Strong Platinum Fundamentals May Relish in a Low-Rate Environment

News

|

Posted 17/09/2024

|

1232

Much of platinum's investment appeal is derived from strong demand and weak supply, leading to ongoing market deficits and the depletion of above-ground stocks. Despite mixed global economic signals, interest rate cuts by central banks could benefit platinum as the cost of holding non-yielding assets decreases. Historically, platinum has performed well within twelve months of the U.S. Fed's first rate cut in past cycles. However, uncertainties remain, particularly due to weak economic growth in China and Europe, though the U.S. economy has been more resilient (even if only due to deficit spending). Platinum's demand strength is often underestimated, especially in a more stable economic environment. The World Platinum Investment Council (WPIC) has recently released its Q2 report which provides updates on many areas of the market which we will cover below.

Platinum demand

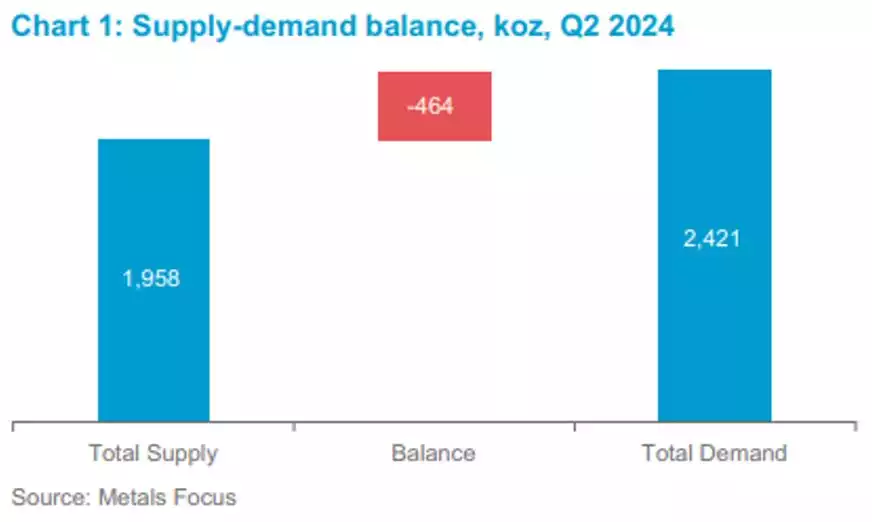

Global demand jumped 13% year-on-year in Q2’24 to 2,421 Koz on the back of significantly higher ETF inflows as well as strong growth in large bars in China, a new segment now reflected from Q1’19. Meanwhile, all other demand categories also grew year-on-year, albeit more modestly compared to the investment category.

Automotive demand

Platinum demand in the automotive sector is expected to rise by 1% year-on-year in 2024, reaching its highest level since 2017. Although there was weaker demand for heavy-duty vehicles, this has been offset by stronger demand in the light-duty segment. The cost of electric vehicles continues to push consumers towards more affordable combustion and hybrid vehicles that require platinum.

Despite the growing demand for battery electric vehicles (BEVs), their market share growth has slowed, with forecasts revised to 13% for 2024, as affordability concerns push consumers toward more affordable combustion engines or hybrid vehicles. Continued platinum demand is supported by substitutions for palladium, with higher platinum usage in current models likely to remain until the end of their production runs. Each 1% shift in the light-vehicle market share for internal combustion engines represents an additional 21,000 ounces of platinum demand.

Jewellery demand

Representing about 25% of total platinum demand, platinum jewellery demand is forecast to increase by 7% year-on-year in 2024. This would represent a 5-year high in jewellery demand and although demand growth is expected to occur worldwide, India is expected to be the main driver of growth. We have gold to thank for the forecast as platinum is seen as a more affordable alternative.

Industrial demand

This remains resilient and is forecast to increase by 1% year-on-year in 2024. Despite the normalisation of chemical demand from China after 5 years of aggressive expansion, other subsectors in this demand segment are more than offsetting this reduced demand. Total industrial platinum demand remains 2% above the trailing five-year average and 17% higher than the pre-COVID five-year average.

Investment demand

Q2 data provides a positive surprise with strong growth in ETF inflows over April and May (437 Koz), believed to be caused by a rotation from profit-taking in gold to a similar asset with attractive fundamentals. Platinum bar and coin demand is growing but is again being spurred by demand from China, while the North American and Japanese markets, in particular, were weak.

Platinum supply

Despite a strong quarter for mine production and recycling, at 1,958 Koz globally, supply fell well short of demand, resulting in a 464 Koz deficit. South African output rose by 7% year-on-year to 1,126 Koz which more than offset a decline in North American output.

According to the WPIC, the market’s sentiment toward attractive fundamentals appears to be gradually improving, although this has not been matched by a platinum price reaction. With time, market deficits stemming from higher-for-longer automotive demand and ongoing supply challenges will mean that above-ground stocks are the supply of last resort. The depletion of above-ground stocks (-37% between 2022 and 2024) should tighten physical markets and result in platinum’s strong underlying fundamentals playing a more prominent role in establishing its market value.