Stock Markets Beginning to Tumble as Debt Ceiling Negotiations Further Apart Than Ever

News

|

Posted 24/05/2023

|

8477

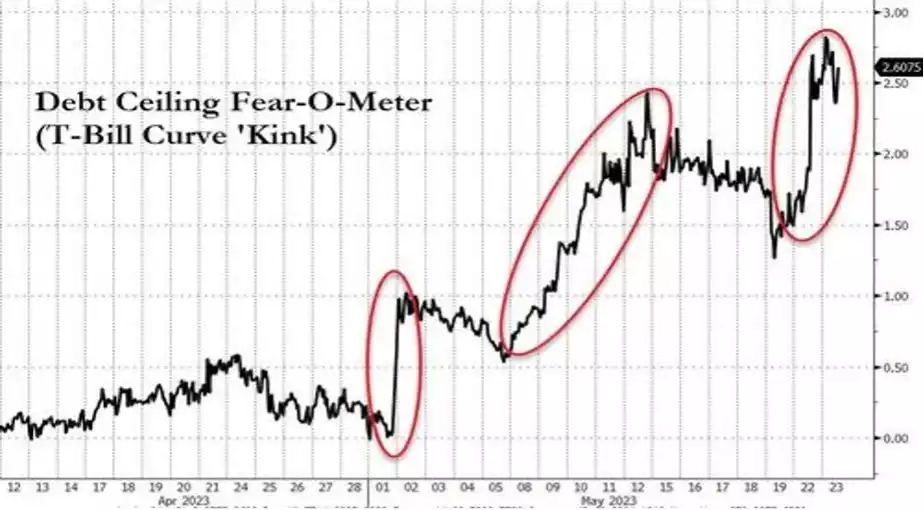

US Equity markets are finally facing the reality that the T-Bill market has been preaching these past two months – that this debt ceiling crisis is not going to go away any time soon.

Just prior to the US market open, Senator Ted Cruz appeared to spook stocks by insinuating that the actual odds of a default are much higher than the market believes, due to the significant incompetence of president Biden and his staffers behind the scenes.

As a consequence, today was the worst day in over a month for Nasdaq, down 1.3%.

The Dow Jones was also down 0.7% this morning, followed by the S&P 500 which was -1.1%.

Treasury Secretary Janet Yellen warned congress yesterday about how close we really are to the so-called X date, and what it means for the general public.

“With an additional week of information now available, I am writing to note that we estimate that it is highly likely that the Treasury will no longer be able to satisfy all of the government’s obligations if congress has not acted to raise or suspend the debt limit by early June, and potentially as early as June 1.”

The fear around the possibility of US default continues to drastically grow in light of Yellen’s most recent comments, with the so called ‘Fear-O-Meter’ reaching another high this past week.

Janet Yellen went on to discuss in her letter the possible consequences of a delayed but eventual negotiation.

“We have learned from past debt limit impasses that waiting until the last minute to suspend or increase the debt limit can cause serious harm to business and consumer confidence, raise short-term borrowing costs for taxpayers, and negatively impact the credit raring oof the United States.”

The previous crisis, in 2011, which Yellen is referring to, saw congress strike a deal 3 days before the X date, and had significant impacts on the economy as a result.

Though sadly, as discussed last week here, we’re already beginning to see strong impacts on business and consumer confidence.

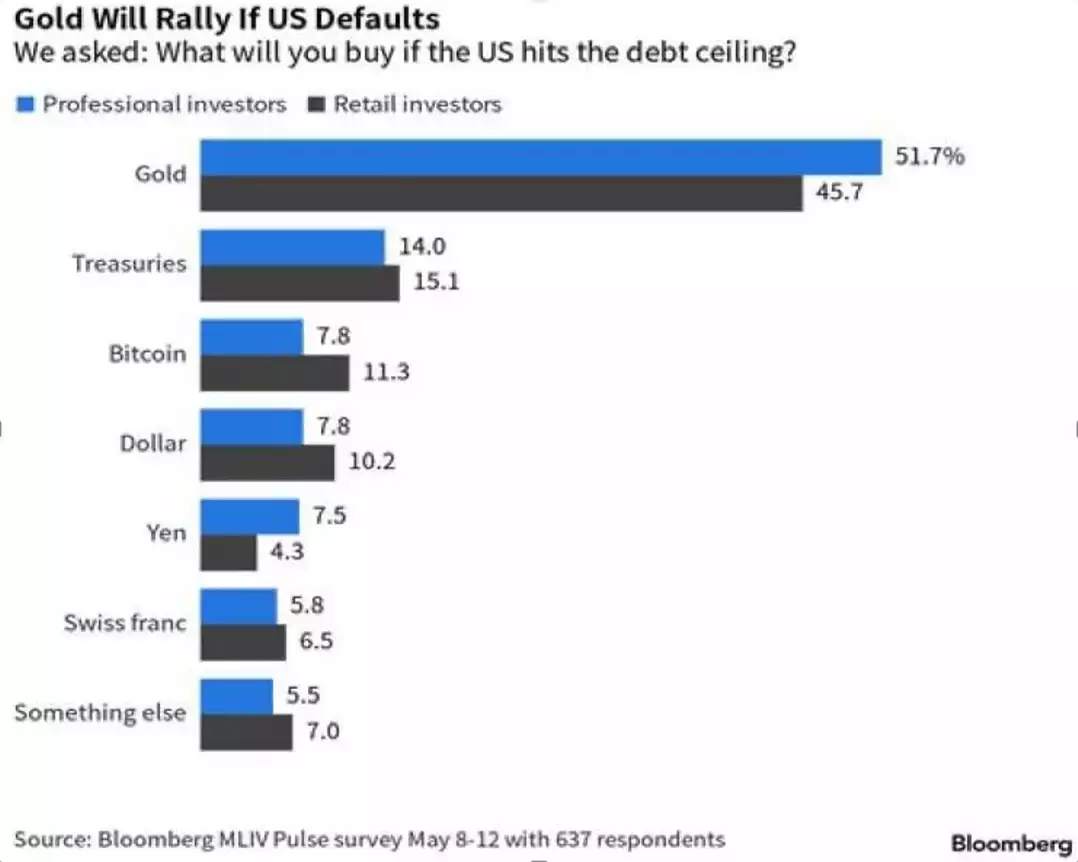

Finally, Yellen hinted that safe haven assets are likely to see increased investor interest during this period.

“The closer we get to the deadline the more nervous clients will get. You could have a move towards safer havens.”

There is no safer haven than gold.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************