The Big Squeeze(s) Ignite Next Gold Bull Rally

News

|

Posted 20/03/2023

|

9776

As gold makes another end of week high in Aussie Dollars of $2,970/oz (USD1990), we examine today the multi market squeeze happening right now that appears to be pushing money to real low counter party risk assets like commodities and gold. We say real no-counter-party-risk assets, as the headlines this week of 3 banks failing and Credit Suisse on Swiss government life support may have hidden some worrying developments within the US Government’s Debt ceiling. Hence, the traditional low counter party risk assets of bonds are becoming riskier by the minute….

Today we discuss a BIG squeeze happening not in one market but in multiple, and go into what these markets are telling us and why this is squeezing capital into a very small margin of the market…. The gold market.

So what was the headline that was missed?

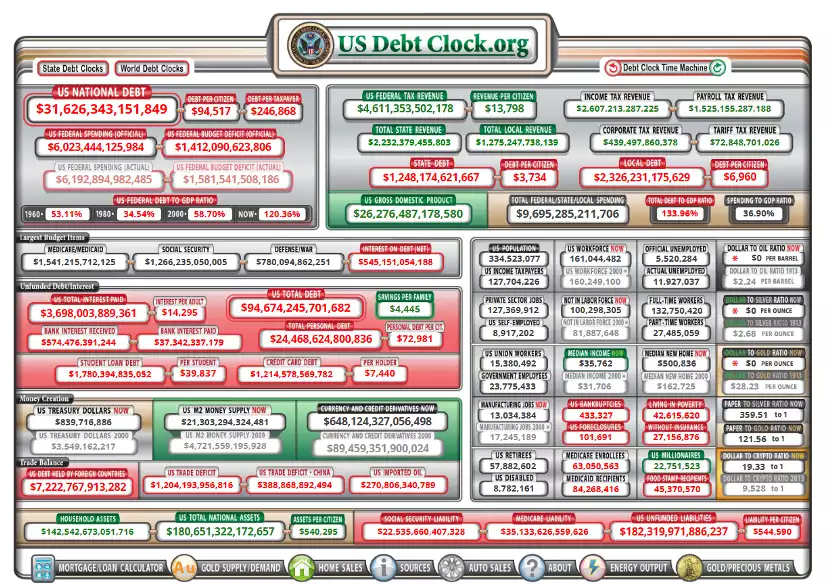

Get ready for the next headline, as the ‘look over there’ tactic of the US Government and fancy footwork of the US Treasury comes to a screeching finale. You may not be aware of this yet, but you will soon. The US breached their debt ceiling of $31.4 trillion on the 19th of January 2023. Since then, treasury has used accounting tricks to allow the credit party to continues, with estimates of June and August but with bank collapses and the need for Treasury to help find solutions to the banking crisis and contagion, this may come sooner. If you look at the US debt clock (below), the US is actually currently sitting on $31.6 trillion. The US deficit this year is estimated at $1 trillion, but appears to be accelerating with the last 5 months having a deficit of $723 billion, and an interest expense of $262 billion. Just extrapolating this out, this will be over a $1.8 trillion deficit unless spending is brought back in and interest expenses stop rising, which is unlikely. The Federal Reserve is also losing mark to market losses on their bond holdings (as undid SVB), which if they did start selling rather than running off would lead to greater losses that may eventually need to be resolved.

Government debt is encouraging short bonds, long cash

During the Finance Senate this week, with a debate of a Republican Bill to preferentially pay back debt, Yellen quite rightly pointed out this is just ‘a default by another name’. With no consensus and a rapidly approaching June deadline (possibly earlier with increasing interest costs), the debt ceiling issue continues to rage on in the US. Now this issue is undoubtedly a political issue that is likely to be resolved, but the stress on the bond market it is creating is an intolerable counter party risk with the possibility of a credit downgrade on the US and higher debt cost. On Monday last week Fitch Ratings told CNN that the US credit rating could get downgraded even if a default is avoided to the repeated debt ceiling stand offs. This will further cause a loss on bonds, raise US borrowing costs and rising deficit, encouraging…. Short bonds, long cash.

Bank risk is encouraging short cash, long bonds

We don’t need to go in much detail here – there’s been a lot of commentary on this this last week (you can review all our articles and interview here), but let’s just explore a little further why these banks are under so much pressure. Most banks, due to their long dated low interest bond holdings, are offering very little in way of interest to their depositors, this is causing retail cash holders to look for better returns, which they are receiving on government bonds. As the risk in holding cash in banks is becoming riskier, deposit risk (cash) for depositors, they are removing more deposits from banks and either looking for greater returns (bonds) or safer non counter party risk assets (gold). This therefore makes us think that this risk will not be just in marginal banks but will eventually move through to the larger banks (Credit Suisse)…. Short cash, long bonds

The Federal Reserve (and all Central Banks) are encouraging short asset, long cash

Where is this Fed Pivot? The market is still waiting for the pivot and all indications are the Federal Reserve will continue to steam roll the markets while fracturing and marginalising all asset markets. The Federal Reserve will lift rates this week – 25 points or 50 points but with every raise, assets such as housing and equities have lower returns and lower values. Short assets, long cash

Quantitative Tightening (ahem easing)

Meanwhile Quantitative Tightening (QT) is meant to start soon (where the Fed sells bonds rather than just runs them off like they’ve been doing), the current market turmoil is on the back of a $626 billion reduction in the Fed balance sheet, which was recently quantitatively eased not tightened with the $262 billion bank backstop. With all this stress to run off $400 billion with a balance sheet already at $9 trillion, the Fed pivot or at least acknowledgement that under current conditions tightening is not possible, seems inevitable.

Gold is the last corner of the market

Inflation is slowing, bank stress is seismic, and equity markets continue to drop. Will the Fed Pivot soon, or like its cousin the ECB raise rates into this stress? This week will be telling for the USD, but either way should be great for gold. If the Fed lifts bond stress and bank stress increases then gold should rise on no-counter-party-risk safe haven demand. If the Fed pivots or pauses the USD will drop and gold which is inversely related rises. It appears to be a great week to own gold. The market has been squeezed into an old but traditionally safe market…. Long gold