The Absolute Valuation Approach to Crypto Assets

News

|

Posted 21/07/2020

|

13757

Bitcoin's off-chain velocity is at an all-time high. Fiat currency with high velocity is normally a bad sign, but does that rule apply to crypto? A new report from Crypto Research Report revisits the equation of exchange model with up to date market data to forecast the markets prices over the coming years.

One of the most common ways to estimate the price of a cryptocurrency is with the "equation of exchange". This model comes from the 20th-century economist Irving Fisher. One of the main insights of this model is that the more often a currency changes hands, the less value the currency has. Money changes hands more frequently when people believe the money will lose value. For example, if there is high inflation, people will hold on to the money for the shortest amount of time possible.

For the past few years, Bitcoin’s off-chain velocity has been increasing. But what does this mean? Vitalik Buterin, the co-founder of Ethereum, famously applied this model to crypto assets in 2017 to argue that coins need velocity sinks that encourage hoarding. Partner of Multicoin Capital, Kyle Samani, wrote an article in agreement with Vitalk’s understanding of velocity.

He wrote, “As I noted in Understanding Token Velocity, the V in the equation of exchange is a huge problem for basically all proprietary payment currencies. Proprietary payment currencies are, generally speaking, susceptible to the velocity problem, which will exert perpetual downwards price pressure. Due to this effect, I expect to see utility tokens that are just proprietary payment currencies exceed a velocity of 100. Velocities of 1,000 are even possible.”

However, Scott Locklin, an engineer for Brave Attention Token posits in a recent paper that both Buterin and Samani are wrong. This article models Bitcoin’s price with the equation of exchange model and discusses why the relationship may not be as straight-forward as Buterin and Samani surmised.

Each distributed ledger network offers a specific range of abilities to their cryptocurrency users. The fundamental value of a coin can be defined as the aggregate summation of each individual user’s valuation of the network. The short-term prices of cryptocurrencies are determined by supply and demand and may not reflect their fundamental values.

However, the price can be a noisy signal of a cryptocurrency’s fundamental value over the long-term. Long-term refers to multiple periods of macroeconomic cycles including expansions and recessions, which the cryptocurrency market has still not completed. Several papers have used the equation of exchange model to estimate Bitcoin’s price in 5 years, 10 years, and even on longer time horizons. For example, Kraken and the Economist estimate Bitcoin’s price to be $1.91 million by 2022, Satis estimate $96,000 by 2023, and Vision & $65,000 by 2028.

The equation of exchange model is an absolute approach to valuing crypto assets. This means that the model gives a target price that crypto-assets should be priced at based on assumptions regarding changes in supply and demand.

The equation of exchange model relies on the theory that the value of each cryptocurrency should be directly correlated with the dollar volume of the economy it supports.

A crypto-asset economy that has $1,000 in trading volume each year and has 10 coins in circulation will have a fair coin value of $100 if each coin is traded once during that year. The value of each crypto asset is inversely related to its supply, i.e. the number of coins that are in circulation and its velocity, i.e. the number of times each coin is traded per year. The likelihood of future market adoption is what drives speculation today.

The absolute valuation approach is inspired by Mill’s equation of exchange. In this model, the percentage of the total addressable market can be used to estimate a crypto asset’s implied future price. To estimate the size of the economy supported by crypto assets, the following steps are taken:

- The economic size of all relevant use cases for a crypto asset is summed. This is referred to as the target addressable market. This involves three assumptions:

- Which use cases are applicable for cryptocurrencies?

- What is the total market capitalisation in US dollars of each use case?

- What is the growth in the total market capitalisation in US dollars of each use case over the next decade?

- An estimate of the percentage of each target addressable market that is penetrated by crypto assets over a ten-year horizon is calculated. This involves two assumptions:

- How much of each use case will be penetrated by cryptocurrencies?

- What is the growth rate of penetration for cryptocurrencies over the next decade?

- Each annual addressable market is divided by each coin’s velocity to determine the coin’s market capitalisation. This involves three assumptions:

- What is the supply of each cryptocurrency over the next decade?

- What is the velocity (V) for each cryptocurrency?

- What is the growth in velocity for each cryptocurrency over time?

- To determine the price per coin, the total addressable market multiplied by the penetration rate is divided by its circulating supply.

- Once the price per coin is forecasted for each year over the next decade, the discount rate must be applied to calculate the net present value of the price of each coin for each year. This involves the following assumption:

- The discount rate should reflect each coin’s risk and the nominal inflation rate. This report assumes a standard discount rate of 30 % for each coin.

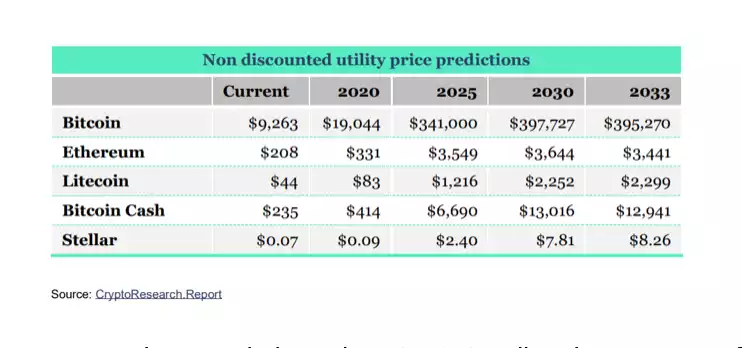

Looking into all the variables and addressable markets, Crypto Research Report has come up with a utility price estimate for each of the examined cryptocurrencies. It is worth noting that each of those estimates is done on a non-discounted basis and with either bearish or moderate market penetration assumptions. (Priced in USD)

As seen above, Crypto Research Report believe that Bitcoin is still at the very start of its adoption curve. The price of $7,200 at the end of 2019 suggests that Bitcoin has penetrated less than 0.44 % of its total addressable markets. If this penetration manages to reach 10 %, their formula suggests a non-discounted utility price should reach nearly $400,000.