with a major societal transition by 2030 - leading into the next 80-year cycle. With silver giving us both shelter from this storm and capital growth during this transition - we are presented with an investment proposition that occurs once in every generation - at a scale that occurs once every 100 years.

For context, the four turnings can be summarised as:

First turning (Spring) - involves the rise of powerful institutions. It is a time of hope and optimism, focusing on growth and prosperity. The most recent first turning started after WWII and ended with the assassination of JFK.

Second turning (Summer) - we see a rise of individuality and the institutions established in the first turning start facing opposition. The recent second turning started with the inner-city revolts of the 1960s and culminated with the Volcker era recession - and tax revolts of the 1980s.

Third turning (Autumn) - individualism is truly alive, and institutions are perceived with increasing distrust. The focus here is on the self; and on having fun. This phase involved tax cuts, low interest rates, and financial overconfidence - leading to increasing inflation and government deficits - which moved us into the next phase. Our most recent one started in the 1980s - through the 90s - peaking around 2000 with the dot com bubble and ending with the Global Financial Crisis.

Fourth turning - Winter - is defined by war and revolution. Institutions are torn down and rebuilt for the sake of a nation's survival. Once the prevailing crises are overcome - society finds a sense of communal direction, unity, and common purpose - into the first turning of the next 80-year cycle. The previous fourth turning started with the Wall Street crash of 1929 and ended with World War II. The current fourth turning started with the Global Financial Crisis of 2009 and is ongoing.

- Some previous fourth turnings are:

- Wars of the Roses (1459–1487)

- Armada Crisis (1569–1594)

- Glorious Revolution (1675–1704)

- American Revolution (1773–1794)

- Civil War (1860–1865)

- Great Depression and World War II (1929-1945)

- Global Financial Crisis and ? (2008–2029?)

The Gold to Silver Ratio has ranged from 1:1 to 1:125 - where it should sit, would depend on who you ask.

Regardless of what one believes the ratio should be at - if silver is bought when the ratio is high and traded for gold when the ratio is lower, investors have done well - to increase their total gold holdings, achieve capital growth, and secure shelter from financial collapses.

As we approach the close of the fourth turning, we are on the lookout for a once-in-a-century drop-off, of this gold-to-silver ratio.