Strength Returns to BTC

News

|

Posted 27/07/2021

|

8794

Over the weekend we saw some good strength return to BTC as it increased off the bottom. Then on Monday, we experienced a textbook short squeeze and the market quickly approached recent highs.

Glassnode’s weekly report perfectly summarises how the squeeze unfolded;

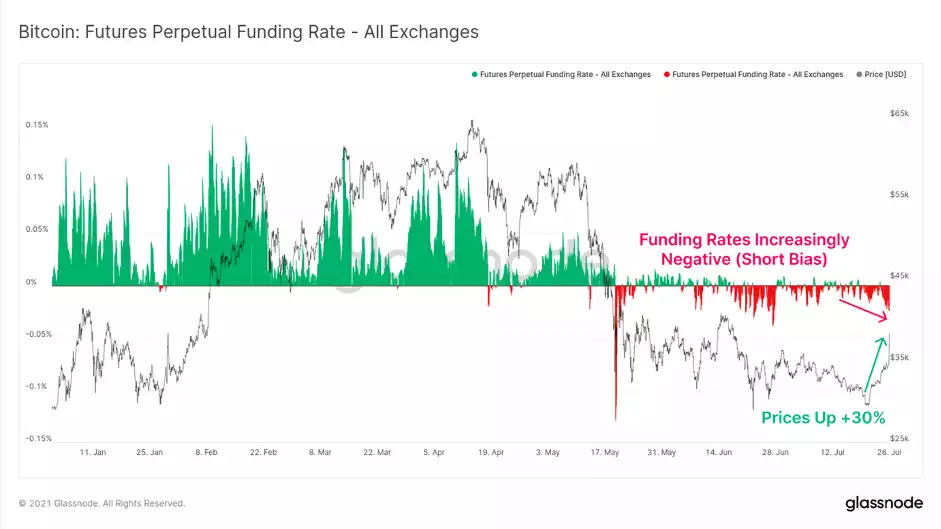

With the growth and maturing of derivative markets, the interplay between spot and leveraged markets creates new dynamics in this market cycle that were not present in the past. As we opened the week, open interest in the options markets suggested that volatility was expected. Open interest by strike price one month out (27-August contracts) shows a notable preference for strikes well outside the current consolidation range. Open interest in perpetual futures markets has remained largely flat over the past two months, ranging between around $10B and $12B since May. Over the last week, however, perpetual futures open interest climbed by a notable $1.4B alongside the rally in price. Oftentimes, elevated open interest starts to increase the probabilities of a volatile leverage squeeze occurring. To assess the directional bias of futures markets, we can see that perpetual funding rates have continued to trade negative. This indicates the net bias remains short Bitcoin. This metric helps us identify that Monday's price rally is likely associated with an overall short squeeze, with funding rates continuing to trade at even more negative levels despite price rallying +30%.

Additionally, Glassnode reviewed whether there are any signs of older profitable coins being spent on-chain to take advantage of market strength for exit liquidity. What would be relatively bearish is to see a significant increase in older coins (>1yr) spending during this relief rally as was seen in 2018 after the blow-off top. So far, this behaviour has not occurred. If the dormancy of older coins persists, it would suggest conviction to HODL remains relatively strong and favour a more constructive view on market structure moving forwards. Conversely, the spending of older coins would indicate a wave of illiquid coins are returning to liquid supply and a more bearish outlook ahead.

Another rumour adding to the price gains is that Amazon could be adding Bitcoin payments to their platform. This rumour came about after the e-commerce giant had posted that it was looking for a Digital Currency and Blockchain Product Lead. The job posting led to investors speculating that Amazon must be looking to add cryptocurrencies as a payment option. The earlier reports had shown that Amazon was looking to explore the blockchain industry. A spokesperson for the company saying the company was inspired by the innovation happening in the space.

As faith returned to the market and more investors begin injecting money back into the market, the bulls will regain control of the market. This means that we might only be at the start of the rally. Market sentiments seem to be turning in favour of a bull market. With personalities like Elon Musk coming out to confirm that they indeed held a “significant portion” of their investment portfolios in bitcoin. Institutional money continues to go into the digital asset. Only recently was it reported that Cathie Wood's Ark Invest had put in another $10.8 million into Grayscale Bitcoin Trust. The CEO said that she believed the price of bitcoin would shoot up to as high as $400,000 US.

Bitcoin is still about 40% below its high of nearly $65k US in April. Its decline was a result of a market that needed to cool off and was likely accelerated by China’s crackdown on bitcoin mining – which led to miners selling profits. The short squeeze which occurred yesterday resulted in over $1B of future liquidations, lifting a great deal of downward pressure off the market.

Interestingly the recent price increase realigns in the price with the S2F Model from PlanB. The model predicts a Bitcoin price of $288,000 by 2024. Based on the analyst's prediction, the BTC price aligns with the S2FX model and is on track for hitting $288,000. If we are kicking off the next phase of the bull market, then we cant discredit these predictions. Let’s see how it unfolds.