The Fed's “Xmas” Gold Confiscation Scheme

News

|

Posted 17/11/2023

|

3607

Startling information has come to light regarding a plan by the Federal Reserve to confiscate gold from American citizens, dating back to the early years of its existence. This revelation sheds light on the historical context and the motivations behind such a drastic measure.

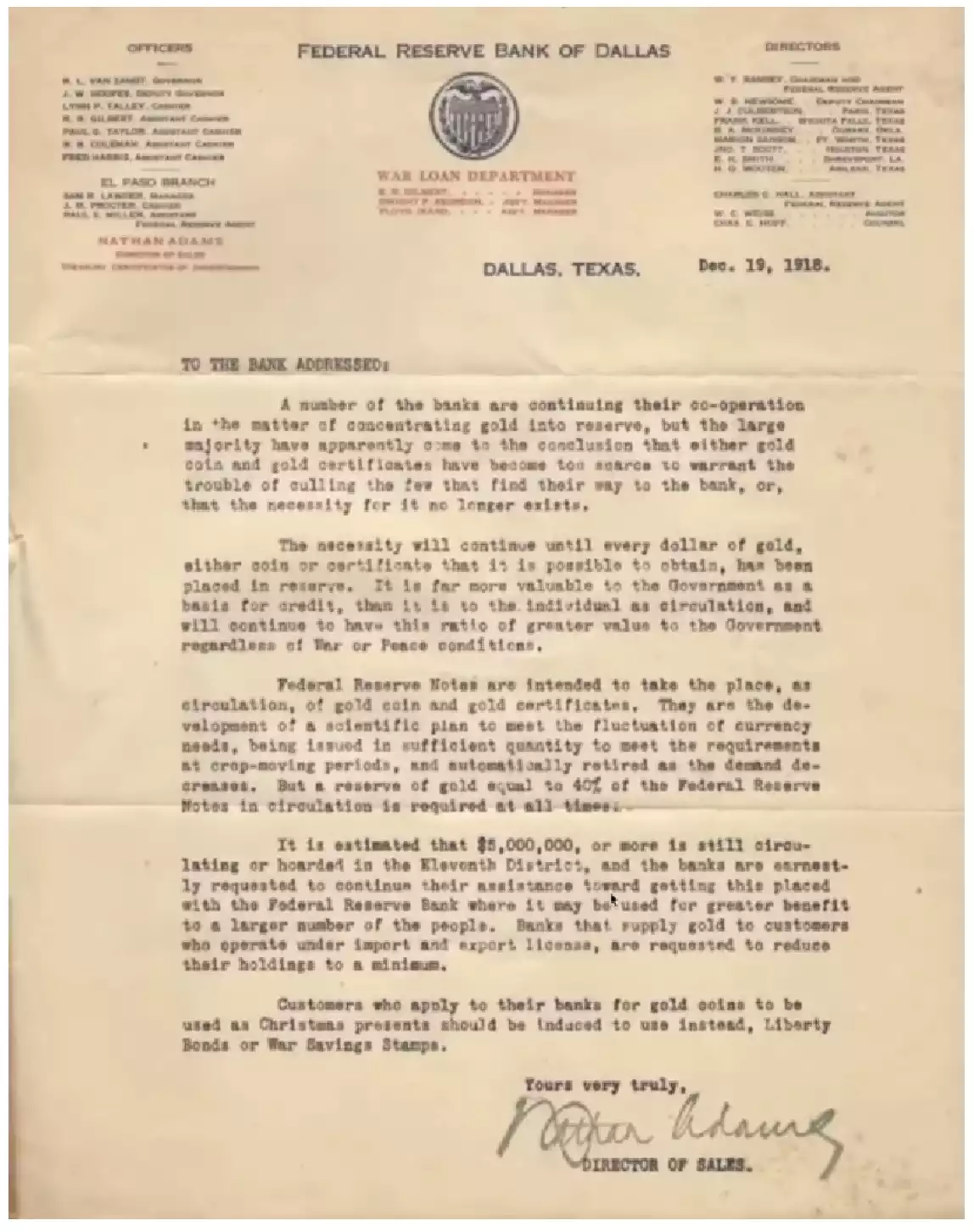

The Federal Reserve, established in 1913, was supposedly designed to serve as a central bank to "stabilize" the financial system. However, as uncovered in a letter from the Federal Reserve Bank of Dallas dated December 19, 1918, it appears that the idea of confiscating gold had been in play from the early stages of the institution.

The letter discusses the collaboration between banks in concentrating gold into reserves. The banks, operating under a fractional reserve system, issued paper money representing ownership of gold held by the banks. This system, while commonly accepted at the time, had inherent risks, particularly when banks did not hold 100% reserves.

The revelation suggests that the Federal Reserve aimed to centralize gold holdings, with the ultimate goal of controlling the money supply. The plan involved retiring gold coin and gold certificates, replacing them with Federal Reserve notes. This centralization was seen as a way to exert control over the economy by managing the elasticity of the money supply, adjusting it as deemed necessary.

The letter also indicated that the Federal Reserve viewed gold as more valuable to the government as a basis for credit than to individuals as circulating currency. This perspective raises questions about the perceived separation between the Federal Reserve and the government, as the central bank's existence relies on the government's approval for the benefit of the government.

Gold for Christmas? You Must be Crazy.

Furthermore, the document suggests a concerted effort to discourage individuals from buying gold, labelling them as "hoarders." However, this characterisation fails to recognize the role of savers in creating a deflationary force that benefits society by making goods and services more affordable for everyone. The Federal Reserve's plan to induce banks to dissuade customers from gifting gold for Christmas, instead promoting Liberty Bonds or War Savings Stamps, raises concerns about manipulating public preferences for financial assets. We often hear about how the Coca Cola company changed Santa's outfit from green to red, in order to promote the soft drink. We don't hear about the Federal Reserve changing the entire gift-buying culture away from gold and labelling gold buyers as mentally unfit in an effort to amass all the gold for themselves.

This revelation prompts reflection on the impact of historical decisions made by central banks and the potential consequences of consolidating power over the money supply. It is apparent, from this letter at least, that the best way to confiscate gold is to convince people that it is useless and create excitement over paper assets - the assets that the Fed does not want…

We wrote to the practical impossibility of gold being confiscated in the modern era in an article here. There is a wise saying “don’t do as they say, do as they do” and the last few years have seen the worlds central banks acquiring and hoarding gold at an historically unprecedented rate…